Those of us who grew up reading Mad Magazine will be immediately familiar with today’s headline and the image that it conjures.[i] I don’t mean to minimize the recent market declines by comparing them with a (sadly) bygone satiric publication, but the phrase encapsulates traders’ sudden shift from complacency to a more normal volatility footing.

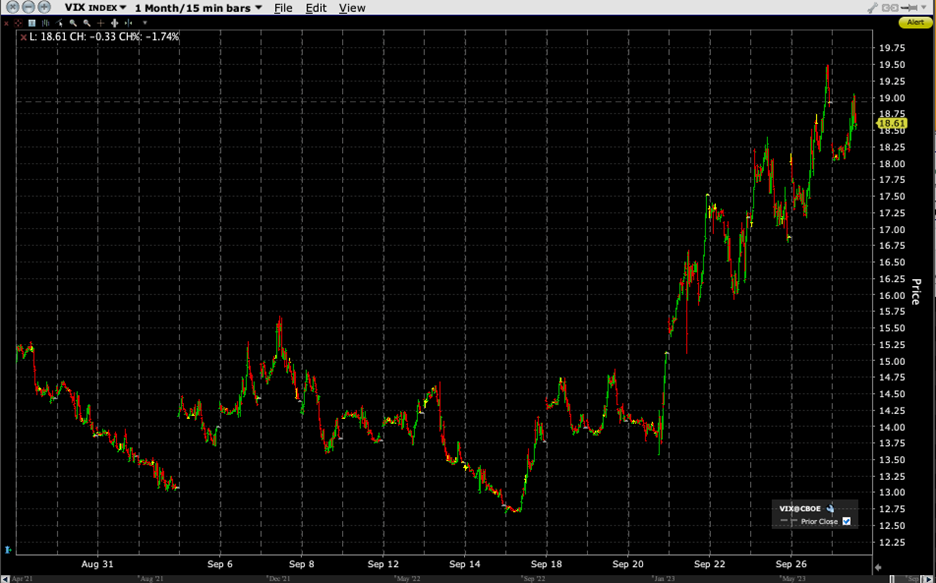

When we look at the Cboe Volatility Index (VIX) on a relatively short-term basis, its recent jump is quite stunning:

VIX, 1-Month Chart, 15-Minute Bars

Source: Interactive Brokers

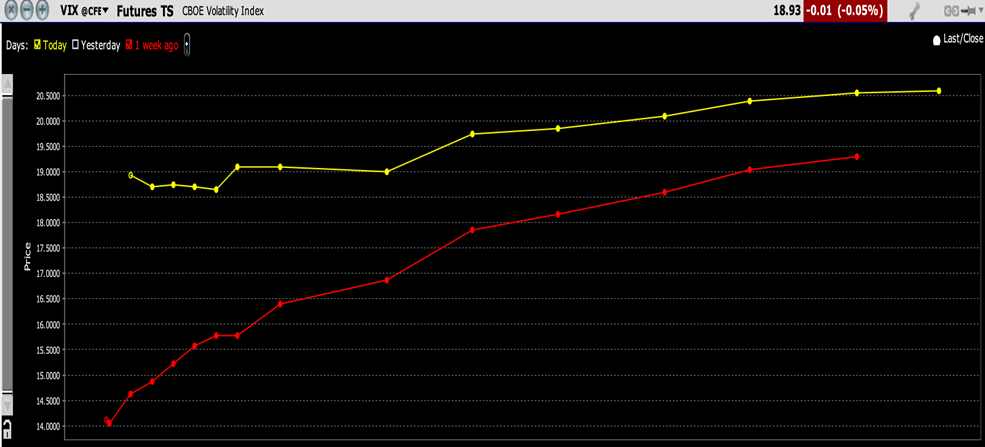

A look at the VIX futures term structure brings the recent moves into sharp relief:

VIX Futures Term Structure, Today (yellow), 1-Week Ago (red)

Source: Interactive Brokers

We see not only that the prices of VIX futures have risen throughout the curve, but that the shape of the curve has shifted from steep to contango to relatively flat. As we explained in greater depth in this piece, a futures market that is in contango reflects a generally plentiful supply of the given commodity in the near-term. It’s counterpart, backwardation, implies that there is a relative scarcity of the commodity in the near-term. In the case of the VIX futures curve, the commodity in question is volatility protection. Just a week ago, few seemed to want or believe that they needed protection; that attitude has shifted dramatically in just a few days.

In a recent IBKR podcast, I defined the market’s mentality toward VIX and volatility protection:

I’ve … said too way too many times, “VIX is not a fear gauge. It just plays one on TV…”

… but I do find that that one of the analogues, not sort of day-to-day, but when you get to turning points, is that VIX is the price of parachutes when a plane hits turbulence. This comes from my experience as a market maker. Nobody really wants umbrellas when it’s when there’s a drought, nobody really thinks about a parachute if the plane is moving along smoothly at 30,000 feet, but as soon as you hit some turbulence, or as soon as the rain clouds develop, people want them and they want them in a hurry. And to me, VIX is still the most efficient way for an institutional manager to hedge his or her risks. Just, “I want to de-risk quickly.”

The chart above shows that rush for parachutes or umbrellas as the market hit turbulence.

Yet the question that plagues me is, “what took them so long?” As we noted yesterday, major US equity indices have not closed above their July 31st levels in the ensuing two months, but even as the markets meandered lower, VIX had become quite resistant to rallying – even back to the levels seen in mid-August:

2-Month Chart, VIX (red/green hourly bars), SPX (blue)

Source: Interactive Brokers

It was as though a bout of complacency broke out earlier this month. In other words, “what, me worry?”

But here’s something to keep in mind – the recent bump in VIX is barely a blip on a longer-term basis. The current level around 19 would have been relatively normal in the pre-Covid era, and quite low through most of the period since then. Even compared to earlier this year, we are now back to levels that prevailed in the first and second quarters, with the obvious exception of March’s banking crisis.

VIX, 5-Year Chart, Daily Bars

Source: Interactive Brokers

But it is important to keep in mind that the level of the broader market is less a determinant of the demand for volatility than its recent movement and the surrounding circumstances. Just yesterday, I was asked why VIX was nowhere near as high as it was in March, even though SPX is now at a roughly similar level. I reminded the questioner that the mentality was very different in March. People were worried about the security of some of their safest assets – bank deposits – and that created visceral fear. This is more of a garden variety correction.

Of course, that should make us wonder why VIX is nowhere near the levels it was in last October, when we were experiencing a sharper correction, but a correction, nonetheless. It has been my contention that VIX has been trading at relatively low levels because portfolio managers spent much of 2022 de-risking their asset mix. High short-term rates have certainly offered ample opportunities to reduce portfolio risk.

But the moves that we experience last spring and summer seemed to indicate that investors were willing to accept higher weightings in at least a cadre of high-flying stocks. Volatility traders need to ask themselves whether they think investors are truly more comfortable with their current risk levels, or if rocky markets might cause those investors to reassess their risks and scramble for more protection.

—

[I]

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!