As the earnings season conclude, REITs and Property Trusts listed in Singapore have announced financial results or published business updates for the period ending 31 Dec 2022.

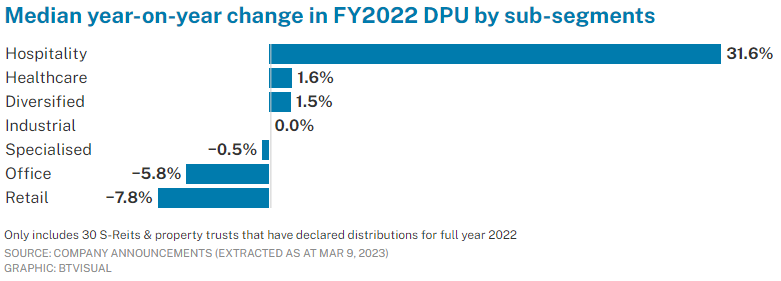

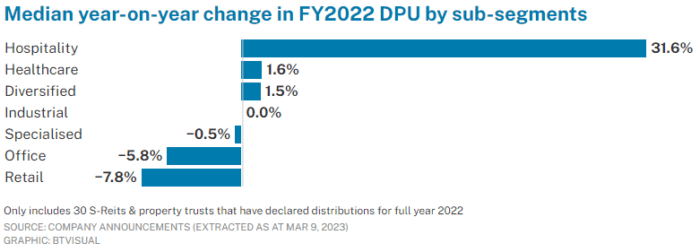

Of the 30 S-REITs which have declared full year 2022 distributions, median change in distribution per unit (DPU) increased marginally by 0.2 per cent year-on-year (y-o-y). By sub-segments, the Hospitality segment saw the highest median increase of 31.6 per cent while Healthcare and Diversified segments were resilient at 1.6 per cent, 1.5 per cent respectively.

The five trusts with the highest y-o-y DPU increments for FY22 are: ARA US Hospitality Trust (760 per cent), Paragon REIT (34 per cent), CDL Hospitality Trusts (32 per cent), CapitaLand Ascott Trust (31 per cent) and Far East Hospitality Trust (24 per cent).

ARA US Hospitality Trust (ARA H-Trust) declared a Distribution per Staped Security (DPS) of 3.054 US cents for FY22, up 760 per cent from FY21’s 0.355 US cents. This came on the back of stronger operating performing as the US lodging market continued to recover. ARA H-Trust achieved higher revenue of US$169.0 million and Net Property Income (NPI) of US$41.4 million in FY22, up 29.3 per cent and 66.4 per cent y-o-y respectively. This contributed to the 767.6 per cent y-o-y growth in FY22 distributable income.

Paragon REIT announced a change in its financial year-end from 31 Aug 2022 to 31 Dec 2022. It’s latest FY22 reporting period was therefore a 16-month period from 1 Sep 2021 to 31 Dec 2022 and comparison of y-o-y DPU change was based on the current 16-month period in FY22 to a 12-month period in FY21. Its FY22 DPU was up 34.1 per cent to 7.24 Singapore cents from 5.40 Singapore cents in FY21. DPU for the 4-month period ended 31 Dec 2022 was 1.72 Singapore cents, unchanged from the same period a year ago.

CDL Hospitality Trusts (CDLHT) declared a DPS of 5.63 Singapore cents for FY22, up 31.9 per cent y-o-y. Accelerated global travel recovery saw most of CDLHT’s portfolio markets experience robust performance growth in FY22. Driven by higher revenue achievement, its FY22 NPI increased by 43.7 per cent to S$123.7 million. The higher NPI was largely attributed to the Singapore portfolio and UK Hotels. In FY22, Revenue per Available Room (RevPAR) for its Singapore portfolio increased 104 per cent to S$166 from S$82 in FY21.

CapitaLand Ascott Trust (CLAS) announced a FY22 DPS of 5.67 Singapore cents, up 31 per cent y-o-y. The trust saw strong operating performance as international travel recovers, lifting FY22 Revenue Per Available Unit (RevPAU) to $120, up 74 per cent y-o-y. As a result, FY22 revenue and gross profit increased 58 per cent and 63 per cent respectively. The trust noted that to further enhance income stability, CLAS invested S$420 million in 15 accretive acquisitions in FY22, predominantly in the longer-stay segment.

Far East Hospitality Trust (Far East H-Trust) declared a FY22 DPS of 3.27 Singapore cents, up 24.3 per cent y-o-y. NPI for FY22 increased by 2.9 per cent while total distributions increased by 25 per cent to S$65 million on the back of higher NPI, lower finance expenses, and sharing of gains from the Central Square divestment. The trust noted that with the recovery of the hospitality sector, its hotels and serviced residences benefited from the increased flow of business and tourist traffic into Singapore. RevPAR for its hotel portfolio grew 64.3 per cent in FY22 to S$92 while RevPAU for its serviced apartment portfolio increased 39.3 per cent to S$195 in FY22.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted March 13, 2023 – REIT Watch – Hospitality S-REITs’ DPU rebound 32% in 2022

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!