- An earnings recession is likely ongoing across the global corporate world

- Outlooks provided on new products, services, and initiatives at investor days this month will lay the foundation for how the balance of 2023 unfolds

- Following market-moving events from Tesla and GE, we highlight three consumer companies moving in different directions with upcoming investor days

Now that the fourth quarter earnings season is in the rear-view mirror, investors aim to spot clues from outlooks given at analyst and investor days in March. This is peak season for these important gatherings before the Q1 reporting season begins in mid-April. With inflationary pressures returning to the headlines and what may be a weakening labor market over the ensuing months, corporate executives may have to tighten their belts in order to maintain profitability.

Earnings At Risk

And we might already be in the midst of an earnings recession on Wall Street. Per-share profit growth on the S&P 500 was solidly in the red last quarter, and the first half of 2023 is forecast to feature another two quarters of earnings declines, according to FactSet.

How are CEOs and CFOs handling this tough economic backdrop? What steps are companies taking to protect margins? Are dividends and share buybacks at risk? And which firms benefit from shifting consumer trends and volatile capital markets?

Tesla & GE Move in Opposite Directions

Those are some of the questions market participants want answered during “investor day month.” And we have already seen some volatility in the wake of a pair of high-profile events. Recall earlier this month when Tesla (TSLA) shares dropped big as CEO Elon Musk failed to deliver on specifics related to his “Master Plan Part 3” back on March 1 in Austin, Texas. This was an example of how investors seek specifics from a company’s management team, not simply lofty visions and vague predictions. Shares of the EV-maker fell 7% following its investor day.

On the bullish side of the ledger, General Electric (GE) held its investor day on Thursday, March 9. The blue-chip Industrials sector stock surged to a five-year high close to $95 before paring gains into the close. At the event, Lawrence Culp, chairman and CEO of the conglomerate delivered what stakeholders wanted to hear. “The future is bright at GE,” he said while highlighting strong expected demand for jet engines and related services to power top-line growth in the years ahead. There’s no doubt that certain niches – such as aerospace and defense – are in a prime spot to benefit from the uncertain new world post-COVID.

Setting the 2023 Table

But what other investor days are on the horizon to drive volatility that investors should mark on their calendars? Risk management is more critical than ever this year, and information gleaned at investor days often sets the stage for how companies perform in the coming quarters and years.

Key Dates to Watch

The consumer is in focus this month. With stubbornly high inflation and dwindling excess savings from the pandemic, what’s happening at the firm level may have broader implications for the macroeconomy.

March 20 – Foot Locker (FL) Investor Day 2023, Q4 Earnings Date, and Same-Store Sales Report

The Consumer Discretionary sector had a tough 2022 with a nearly 15% drop in earnings growth. Goods spending domestically has given way to demand for travel and services, leaving many retailers in a bind. Foot Locker shares surged over the back half of 2020 through 2021 during the ‘reopening’ trade, but the multinational apparel firm has struggled over the last year.

Wall Street Horizon also picked up a potential bearish clue. The company was late to confirm its upcoming Q4 earnings date. This comes after some management changes last year – new CEO Mary Dillon seeks to improve relations with Nike with the goal of boosting sales. Monday the 20th could feature high volatility with FL’s later-than-usual earnings date and investor day.

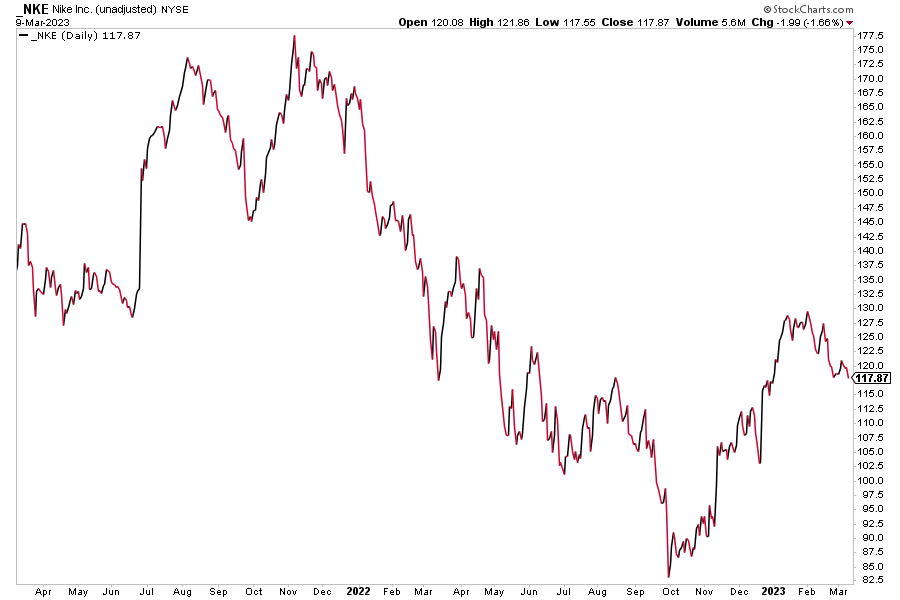

Nike 2-Year Stock Price History

Source: Stockcharts.com

March 22 – The Hershey Company (HSY) Investor Day 2023

Pivoting from the shoe market to a sweeter side of the consumer, Hershey holds its annual investor day on Wednesday, March 22 ahead of its unconfirmed Q1 2023 earnings date of Thursday, April 27. Food inflation continues to run hot while commodity prices ease. Still, cocoa was actually a hot commodity earlier this year, so costs remain a wildcard for HSY.

But back on Groundhog Day, the Pennsylvania Consumer Staples company reported a strong final quarter to 2022 with rich margins and sweet sales. With increasing capex this year, the management team upped its net sales guidance for 2023, too. Is Hershey’s about to unwrap more upbeat news on the 22nd? It’s quite possible given operational tailwinds. The stock is eye-candy for momentum investors, too, as shares rest near all-time highs.

Hershey 2-Year Stock Price History

Source: Stockcharts.com

March 23 – Genuine Parts Company (GPC) Investor Day 2023

Another 2022 winner is in the auto parts space. With the value of used cars failing to fall back fast, workers returning to the office and daily commute are often electing to take the DIY approach, repairing vehicles rather than doling out cash for a new ride. But GPC is not just a domestic story – it has strong international sales and impressive global profitability trends. The Atlanta-based distributor of auto, industrial, and office parts and products reported a top and bottom line beat last month and introduced guidance above the consensus call.

GPC’s share price has hit the brakes lately, though, as the consumer may be stretched too thin. Comments from its management team on the 23rd regarding the U.S. and foreign demand situation along with broader color on the manufacturing picture will help determine where the global economy will progress.

Genuine Parts 2-Year Stock Price History

Source: Stockcharts.com

Conclusion

There is no let-up in breaking news at the corporate level in March. The period between earnings seasons is when companies meet with analysts and shareholders to offer insights into the micro and macro landscapes. With uncertainty as to whether the economy achieves a soft landing or if a steeper recession is in the cards, executives’ commentary and guidance help investors position themselves for future volatility.

—

Originally Posted March 13, 2023 – Investor Day Month: Key Analyst Days Happening in March

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!