Even though we have seen third-quarter earnings begin to trickle out – PepsiCo (PEP), Delta Air Lines (DAL) and Walgreen Boots Alliance (WBA) among them – the unofficial start to earnings season starts tomorrow morning when a quartet of large banks report. Releases from JPMorgan Chase (JPM) and its smaller, but still-huge competitors, Citigroup (C), Wells Fargo (WFC) and PNC Financial (PNC) are the harbinger of a few weeks of a steady stream of corporate results.

Let me first get one of my biases out of the way. I have never been a fan of the fact that banks lead off the earnings parade. I wrote about this in July 2022 in an article entitled I Wish I Could Rearrange Earnings Season. My ongoing premise is:

If I had the power to reorganize earnings season, I would not have the major banks kick off the festivities.

I say this as someone who spent over 20 years as either the specialist or a market maker in the options of bank stocks large and small, domestic and foreign-based. It is human nature to try to extrapolate trends from limited data sets, and an early slew of bank earnings offer an unrepresentative small sample of data from which market commentators (present company included) try to divine a trend for the flood of reports that will follow. No other industry’s bottom line is nearly as dependent upon idiosyncratic items like the shape of the yield curve and trading results. And as any trader will tell you, those are extraordinarily difficult to project. Sure, management might offer some insight into the bank’s loan demand from customers, but those insights rightfully lack specificity – they can’t discuss individual customers in a public forum.

But like it or not, the banks are coming, and I will be paying close attention just like everyone else.

Interestingly, UnitedHealth Group (UNH) also reports tomorrow. It has a larger weight in the S&P 500 (SPX) than JPM – #10 vs. #13 – and is the highest weighted stock in the price-weighted Dow Jones Industrial Average (INDU) where JPM is #18 – but JPM and friends will likely garner more attention. BlackRock (BLK), no financial slouch itself, reports tomorrow too.

Although traders seem to be quite a bit more sanguine as major indices rallied over the past week, we are indeed seeing some risk aversion in these names and their sector. Notice the change in the term structure of implied volatility in XLF, the Financial Select Sector SPDR, over the past week:

XLF, Term Structure of Implied Volatility, Today (yellow) vs. 1-Week Ago (red)

Source: Interactive Brokers

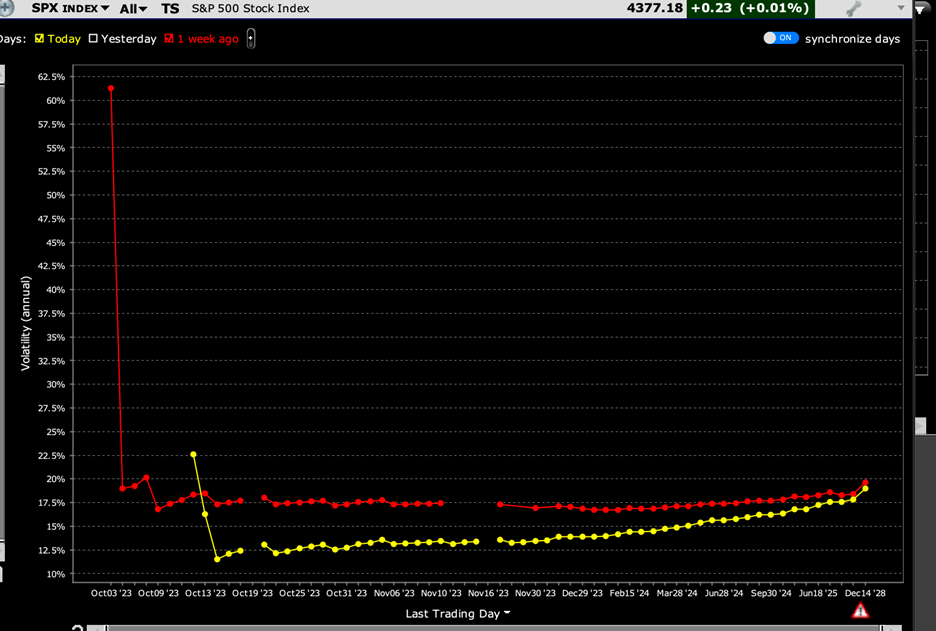

Overall, the volatility curve sank substantially. As we see below, this is commensurate with the broad pullback in implied volatilities in SPX. Because it lacks zero-dated options expiring on Thursdays, XLF didn’t have the staggeringly high reading on for its first expiration, but otherwise the decline in the term structure is quite similar:

SPX, Term Structure of Implied Volatility, Today (yellow) vs. 1-Week Ago (red)

Source: Interactive Brokers

In both cases, note the spike at the start of the yellow lines. They reflect some logical concern about the potential for earnings to move both the banking sector and the broader market. This is partly driven by some risk aversion in the individual banks. Tomorrow’s options in WFC are implying a roughly 4% move even though the stock’s historical average move is 2.3%. Also, it barely moved after the last two reports, falling -0.34% and -0.05% respectively. The implied volatility in at-money C options is also around 4%, understandable because it moved about that much after its last two reports (-4.05% and +4.78%). Not surprisingly, JPM is a bit closer to 3.5%. They are perceived to have greater earnings power and fewer issues for management to contend with. Although JPM’s long-term average post-earnings move is around 2%, it rose 7.5% in April and +0.6% in July. Traders seem to be splitting the difference.

As difficult as it is for analysts to project these banks’ trading profits, investment banking revenues, and potential adjustments to loan loss provisions, it is even more difficult for investors to predict the most consequential part of big bank earnings – the conference calls. Because of their reach across the domestic economy along with varying degrees of international scope, top management at these companies have unique insights into a broad range of customers and the economy at large. Even those who are not particularly exposed to bank stocks will be attempting to glean insights about the banks’ customers and their insights into the broader economy.

That said, I await the inevitable questions about how artificial intelligence may affect the bank’s business. At least when UNH gets the inevitable questions about how weight-loss drugs will affect its bottom line, it will be more tangible than when a wide range of consumer companies get theoretical questions about how they might affect their businesses. It’s impossible to escape the market’s favorite futuristic themes, though it likely behooves us more to try to glean as much information as we can about the more immediate path of the corporate sector and the US economy.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!