Wall Street analysts are too bullish on third quarter earnings expectations for 75% of S&P 500 companies.

In theory, Wall Street analysts adjust EPS for unusual gains and losses that distort reported EPS. In reality, they do not. Street EPS estimates are materially misleading more often than investors realize[1].

This report shows:

- five S&P 500 companies with overstated Street estimates likely to miss 3Q21 earnings

- why Street Earnings, GAAP Earnings, and consensus estimates are flawed

- how our Core Earnings[2] and Earnings Distortion factor generate novel alpha

Get our report on the S&P 500 companies more likely to beat 3Q21 Street EPS estimates here.

Street Overstates EPS for 375 S&P 500 Companies

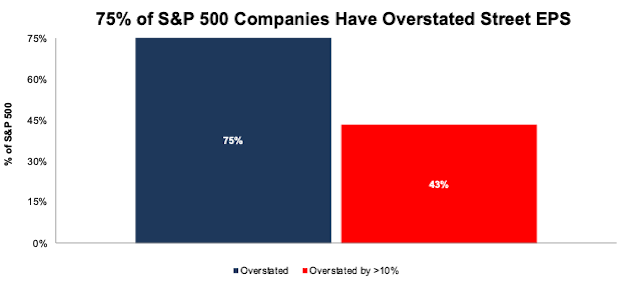

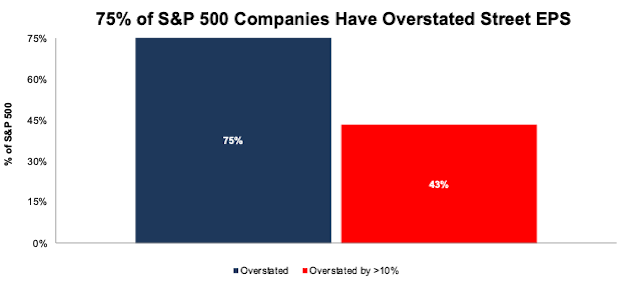

Per Figure 1, Street EPS overstate Core EPS for 75% of S&P 500 companies for the trailing-twelve-months (TTM) ended calendar 2Q21[3]. For 43% of S&P 500 companies, Street EPS are overstated by more than 10% (examples are below).

Figure 1: Street Earnings Are Overstated for a Large Amount of S&P 500 Companies

Sources: New Constructs, LLC and company filings.

When the Street EPS overstates Core EPS, it does so by an average of 24% per company, see Figure 2.

Figure 2: Street Earnings Overstate by 24% on Average

Sources: New Constructs, LLC and company filings.

Click here to read the full article

—

This article originally published on October 8, 2021.

Disclosure: David Trainer, Kyle Guske II, Alex Sword, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] The same is true for other well-known “adjusted” measures of earnings: S&P’s “Operating Earnings” Remain Overstated in 2Q21.

[2]The Journal of Financial Economics proves that only Core Earnings enable investors to overcome the flaws in legacy fundamental data.

[3] The most recent Core Earnings and Street Earnings values are based on the latest audited financial data from calendar 2Q21 10-Qs.

Click here to download a PDF of this report.

Disclosure: New Constructs

David Trainer, Kyle Guske II, Sam McBride, Matt Shuler, Alex Sword, and Andrew Gallagher receive no compensation to write about any specific stock, style, or theme.

The information and opinions presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or solicitation of an offer to buy or sell securities or other financial instruments. New Constructs has not taken any steps to ensure that the securities referred to in this report are suitable for any particular investor and nothing in this report constitutes investment, legal, accounting or tax advice. This report includes general information that does not take into account your individual circumstance, financial situation or needs, nor does it represent a personal recommendation to you. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about any such investments or investment services.

Information and opinions presented in this report have been obtained or derived from sources believed by New Constructs to be reliable, but New Constructs makes no representation as to their accuracy, authority, usefulness, reliability, timeliness or completeness. New Constructs accepts no liability for loss arising from the use of the information presented in this report, and New Constructs makes no warranty as to results that may be obtained from the information presented in this report. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information and opinions contained in this report reflect a judgment at its original date of publication by New Constructs and are subject to change without notice. New Constructs may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared them and New Constructs is under no obligation to insure that such other reports are brought to the attention of any recipient of this report.

New Constructs’ reports are intended for distribution to its professional and institutional investor customers. Recipients who are not professionals or institutional investor customers of New Constructs should seek the advice of their independent financial advisor prior to making any investment decision or for any necessary explanation of its contents.

In-depth risk/reward analysis underpins our stock rating. Our stock rating methodology grades every stock according to what we believe are the 5 most important criteria for assessing the quality of a stock. Each grade reflects the balance of potential risk and reward of buying that stock. Our analysis results in the 5 ratings described below. Very Attractive and Attractive correspond to a “Buy” rating, Very Unattractive and Unattractive correspond to a “Sell” rating, while Neutral corresponds to a “Hold” rating.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from New Constructs and is being posted with its permission. The views expressed in this material are solely those of the author and/or New Constructs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!