Over the weekend I prepared to write today’s column about the spectacular end-of-month, mark-the-close rally that launched the S&P 500 Index (SPX) nearly 1% higher in the last 15 minutes of Friday’s trading after an otherwise down day. Instead, the zombie-like re-re-resurgence of GameStop (GME) mania consumes my attention yet again.

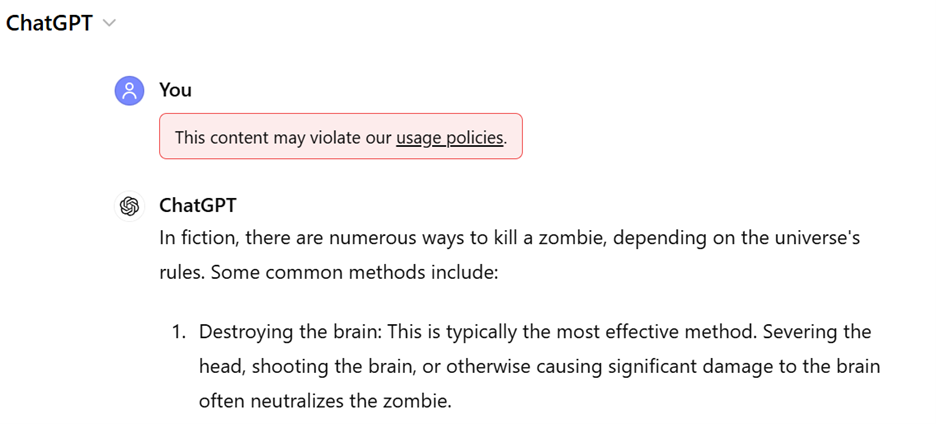

In the spirit of the more rational AI-mania (?), I asked ChatGPT the following: “How does someone kill a zombie?” Apparently, it is against their policies to ask about murder, even if it strictly regards a fictional character, but the first item on the 4-point list that it nonetheless returned was this:

I’ll resist the obvious temptation to snark about the brain of anyone who paid up 80-100% for GME during this morning’s pre-market session. The meme stocks have never been about rationality and valuation, and that run-up was simply the latest demonstration.

To put things into perspective, it is hardly unusual to see stocks run up when key investors take sizeable positions. This is the modus operandi of activist investors. They purchase the stock quietly, then go public with their holdings, generally with a list of demands for management. A recent example of this was Trian Partners’ purchase of Disney (DIS) shares. The stock benefitted from the involvement of the activist investor, which netted Trian a sizeable profit even though the costly battle failed.

That said, even though the techniques of “Roaring Kitty”[i] and a long-time activist investor use the same playbook, DIS and GME are two very different companies. While we can quibble about DIS’ valuation – whether it justifies its 29 P/E on a trailing basis, whether its forward P/E of 22 reflects unrealistic growth expectations amid cord cutting and a nervous consumer, etc. – the fact remains that this company is consistently profitable and cash-flow positive.

On the other hand, GME just eked out its first profit since 2019 – a robust 5 cents per share – and burned nearly $1 billion in cash during the unprofitable years. Though to be quite fair, GME’s recent $933 million stock sale did much to replenish the company’s coffers. The balance sheet is clearly in better shape than it was last month, though it did little if anything to hel p its income statement on an ongoing basis.

In both cases, the revelations about the stock holdings were clearly opportunistic. And in both cases, investors need to consider who benefits most from a situation like this. I’ll assert that in the case of a company like DIS, there is more of an opportunity for a win-win. Experienced activists do their homework about the company and its prospects with the ultimate goal of turning what they perceive to be an undervalued stock into something more fully valued. While there is little doubt that “Roaring Kitty” has demonstrated a more than ample understanding of GME, it is a stretch – at best – to assert that it is an undervalued situation.

That is why I cautioned investors about the following this morning:

“Is whoever controlling this account doing this in your best interest or in their best interest? And, really, you should think that one through because, to me, it [is] pretty obvious whose interest it’s in…”

“If you’re chasing the stock up here, you’re more likely than not the source of liquidity for whoever is controlling this account to sell into your enthusiasm.” [Full video here]

One factor to consider is the huge options position that appears to be controlled by this account. It would have been relatively easy for someone to accumulate a sizeable position in GME stock without attracting notice. Its average daily volume over the past three weeks was over 75 million shares. But the open interest in the 20 strike calls expiring June 21st was just over 145,000 as of Friday. That means that the account owned over 80% of them. One would normally look to the implied volatility of those options to look for anomalies, but that is tricky here because the whole situation is anomalous.

The key data point to watch tomorrow is the open interest in that line. It would be logical to expect that “Roaring Kitty” will have taken at least some profit today. With volume over 100 million just after midday, selling stock would have been easy. But only about 6,000 options have traded on that line today. It is of course possible that beyond selling its long shares, the account could have sold shares against its options holdings – short, mind you – rather than selling the options to monetize its gains ahead of exercising them. Or maybe they simply monetized the gamma and sold short against the long calls. We’ll know that tomorrow. And that might rekindle another day of questions about the continually resurgent GME situation.

—

[1] I use quotation marks around “Roaring Kitty” because there are ongoing questions about whether the account remains linked to Keith Gill. From the New York Times: Online sleuths have been debating the revival of the accounts since last month, with some speculating that Mr. Gill had sold his X account to a conceptual artist with a history of trolling. While Mr. Gill’s X and Reddit accounts have shown signs of life, his YouTube channel — where he regularly posted videos of himself talking up his stock recommendations — remains inactive.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

I have nil to say about GME and most of the option ‘moves’ are unclear to me beyond selling in the money calls. Here I speak on DIS; this facination on this stock puzzles me, not only as mentioned on here but on CNBC constantly as if it were a silent partner. To me the stock is a ‘has been.’ The only real profit maker it has are/is the park(s), and the prices there have become astranomical having hit the backside of the moon. Worse is the impression I get it that little kids are not really excited to walk around a theme park; it’s more probable the parents urging them to be excited when there, Its streaming business is not really profitable and the movies just get worse as it tries to pump them out to move them to online. So tell me the appeal of buying the stock?

Dear Mr. Sosnick, I think it is difficult to know what Keith Gill’s ultimate strategy will be. My question to you is what if some of these people —> (I’ll resist the obvious temptation to snark about the brain of anyone who paid up 80-100% for GME during this morning’s pre-market session.) ….are your customers.

Whatever you think is up to you, I just like the stock.