Stocks – SBUX, PYPL

Macro – VIX, VXN, IRON ORE, SHIPPING, HYG

Stocks finished the day higher, with the S&P 500 gaining 18 bps. Not much was accomplished between Friday and today, so from my standpoint, that leaves a lot of the technical views I have shared relatively unchanged and not worth diving into. Given the Fed meeting on Wednesday, it seems likely we will grind sideways until that meeting.

VIX

The VIX did rise slightly today to 16.4, and it has been trending higher the past few trading sessions. It isn’t normal to see the VIX and the S&P 500 both trending higher simultaneously.

VXN

The VXN is also moving higher as well, and again this is highly unusual activity. Typically, when I have seen this rise in volatility and an increase in the market, it leads to a pullback; think about September 2020. It doesn’t have to lead to a drop; I guess it could even lead to a push higher if the volatility melts.

It would make sense to see the VIX and VXN rise heading into the Fed meeting. But still worrisome.

High Yield (HYG)

There is a massive divergence forming between the HYG ETF and the S&P 500. These two tend to trade together, so a deviation of this size seems notable. It doesn’t tell us which asset class is correct, but couple that with rising volatility, and one should be paying close attention.

Starbucks (SBUX)

Starbucks rebounded sharply today after falling on Friday. Friday’s gap is still open and will likely get filled at $113.50 before the stock resumes its move lower.

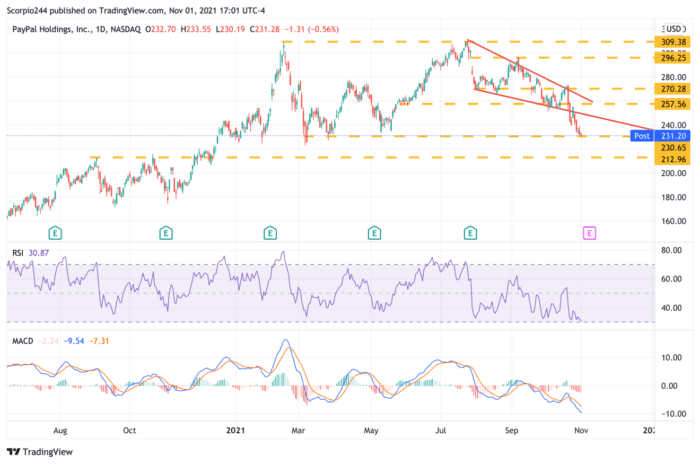

PayPal (PYPL)

The chart for PayPal doesn’t look encouraging heading into results later this week. I have seen some options activity in the name, but I need to go through and analyze it better; I just haven’t had the chance. But the stock is sitting right on support at $230, and it won’t take much of a push at this point to get the shares trading down to $213.

China

Iron ore and shipping prices keep dropping, and the manufacturing slowdown in China for two months seems to be going ultimately unnoticed by the market. At some point, everyone will see it, but so far, no luck. I wonder how much longer the market will continue to rise in front of a global slowdown as the Fed reduce its asset purchases. ¯\_(ツ)_/¯

–

Originally Posted on November 1, 2021 – Volatility Indexes Are Sending A Strange Message As High Yield Melts

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!