Investors in the week ahead will receive The Coca-Cola Company’s (NYSE: KO) latest earnings results, as the soft beverage behemoth has enjoyed stellar demand for its products, despite a long list of challenges, including higher commodity costs, currency fluctuations, and overall slowing global growth.

Coca-Cola, the iconic, Atlanta-based soft drink company, has materially transformed its operations since its founding in the 19th century – now boasting a diverse portfolio of brands that include not only Coca-Cola Classic, Sprite, and Fanta but also a wide array of hydration, sports, coffee, tea, juice, dairy, and plant-based beverages.

The broad range of offerings has helped spur healthy revenue generation recently, with the company’s strong second quarter 2022 figures buoyed by the ongoing recovery in away-from-home consumption, as well as low price elasticity.

The rosy picture prompted John Murphy, Coca-Cola’s chief financial officer, to state on the firm’s past earnings call that he expects organic revenue growth to climb 12% to 13% year-on-year in the third quarter compared to his prior projection of 7% to 8%.

Murphy also said he continues to expect comparable EPS growth of 5% to 6% over 2021, as well as maintains his outlook on generating US$10.5 billion worth of free cash flow for 2022 – derived from around US$12 billion in cash from operations, less an estimated US$1.5 billion in capital investments.

Getting More Expensive to Teach the World to Sing

However, the company’s margins are likely to be impacted by commodity price inflation, which Coca-Cola’s CFO expects to move to a high single-digit from a mid-single one. “This is primarily due to commodity cost increases across our concentrate and finished goods businesses,” Murphy said, while other costs, including wages, transportation, media, and operating expenses, are also increasing, and adding incremental pressures.

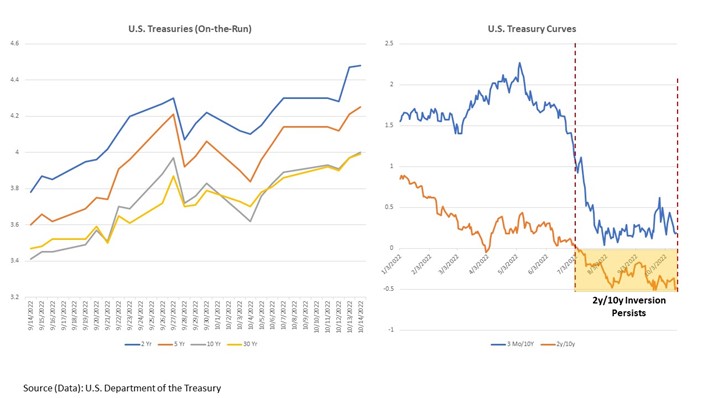

Furthermore, given the backdrop of rising interest rates, Coca-Cola expects to see an impact on its interest expense, given its exposure to floating-rate debt.

But debt management should be quite manageable.

Dave Novosel, a senior analyst at corporate bond research service firm Gimme Credit, recently noted that the company’s “superlative revenue expansion should allow EBITDA to increase significantly, thereby reducing leverage. Free cash flow is excellent, providing the financial flexibility for share repurchases and some acquisitions without adding any debt. Moreover, we think the beverage business in general, and Coca-Cola in particular, will do well in a weaker economic environment.”

Novosel continued that he expects “much better” free cash flow in the second half of 2022, bringing his full year estimate to around US$3 billion, while the “substantial increase” in EBITDA he anticipates should take leverage down to 3.4x by year-end. He added that if the company employs some of its free cash flow and/or the US$9 billion of cash on hand to slash debt by US$2 billion, leverage would drop to 3.2x.

Against this backdrop, Coca-Cola’s 2.0% notes due March 2031 were last up 0.26% on the day Friday at US$78.61, while its 4.125% March 2040s were 2.56% higher at US$86.94, according to the IBKR Trader Workstation.

