This company’s best-in-class customer service and extensive payment network insulate it from incumbents and disruptors. Discover Financial Services (DFS: $123/share) remains a Long Idea after 3Q21 earnings.

We leverage more reliable fundamental data, as proven in The Journal of Financial Economics[1], and shown to provide a new source of alpha, with qualitative research to highlight this firm.

Discover Has More Room to Outperform

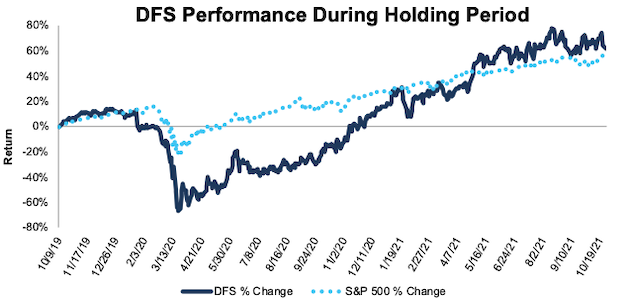

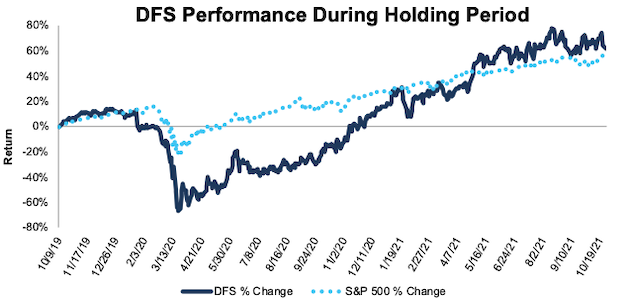

We made Discover Financial Services a Long Idea in October 2019 and the stock has outperformed the S&P 500 by 5% since then. Despite its slight outperformance, we still see upside in the stock.

Figure 1: Long Idea Performance: From Date of Publication Through 10/26/2021

Sources: New Constructs, LLC and company filings

What’s Working:

While coming in below expectations, Discover’s revenue grew 2% year-over-year (YoY) in 3Q21. Importantly, after five consecutive quarters of YoY decline, Discover returned to growing its loan portfolio and total loans in 3Q21 were 1% higher than 3Q20. Furthermore, the company continues to attract new customers and new accounts are up 17% over 2019 levels.

During the pandemic, consumers paid down outstanding credit balances with the help of government stimulus payments and fewer opportunities for discretionary spending, which improves the quality of Discover’s loan portfolio. The company’s net charge-off rate fell from 3% in 3Q20 to 1.5% in 3Q21. Discover’s 30+ day delinquency rate fell 43 basis points YoY in 3Q21.

Discover operates an extensive payments network across 200+ countries that is rivaled only by other major credit card companies Visa (V), Mastercard (MA), and American Express (AXP).

Discover increased its share of outstanding balances from 7.6% in 2019 to 8.2% in 2020. The company’s high-level customer service, as proven by its customer satisfaction rankings, fosters strong customer relationships that create a competitive advantage. When coupled with Discover’s payment network, the company has a large moat that enables it to take market share from incumbents while protecting its business from new decentralized finance (DeFi) entrants.

Discover’s established network and deep customer relationships have also prevented perceived threats from buy now, pay later (BPNL) companies from materializing. Our recent report on Affirm Holdings (AFRM) shows that BPNL companies don’t replace credit cards, but rather just increase consumer debt.

Discover’s integrated digital bank and payments model provides greater value than its direct peers as well. The company’s trailing-twelve-months (TTM) return on invested capital (ROIC) of 19% is well above card issuing peers’ Capital One Financial (COP) and American Express (AXP) ROIC’s of 8% and 9%, respectively.

What’s Not Working:

While card and organic student loans grew in 3Q21, Discover saw personal loan balances fall 4% YoY in 3Q21 as customers quickly paid down outstanding balances during the period. However, personal loans accounted for just 8% of the company’s total loan balance in 3Q21, and the company believes its return to pre-pandemic underwriting practices for this segment will lead to future growth.

Discover felt the pressure of the low-interest rate environment in 3Q21, which caused yields on personal loans to fall quarter-over-quarter. However, the company’s large credit card portfolio positions the company for consistent returns even if the current low-interest rate environment persists.

Credit cards traditionally have provided a convenient transaction method, which the proliferation of digital payment platforms and DeFi now challenges. Grand View Research expects the digital payment market to grow 19% compounded annually from 2021 to 2028. However, Discover’s extensive, secure network and credit facilities can be easily integrated within digital payment platforms. For example, Discover already leverages agreements with digital payment platforms such as PayPal, which contributed to the company’s strong 3Q21 sales.

Click here to read the full article

—

This article originally published on October 27, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our research utilizes our Core Earnings, a more reliable measure of profits, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan and published in The Journal of Financial Economics.

Click here to download a PDF of this report.

Disclosure: New Constructs

David Trainer, Kyle Guske II, Sam McBride, Matt Shuler, Alex Sword, and Andrew Gallagher receive no compensation to write about any specific stock, style, or theme.

The information and opinions presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or solicitation of an offer to buy or sell securities or other financial instruments. New Constructs has not taken any steps to ensure that the securities referred to in this report are suitable for any particular investor and nothing in this report constitutes investment, legal, accounting or tax advice. This report includes general information that does not take into account your individual circumstance, financial situation or needs, nor does it represent a personal recommendation to you. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about any such investments or investment services.

Information and opinions presented in this report have been obtained or derived from sources believed by New Constructs to be reliable, but New Constructs makes no representation as to their accuracy, authority, usefulness, reliability, timeliness or completeness. New Constructs accepts no liability for loss arising from the use of the information presented in this report, and New Constructs makes no warranty as to results that may be obtained from the information presented in this report. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information and opinions contained in this report reflect a judgment at its original date of publication by New Constructs and are subject to change without notice. New Constructs may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared them and New Constructs is under no obligation to insure that such other reports are brought to the attention of any recipient of this report.

New Constructs’ reports are intended for distribution to its professional and institutional investor customers. Recipients who are not professionals or institutional investor customers of New Constructs should seek the advice of their independent financial advisor prior to making any investment decision or for any necessary explanation of its contents.

In-depth risk/reward analysis underpins our stock rating. Our stock rating methodology grades every stock according to what we believe are the 5 most important criteria for assessing the quality of a stock. Each grade reflects the balance of potential risk and reward of buying that stock. Our analysis results in the 5 ratings described below. Very Attractive and Attractive correspond to a “Buy” rating, Very Unattractive and Unattractive correspond to a “Sell” rating, while Neutral corresponds to a “Hold” rating.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from New Constructs and is being posted with its permission. The views expressed in this material are solely those of the author and/or New Constructs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!