With deep customer relationships and innovative solutions for future equipment needs, this global supplier has a durable business ready for a changing industry. Snap-on Services Corp (SNA: $206/share) remains a Long Idea after 3Q21 earnings.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to highlight this firm whose stock present excellent risk/reward.

Snap-on Has Very Attractive Risk/Reward

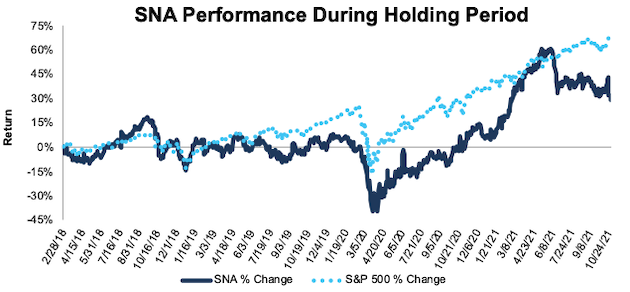

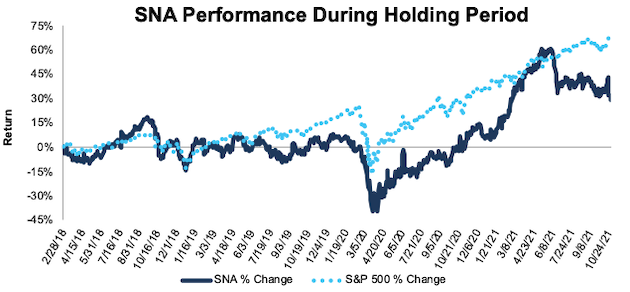

We made Snap-on a Long Idea in February 2018 and the stock has underperformed the market by 39% since then. However, given the company’s strong market position and cheap valuation, we continue to see upside in the stock.

Figure 1: Long Idea Performance: From Date of Publication Through 10/26/2021

Sources: New Constructs, LLC and company filings

What’s Working:

Snap-on beat on both its top and bottom lines in 3Q21. Total revenue in 3Q21 rose 10% year-over-year (YoY) and is 15% above 3Q19 levels. The company’s Commercial and Industrial segment (30% of revenue in 3Q21), which expands its offerings beyond traditional auto tools and into the aerospace, power generation, and military markets, also showed signs of continued recovery from the pandemic as the segment’s revenue was up 11% YoY from 3Q20.

While other businesses with more complex supply chains may struggle to maintain inventory levels, Snap-on’s vertically integrated business enables it to better navigate the current global challenges. Snap-on’s available inventory during the supply crunch is an advantage that will help the company keep existing customers and effectively compete for new ones as other tool and equipment suppliers struggle to maintain desired inventory levels. Management spoke to the company’s advantageous supply chain position in its 3Q21 earnings call when it mentioned that its vertically integrated business, “certainly puts us in a better position to grow and probably capture new customers who might not be serviced by these people (i.e. competitors).”

Snap-on benefits from long-term demand in the automotive repair industry as it supplies auto service technicians, auto service centers, and car dealerships with tools, equipment, and diagnostic tools. For years, the average age of vehicles on the road in the U.S. has steadily increased, which creates more repair opportunities for service providers. The average age of a vehicle in 2021 of 12.1 years is up from 11.9 years in 2020.

The proliferation of driver assistance systems provides more runway for Snap-on’s diagnostic segment over the long run as demand for third-party repairs and system calibrations rise. Snap-on is already meeting this demand by offering diagnostic platforms that give repair shops the ability to make manufacturer-compliant calibrations to driver assistance systems.

Click here to read the full article

—

This article originally published on October 27, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

Click here to download a PDF of this report.

Disclosure: New Constructs

David Trainer, Kyle Guske II, Sam McBride, Matt Shuler, Alex Sword, and Andrew Gallagher receive no compensation to write about any specific stock, style, or theme.

The information and opinions presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or solicitation of an offer to buy or sell securities or other financial instruments. New Constructs has not taken any steps to ensure that the securities referred to in this report are suitable for any particular investor and nothing in this report constitutes investment, legal, accounting or tax advice. This report includes general information that does not take into account your individual circumstance, financial situation or needs, nor does it represent a personal recommendation to you. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about any such investments or investment services.

Information and opinions presented in this report have been obtained or derived from sources believed by New Constructs to be reliable, but New Constructs makes no representation as to their accuracy, authority, usefulness, reliability, timeliness or completeness. New Constructs accepts no liability for loss arising from the use of the information presented in this report, and New Constructs makes no warranty as to results that may be obtained from the information presented in this report. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information and opinions contained in this report reflect a judgment at its original date of publication by New Constructs and are subject to change without notice. New Constructs may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared them and New Constructs is under no obligation to insure that such other reports are brought to the attention of any recipient of this report.

New Constructs’ reports are intended for distribution to its professional and institutional investor customers. Recipients who are not professionals or institutional investor customers of New Constructs should seek the advice of their independent financial advisor prior to making any investment decision or for any necessary explanation of its contents.

In-depth risk/reward analysis underpins our stock rating. Our stock rating methodology grades every stock according to what we believe are the 5 most important criteria for assessing the quality of a stock. Each grade reflects the balance of potential risk and reward of buying that stock. Our analysis results in the 5 ratings described below. Very Attractive and Attractive correspond to a “Buy” rating, Very Unattractive and Unattractive correspond to a “Sell” rating, while Neutral corresponds to a “Hold” rating.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from New Constructs and is being posted with its permission. The views expressed in this material are solely those of the author and/or New Constructs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!