By: Shaon Baqui & Denny Fish

Portfolio Manager Denny Fish and analyst Shaon Baqui posit that semiconductor producers face an uphill battle in meeting rising demand for chips as the digitization of the global economy accelerates.

Key Takeaways

- Low inventory levels and a hunger for chips have resulted in a historical supply/demand imbalance for the semiconductor industry.

- Given the increasingly important role played by semiconductors in a rapidly digitizing global economy, the shortfall’s knock-on effects will have far-reaching implications.

- How management teams across industries navigate the chip shortage will likely influence their near- to mid-term revenue and earnings profiles.

The COVID-19 pandemic has brought about many economic dislocations. One that has received considerable attention is the global shortage of semiconductor chips. This development is often framed within the context of the automotive industry and the knock-on effects of idled assembly lines and skyrocketing used car prices. But the chip shortage and the tribulations caused by it spread much wider, impacting all industry sectors, regions and likely a sizable share of the world’s households.

Really Bad Timing

The semiconductor industry has been notorious for persistent imbalances as chip producers and consumers try to find an equilibrium between supply and demand. A historically fragmented industry structure typically exacerbated the problem. The current – historic – imbalance is the result of the collision of two forces, both directly related to the pandemic: Supply chain disruptions caused by economic shutdowns occurred at the same time the world’s hunger for chips exploded as the pandemic accelerated the digitization of the global economy [1].

In a typical cycle, the semiconductor industry increases capacity to meet its order books as demand returns. The challenge presently facing manufacturers is that the slope of the demand curve has steepened during the pandemic, meaning chip makers are scrambling to reach an increasingly higher target. In the shortage’s early innings, industry executives expected inventories to be rebuilt by the end of this year. As the magnitude of the imbalance has come into sharper focus, optimistic estimates call for mid-2022, and more cautious voices fear it won’t fully subside until perhaps early 2023.

Given the complexity of semiconductor fabrication, additional capacity cannot simply sprout up. Since demand continues to outpace supply – and there are no major greenfield facilities coming online until late 2022 – we share the concern that the market for chips will become even tighter in coming months [1]. In the interim, management teams across a host of industries face tough decisions about production prioritization that stand to impact their revenue streams and profitability. When viewed from this perspective, further developments surrounding the chip shortage should merit the attention of all investors.

Two Years in the Making

To understand how the situation reached this point, we must revisit 2018. During that year – and typical of a normal semiconductor cycle – the industry built up inventory in anticipation of late-year demand, which ultimately did not materialize [1]. Entering 2019, as chipmakers were still culling stockpiles, the U.S.-China trade war cast a shadow on global growth expectations, further crimping demand as neither producers nor buyers wanted to hold excess inventory.

The arrival of the global pandemic had the unique consequence of further quashing demand in some semiconductor end markets while catalyzing it in others. The automotive sector was the most notorious example of the former as buyers canceled orders, while anything associated with remote work and the digitization of the global economy – cloud computing, laptops, gaming consoles and Wi-Fi routers – exemplified the latter.

By the time demand returned for cars and other products used outside the home, the order books of raw materials providers and chip foundries were already full. To make matters worse, a series of idiosyncratic disruptions along the supply chain further hindered capacity. The stark reality is that it took two years for the semi ecosystem to slip into such a deficit and it may take almost that long for it to claw itself out.

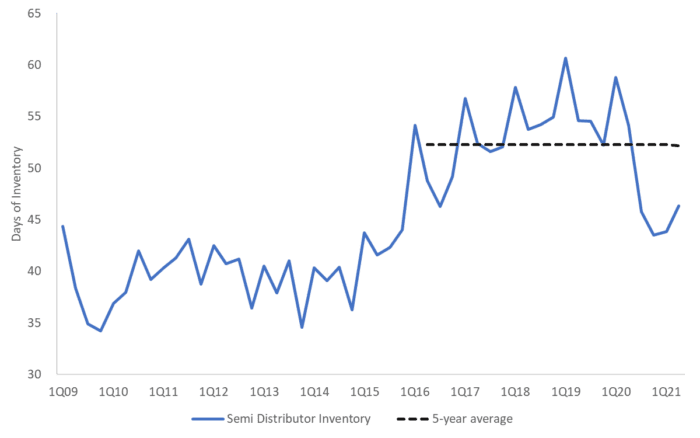

Semiconductor Distributor Days of Inventory

A confluence of factors has resulted in the industry unable to meet skyrocketing chip demand in the wake of commercial activity rebounding and the digitization of the global economy accelerating.