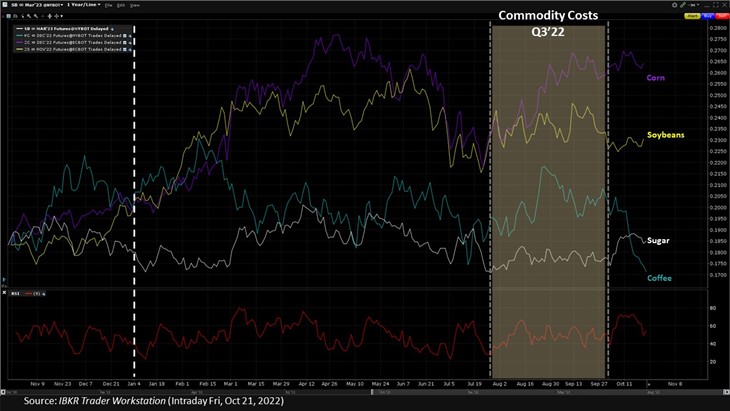

Commodity Pressures

Meanwhile, given the expansion of its offerings, Coca-Cola’s range of required agricultural raw materials has grown in tandem, with the firm reliant on sourcing its ingredients from sugarcane, sugar beet, corn, coffee, soybeans, nuts, and dairy, among other products, amid challenging global supply chain conditions, and increasing commodity costs.

Since the global COVID pandemic rattled supply chains around the world, prices of several agricultural commodity futures have skyrocketed. The active sugar contract, for example, is around 61.8% more expensive than it was in mid-May 2020; corn is up about 84.6% since April 2020; and coffee has risen about 69.0% since June 2020.

The rise in the U.S. dollar can also be attributed to higher prices of commodity futures, with the U.S. Dollar Index (DXY) having risen just north of 17.5% year-to-date in 2022 and increasing nearly 20.5% year-over-year.

While agricultural commodities generally have several other dynamics that influence their futures contract prices, including weather and geopolitics, for example, it is clear they have reached much higher levels over the past two and a half years.

Moreover, the Russia-Ukraine war has not only impacted some agricultural commodities such as wheat and corn, but also some corporate balance sheets – such as Coca-Cola’s.

The company said it expects the direct impact of the Ukraine conflict and the resulting suspension of its business in Russia will amount to around US$0.03 to comparable EPS – which analysts generally translate to 1% to 2% of net operating revenue.

Coca-Cola is expected to release its third quarter 2022 financial results Tuesday, October 25 before the opening bell at the New York Stock Exchange. Analysts generally expect the company to earn around US$0.64 per share (EPS) on US$10.50 billion in revenue.

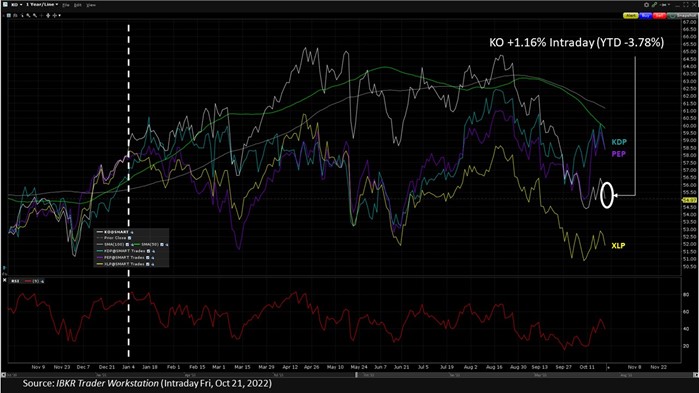

The company’s stock was last trading up around 1.16% at US$55.72, according to the IBKR Trader Workstation, after the firm declared a dividend Thursday of US$0.44 per share, payable Dec. 15, 2022, to shareowners of record as of the close of business on Dec. 1, 2022.

Earnings History

| Period | EPS (US$) | Revenue (US$bn) |

| Q2 2022 | 0.70 | 11.3 |

| Q3 2021 | 0.65 | 10.0 |

Related Earnings Releases

- Keurig Dr Pepper (Thursday, Oct 27)

Learn More

- Economic Indicators & Corporate Earnings

- IBKR Traders’ Academy: Finance Courses About Futures

- IBKR Traders’ Insight: Corporate Earnings Commentary & Analysis

- IBKR Traders’ Insight: Commentary on the Futures Markets

- IBKR Webinars: Futures-related Presentations

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!