Stocks – INTC, FB, SNAP, CMG

Macro – SPY, IEF, DXY

Strange day for stocks, with the rally coming in the final hour on a relatively small buy imbalance. Whatever the case, it did the job of pushing the S&P 500 to a record close. Whether it holds tomorrow, I’m not so sure. Volume levels have been melting away, not exactly what you want to see for a sustainable rally.

There was a risk-off move across the entire market complex, from copper falling by 4% to the dollar rallying. Yields also rose dramatically on the front of the curve. Stocks ignored it all, perhaps trying to buy the rumor ahead of earnings. But tonight’s earnings have not gone very well.

S&P 500 (SPY)

Now the S&P 500 closed right on that February trend line I mentioned yesterday, which doesn’t tell me much in terms of this recent push higher sticking. Now I don’t usually look at the 4-hour RSI, but it works well enough at times to indicate the index remains very overbought. Again, gap over that trend, and the bulls can continue to party. If not, it could be the start of a rather dramatic turn of events.

Rates (IEF)

Now it seemed not to matter that rates rose today. In March, growth was getting hammered because the 10-Yr was at 1.7%. Now the 10-Yr is at 1.7%, and nobody seems to care, which makes total sense. I haven’t spoken about the 10-year in some time, but my general thoughts the last few weeks was that it could run up to around 1.76%, which would be the spring highs, with the potential to run to 1.95%. I have believed now for some time that rates on the long-end of the curve would either stay flat or rise at a slower pace than the front-end of the curve, resulting in flattening.

Dollar (DXY)

This is helping to set up the dollar index to get very close to breaking out. I have thought the dollar index could rise to around 96.30.

Intel (INTC)

Intel is falling after it gave guidance that missed expectations, now down around 9%. There’s not much to say here. Intel has no growth, and can’t seem to get out of its own way. So either the environment is slowing or maybe it is losing to the competition. If the stock manages to stay below $52 it will probably be on its way to $47.

SNAP (SNAP)

Snap is falling nearly 23% after reporting guidance that missed the consensus. It seems the iOS 15 adoption is creating issues for them, and what is most likely to be a problem for Facebook too. I’m surprised Facebook is only down 5% tonight. Maybe they pull off a miracle when they report on Monday. Anyway, Facebook needs to hold on to support $323, or this is toast on its way to $300.

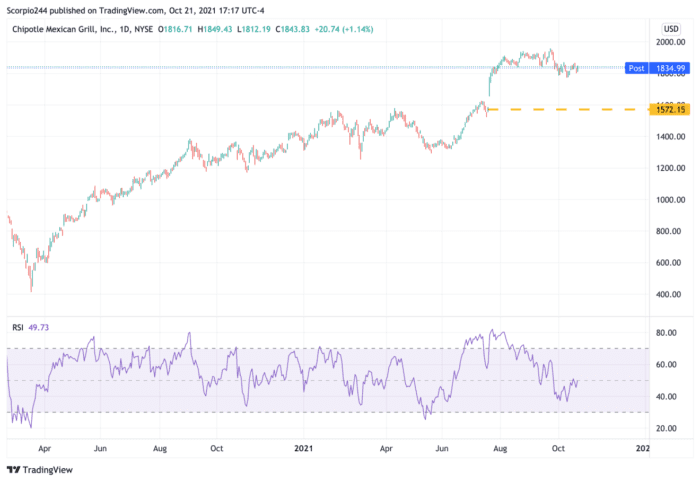

Chipotle (CMG)

Chipotle is down about 1.5% after hours, but they seemed to guide margins, lower for next quarter, and the moment the market seems fine with it. We will see how it goes tomorrow. There’s is that giant gap down around $1570 that needs to be filled, and I guess you just never know. There is a bearish trend in the RSI and looks diamond pattern.

–

Originally Posted on October 21, 2021 – Stocks Rally On October 21 But Earnings Disappoint

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!