Executive Summary

- Inflation fears continue to spur volatility in global stock and bond markets

- Supply chains disruptions persist despite improving COVID-19 figures

- Analysts are hopeful for semiconductor capacity additions next year, but traders should be cognizant of volatility in the near-term

- Wall Street Horizon’s interim corporate data provides valuable information—we feature several firms from chip manufacturers to a device maker that will report monthly sales data in the coming days ahead of quarterly earnings season

Transitory inflation might not be so transitory after all. Investors are coming to that reality as seen in recent global stock market volatility. Raw material prices are on the rise and supplies are low. After a second quarter dip, there are now a record number of containerships anchored off the Los Angeles and Long Beach ports (Figure 1). Transportation costs and lead times have gone through the roof, casting an ominous shadow on the global economic rebound. Car buyers and those remodeling their kitchen certainly feel the supply crunch and product delays. While delivery times have gone up stateside, we can look to Asia for a culprit—semiconductor chip shortages.

Figure 1 [1]

Investors need to have the latest supply chain information to stay ahead of financial market volatility. Simply waiting on stale monthly economic data from government bureaus will not suffice. Where to turn? Gathering interim data from companies yields the best real-time clues and insights.

October features several global firms issuing intra-quarter business insights between their usual earnings reports. We highlight important international corporations scheduled to issue interim results and why traders should mark the dates on their calendars.

October 8 – Taiwan Semiconductor (TSM) Monthly Revenue Report September 2021 (unconfirmed)

Following a bloodbath third quarter for once-stalwart Chinese stocks Tencent and Alibaba, Taiwan Semiconductor took the helm as the largest non-US public company in the world [2]. Nevertheless, the situation is not rosy for the chip manufacturer. The global supply crunch is perhaps most apparent in the computer chip space. Semiconductors are needed to make so many daily items and durable goods—from cars to washing machines to refrigerators and even electronic toothbrushes. The current shortage is one of the primary drivers of surging inflation around the world.

Traders will get a glimpse into the latest state of the chip market on Friday, October 8 when TSM issues its monthly Revenue Report of September activity. Expect volatility to pick up ahead of the release and options traders should be mindful of weekly options expiration that afternoon. Later in the month, TSM has a confirmed earnings date of Thursday, October 14 (before market).

October 8 – MediaTek Inc. (2454 Taiwan) Sales Report September 2021 (confirmed)

MediaTek also reports monthly sales data on October 8—it is a key day for traders of technology stocks. MediaTek, a $55 billion large cap, is the world’s fourth largest global fabless semiconductor company and powers more than two billion devices a year, according to the firm. The company performs research and development, manufactures, and sells chips. MediaTek’s semiconductors are used in smartphones, TVs, tablets, and cars. The pressure is on the company to deliver ahead of the all-important fourth quarter holiday season. Wall Street Horizon also confirms MediaTek will host an Interim Sales conference call on the afternoon of Friday, October 8. Its August interim sales report was stellar with annual growth of 30.9% while the January through August block saw revenue gains of nearly 70% from the same period in 2020.

Later in the month, MediaTek reports third-quarter earnings on Friday, October 29 (unconfirmed). This is a particularly interesting time for MediaTek as several technology-related news outlets reported that the company could be negotiations with AMD to form a joint venture [4].The interim sales data call on Friday and the earnings report later this month could offer traders clues on potential M&A activity.

Figure 3: MediaTek Stock Price History (1-Year) [5]

October 11 – Vanguard International Semiconductor (5347 Taipei Exchange) VIS Monthly Sales Report September 2021 (unconfirmed)

VIS reported stellar sales growth in its August update, growing revenues by 44.7% year-over-year and 25.4% during the January through August period versus the same time in 2020. Investors will get another look at chip sales for the $9 billion mid-cap in the semiconductor industry within the Information Technology sector. Interestingly, the firm recently announced the issuance of NT$ 5 billion in corporate bonds at interest rates under 1% to finance upcoming projects [6].

Despite the ongoing supply chain bottlenecks, VIS is optimistic for the future. Traders will judge for themselves on Monday, October 11 when the interim report is issued. Expectations could be higher for VIS compared to TSM and MediaTek—the VIS stock price, while in a correction, is up significantly year-to-date.

Figure 4: Vanguard International Semiconductor Stock Price History (1-Year) [7]

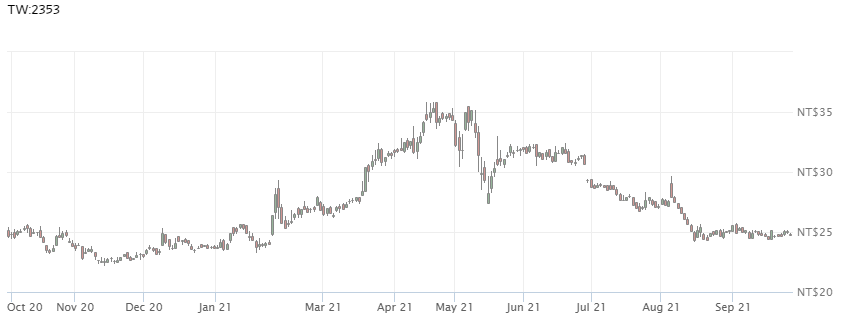

October 8 – Acer Incorporated (2353 Taiwan) Revenues Report September 2021 (unconfirmed)

Moving down the supply chain, Acer Inc provides its September sales report on Friday, October 8. The firm reported robust growth in August but cautioned the investors that demand was higher than supply. Under normal circumstances, that would not be cause for much alarm, but that is a red flag in today’s market tight on raw materials.

Driving strong revenue growth is a global buying spree in Chromebooks and commercial notebooks [8]. Laptop demand is sky high following the work-from-home shift and as many students switched to virtual and hybrid learning over the last 19 months. The recent back-to-school boom put further pressure on chipmakers to deliver the goods. Despite impressive top-line growth, Acer has lost one-third of its market value in the last five months.

Figure 5: Acer Stock Price History (1-Year) [9]

Order backlogs and supply chain bottlenecks are seen most clearly in the semiconductor market. Downstream chips users are feeling the pinch, too. Pressure is mounting to swell inventories ahead of what is sure to be a record holiday season. Consumers, flush with cash, are primed to shop for the latest fun and practical gadgets after last year’s toned-down shopping season (thanks to a harsh COVID wave last winter).

Interim sales reports from global semiconductor firms will be important information for traders to sift through. Conference calls and earnings reports in the following weeks should also be on investors’ calendars. Wall Street Horizon’s new Interim Data offers clients key insights into company metrics between quarterly earnings reports.

—

Originally Posted on October 1, 2021 – October Corporate Events Provide Volatility Clues from Global Chip Shortage

[1] https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/eye-on-the-market/dude-where-is-my-stuff-amv.pdf

[2]https://www.ishares.com/us/products/239594/ishares-msci-acwi-ex-us-etf

[3] https://stockcharts.com/h-sc/ui?s=_TSM&p=D&yr=1&mn=0&dy=0&id=p76377226475

[4] https://www.gizchina.com/2021/09/24/amd-set-to-enter-the-mobile-processor-market-to-partner-with-mediatek/

[5] https://www.wsj.com/market-data/quotes/TW/XTAI/2454/advanced-chart

[6] https://www.vis.com.tw/en/press_detail?itemid=16963

[7] https://www.wsj.com/market-data/quotes/TW/ROCO/5347/advanced-chart

[8] https://news.acer.com/acer-reports-august-consolidated-revenues-at-nt2710-billion-up-24-year-to-august

[9] https://www.wsj.com/market-data/quotes/TW/XTAI/2353/advanced-chart

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!