Weibo (WB US), the Twitter of China, released Q3 financial results before the US market open this morning. The results beat analyst estimates handily. After Tencent’s weak advertising results yesterday, Weibo’s results are a bit of a shock. Hat tip to management on navigating the macro headwinds. It’s interesting to note that the company mentioned the Beijing Winter Olympics as a strong opportunity for the company. Analysts had many regulation-related questions, as the company repeatedly stated “we have had a very good communication and relationship with the government even before the implementation of any regulation”. The company noted that the Personal Information Protection Law went into effect on November 1st.

- Revenue increased +30% to $607.4mm versus analyst estimates of $593mm and Q3 2020’s $465.7mm

- Revenue segmentation: advertising/marketing +29% to $537.6mm

- Average daily users reached 248mm in September, monthly active users reached 573mm in September

- Costs/Expenses increased +29% to $394.4mm from $304.8mm driven by “higher personnel-related cost and marketing expense.”

- Adjusted Net Income $209.6mm versus analyst estimate of $189mm

- Adjusted EPS $0.90 versus estimate of $0.83

- Corporate cash is $2.71B

- Q4 Revenue outlook increase between 15% to 20%

Key News

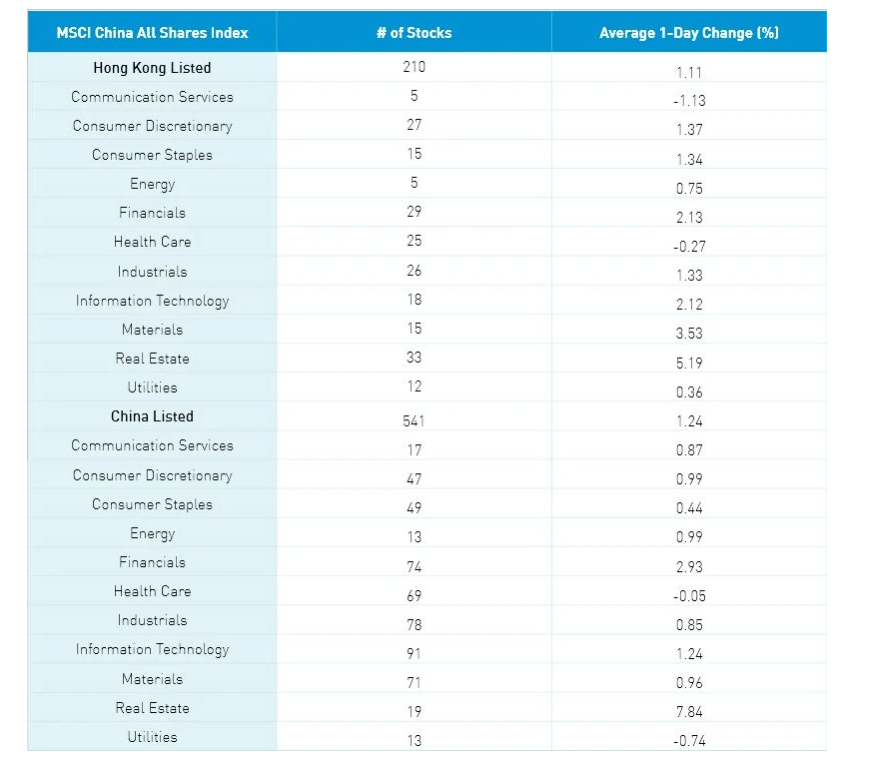

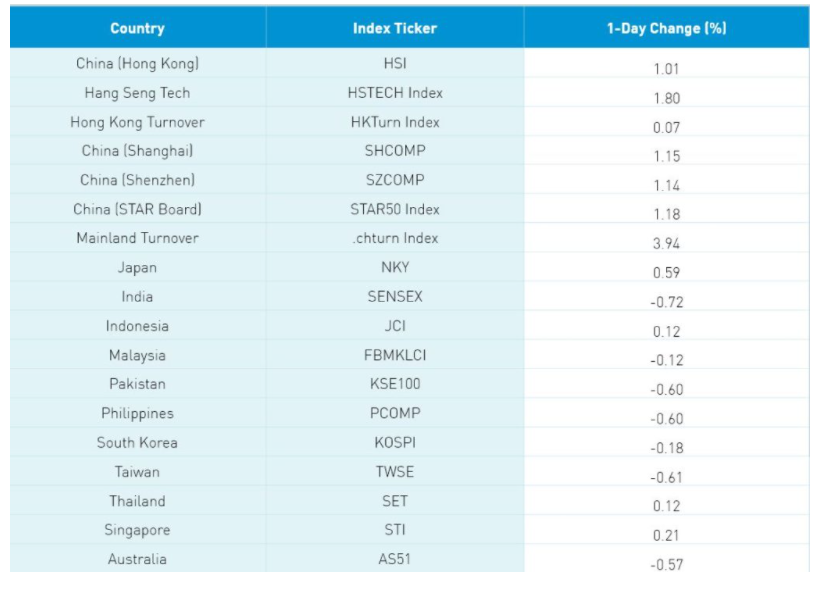