Source: Company data, Bloomberg. As of 30 June 2021.

It Is Different This Time

A convergence of factors has led us to conclude that the current chip imbalance won’t be resolved as easily as in earlier cycles. Foremost, the demand for semiconductors has hit an inflection point and, in our view, there is no going back as an increasing share of global economic activity occurs digitally. Remote work has created incredible demand for the complex chips that power cloud computing, artificial intelligence (AI) and developments with the world’s automotive fleet, including advanced driver assistance systems and vehicle electrification. Case in point: an electric vehicle can contain up to five times the semiconductor content than cars with internal combustion engines.

The automotive industry is also a major consumer of analog chips, as are a range of products and applications associated with the Internet of Things (IoT). This market segment, which includes microcontrollers and sensors, is an area that we believe could remain under acute stress as demand for analog chips becomes even more ubiquitous.

While the semiconductor industry scrambles to meet rising demand, it must also navigate tectonic shifts in the geopolitical and global trading environment. The chip supply chain is among the most globalized and the move toward localization and countries’ desire to control end-to-end production will likely have far-reaching ramifications as chip producers adapt to potentially more fragmented and siloed marketplace.

Lastly, although much of the attention has been placed on end users such as autos and IoT devices, some investors may not fully recognize the risk posed by the prevalence of analog chips in the machinery and tools of the world’s factory floors. In a worse-case scenario, if an assembly line is dependent on a series of four-dollar chips, and a few go down with no replacements in stock, production may grind to a halt, resulting in shortages of products with seemingly no relation to the semiconductor complex.

An Investor’s Perspective

The chip shortage is neither an annoyance nor a sideshow. Investors across asset classes and sectors need to realize that a 21st century economy cannot operate without semiconductors. On the supply side, we believe the current imbalance will create even more tailwinds for the semiconductor capital equipment makers that enable chip production. Should markets become more localized, the number of buyers for this complex machinery will likely grow.

While we are mindful of near-term perturbations surrounding supply and demand, we believe the hunger for analog chips will continue to grow as digitization results in ever higher levels of semiconductor content across a broad range of applications. Finally, we believe secular demand for the processors, accelerators, and networking chips that power AI and cloud computing services will continue to strengthen in the years to come as the world moves toward a digital economy.

Management decisions must also be revisited as the practice of just-in-time inventory on the part of chip buyers exacerbated the current shortage. Consequently, companies especially dependent upon chips in their end products or production processes may need to consider transitioning to a “just-in-case” inventory method. To counter the risk of overordering chips by a magnitude of four or five with the hope of canceling shipments should demand not materialize, chip producers are increasingly requiring orders to be noncancellable.

The semiconductor shortage has proven to be a high-profile pain point for the global economy, and it shows little sign of abating. While the nuances of the industry structure and semiconductor cycle are typically the domain of tech investors, the global economy’s increasing dependence upon the complex functionality of cloud- and AI-enabling chips as well as process-oriented analog chips, means that further industry developments should command the attention of all financial market participants.

Idiosyncratic risks are factors that are specific to a particular company and have little or no correlation with market risk.

Source:

[1] Data from Janus Henderson Research as of October 8, 2021

—

Originally Posted on October 13, 2021 – The Semiconductor Shortage: Why More than Tech Investors Should Care

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

The automotive industry is highly cyclical and can be significantly affected by labor relations and fluctuating component prices.

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!