South Korea’s semiconductor sector has been beset by a slew of headwinds, as currency depreciation, and overall economic turmoil, has taken a toll on the country’s manufacturing capabilities.

South Korea has been widely touted as the center of the semiconductor universe, with companies such as Samsung Electronics (005930.KS) and SK Hynix (000660.KS) fueling global advancements in consumer technologies.

In fact, chipmakers in general, are critical to the advancement of new technologies, including self-driving cars, artificial intelligence, 5G and the Internet of Things. However, concerns about a global recession, as well as cross-currency depreciations, have broadly inflicted pain in related stocks and exchange-traded funds (ETFs).

Indeed, worries about a slowdown in global growth prospects – notably among South Korea’s top trading partners China and the United States – have contributed to that country’s dismal industrial output over the past two months.

August marked the second consecutive monthly decline in Asia’s fourth-largest economy, with South Korean factories registering a worse-than-expected 1.8% fall, after sliding 1.3% in July. The figures further darken the industrial landscape in Asia, after other major economies in the region, including China, Japan, and Taiwan, also reported suffering from industrial weakness.

Cross-Currency Crush

Marc Chandler, chief market strategist at Bannockburn Global Forex, noted the reason the downward surprise in South Korea’s factory output is “particularly noteworthy” is that, for the first-time in four years, semiconductor output fell on a year-over-year basis (-1.7%). He observed that, on a separate, but related note, chip inventories swelled (67.3%), while factory shipments fell for the second consecutive month.

“This is seen reflecting a slowing of world demand,” he continued, underscoring the plunge this past week in the South Korean won to 13-year lows.

Indeed, the country’s currency has been hammered against the U.S. dollar, amid the Federal Reserve’s aggressive tightening of monetary policy, and hawkish rhetoric, as it aims to combat rising levels of inflation. It was last seen trading at around 1,436.50 ahead of the weekend.

Unsurprisingly, the fall in foreign exchange has crimped demand for certain U.S.-dollar denominated commodities, which has ultimately helped to lower input prices.

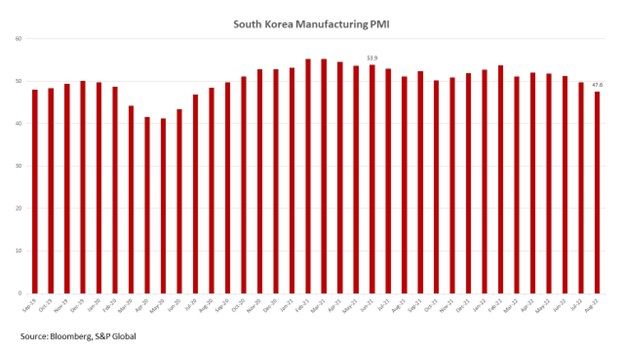

According to the S&P Global South Korea Manufacturing Purchasing Managers’ Index (PMI), weaker demand conditions generally had a positive impact on price and supply pressures, as South Korean firms commented that supply chain disruption, as measured by supplier delivery times, was at its lowest since November 2020. This in turn helped to ease inflationary pressures and contributed to the softest rise in input prices since January 2021.

The PMI fell from 49.8 in July to 47.6 in August, signaling the sharpest deterioration in the health of the South Korean manufacturing sector since July 2020. S&P Global added that the underlying components of the headline index point to “further weakness to come”.

When the Chips are Down

Against this backdrop, the global semiconductor sector has been under relentless pressure following bouts of Covid-induced shortages, as well as cross-border trade tensions, including a history of tariffs, and other geopolitical concerns.

To date in 2022, shares of Samsung and SK Hynix have fallen by around 32% and 36.5%, respectively, while South Korea’s Kospi Index has shed about 28% (to 2,978) over the same period.

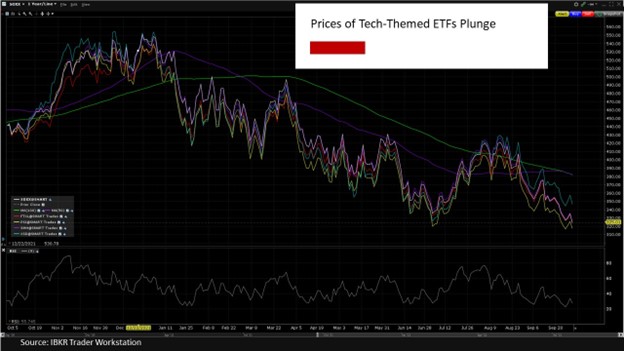

Prices of several global chipmakers’ stocks, and tech-themed ETFs, have also cratered since the start of this year, including NVIDIA (NASDAQ: NVDA -60%), Broadcom (NASDAQ: AVGO -31%), Intel (NASDAQ: INTC -50%), Qualcomm (NASDAQ: QCOM -38%), Advanced Micro Devices (NASDAQ: AMD -56%), the Taiwan Semiconductor Manufacturing Company (NYSE: TSM -46%), and the iShares Semiconductor ETF (NASDAQ: SOXX -40.1%)

Stay Informed

Market participants are likely to receive further clues about the trajectory of the industry in the week ahead, with a line-up of economic data releases & central bank events, including:

Monday, Oct 3

S&P Global Manufacturing PMI (Sept)

Tues, Oct 4

Inflation Rate (Sept)

Tuesday, Oct 11

Bank of Korea’s Interest Rate Decision

In the meantime, select the Event Calendar option in the IBKR Trader Workstation for a full list of U.S. and global corporate events and earnings, dividend schedules, economic data, IPOs and more.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!