Asian equities had a mixed day as Japan, Hong Kong, and China outperformed while Taiwan and India underperformed. Today’s price action is brutal for active emerging market managers who are 10% underweight China, weighted by the size of active EM funds, while overweight India and Taiwan. This underweight is the dry powder that can come back into the stocks. What these managers want to see are indications that China’s regulatory crackdown is coming to an end.

In Tencent’s Q3 earnings call yesterday, President Marin Lau stated “….if there has been already a lot of regulations and the regulations in the future on an incremental basis will be smaller in terms of percentage-wise, and as the industry adapted further, then the impact on the industry will be less and less over time.” Good sign right!

There were several catalysts to today’s China and Hong Kong moves as the US and China unexpectedly agreed to work on methane and environmental issues at COP26 in advance of the Biden-Xi virtual summit next week.

There was chatter that Didi could be coming out of its regulatory review and reports that real estate policies will be eased to support the industry.

October mortgage loans increased 4% while Evergrande made three bond coupon payments at the 11th hour. Evergrande’s April 2022 US $ bond fell -3.7% to $28.10 while the June 2025 bond was off -2.67% to $23.92. The WSJ is reporting today that the company will be dismantled while allowing the company to finish the projects it started. The article states foreign-held bonds aren’t a concern which runs contrary to official statements that foreign bondholders should be treated no different than domestic bondholders. I’m generally in agreement with the article as we’ve been saying this line of thinking for weeks.

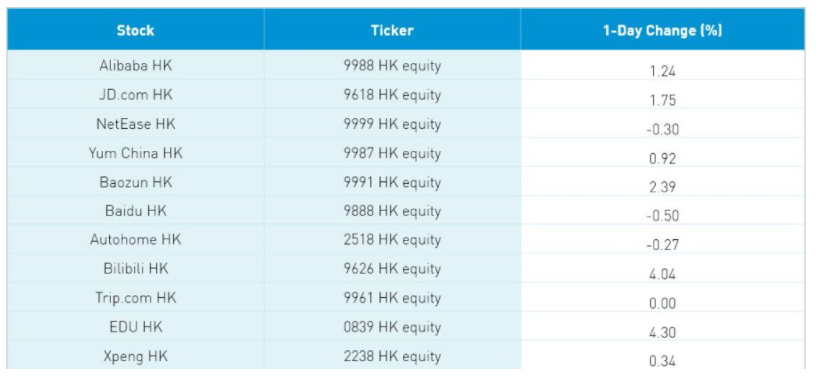

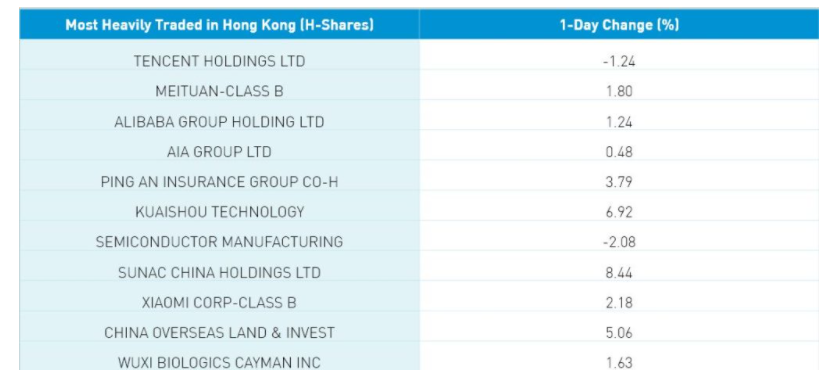

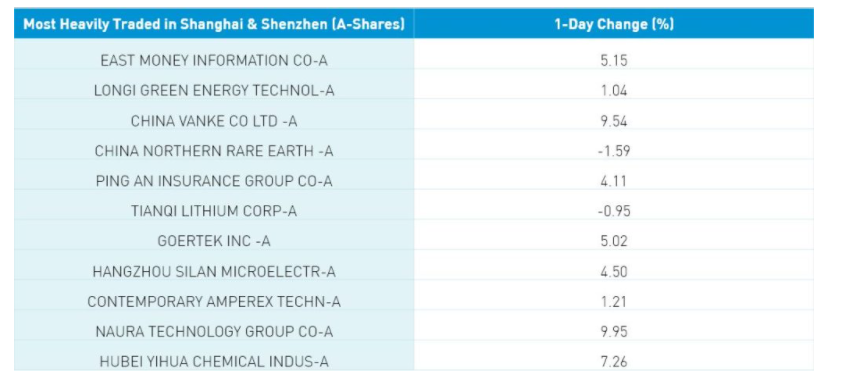

Real estate was the best performing sector in both China +7.87% and Hong Kong +5.19% on the news. Hong Kong-listed internet stocks ripped on the Didi news with Meituan +1.8%, Alibaba HK +1.24%, Kuaishou +6.92%, and JD.com HK +1.75% though Tencent was off -1.24% as Mainland investors were net sellers in moderate size via Southbound Stock Connect. Hong Kong volumes were flat which is only 80% of the 1-year average. The Mainland volumes were up +3.94% which is 112% of the 1-year average. Foreign investors bought $1.347B of Mainland stocks today as Northbound Stock trading accounted for 4.9% of Mainland turnover.

Today is Alibaba’s Singles Day. Amazing how quiet things have been surrounding the largest e-commerce event globally. The company is clearly keeping a low profile this year though the sales numbers will be interesting to find out. The company did state 290,000 brands will have goods sold ranging from high fashion brands to electronics.

After the close, we get MSCI’s Pro-forma for the end-of-month Semi-Annual Index Review.

BNP Paribas upgraded China equity in their Asia allocation model moving the country to overweight from neutral. The December Central Economic Work Conference was noted as a potential policy catalyst.

Xiaohongshu, which is like Instagram, reportedly raised cash from investors in anticipation of a Hong Kong listing.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.40 versus 6.40 yesterday

- CNY/EUR 7.33 versus 7.39 yesterday

- Yield on 10-Year Government Bond 2.94% versus 2.89% yesterday

- Yield on 10-Year China Development Bank Bond 3.20% versus 3.17% yesterday

- Copper Price +0.09% overnight

—

Originally Posted on November 11, 2021 – Weibo’s Wicked Results as Real Estate Policy Adjusts

Author Positions as of 11/11/21 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB, KHYB

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: OTC Securities

An investment in an OTC security is speculative and involves a high degree of risk. Many OTC securities are relatively illiquid, or "thinly traded," which tends to increase price volatility. Illiquid securities are often difficult for investors to buy or sell without dramatically affecting the quoted price. In some cases, the liquidation of a position in an OTC security may not be possible within a reasonable period of time.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!