Cboe Options Exchange plans to extend global trading hours (GTH) for S&P 500® Index (SPX® and SPXW) options and Cboe Volatility Index® (VIX® Index) options to nearly 24 hours a day, five days a week, beginning November 21, 2021, subject to regulatory review. The expanded trading hours will bring a number of benefits to market participants around the world. Below, we explore some of those benefits and explain why participants may want to join the GTH crowd.

Manage Risk Around the Clock

Trade or hedge broad stock market and global equity volatility conveniently across all time zones, day and night with Cboe Options Exchange’s extended global trading hours (GTH) for SPX and VIX options to nearly 24 hours a day, five days a week (24×5).

With extended GTH, market participants will gain more convenience, more access and more opportunities to react to market moving events and access U.S. index options from any time zone. Here are three reasons to explore extended GTH for SPX and VIX options:

1. High Volume During GTH Following Major News Events

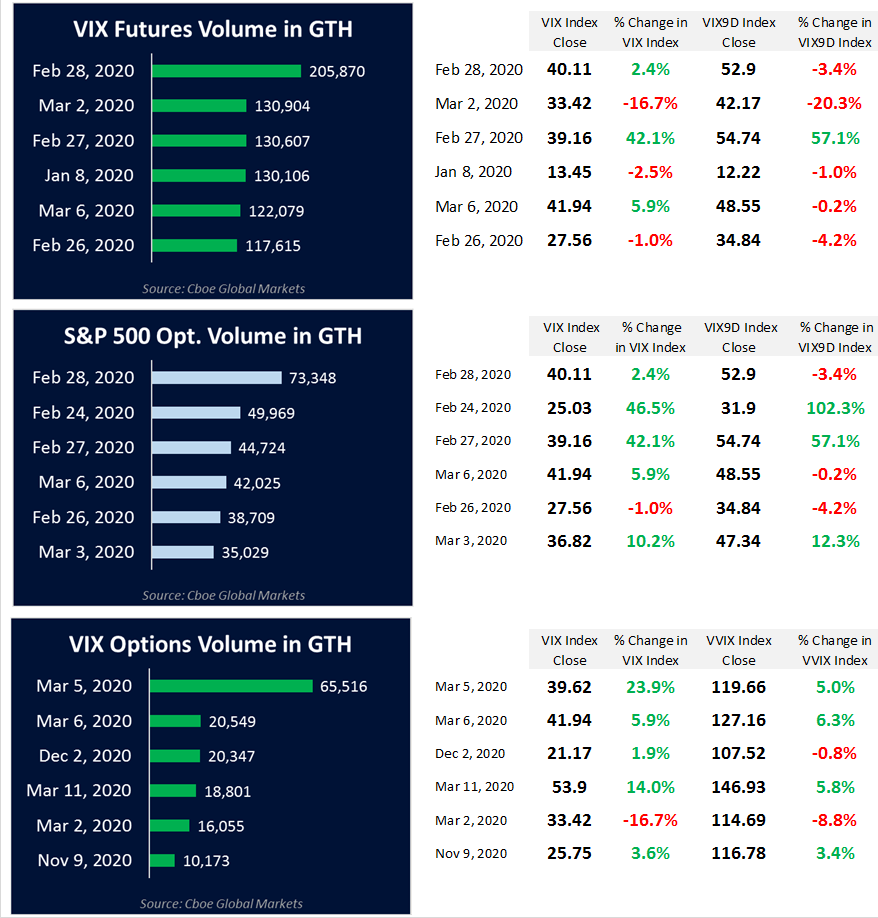

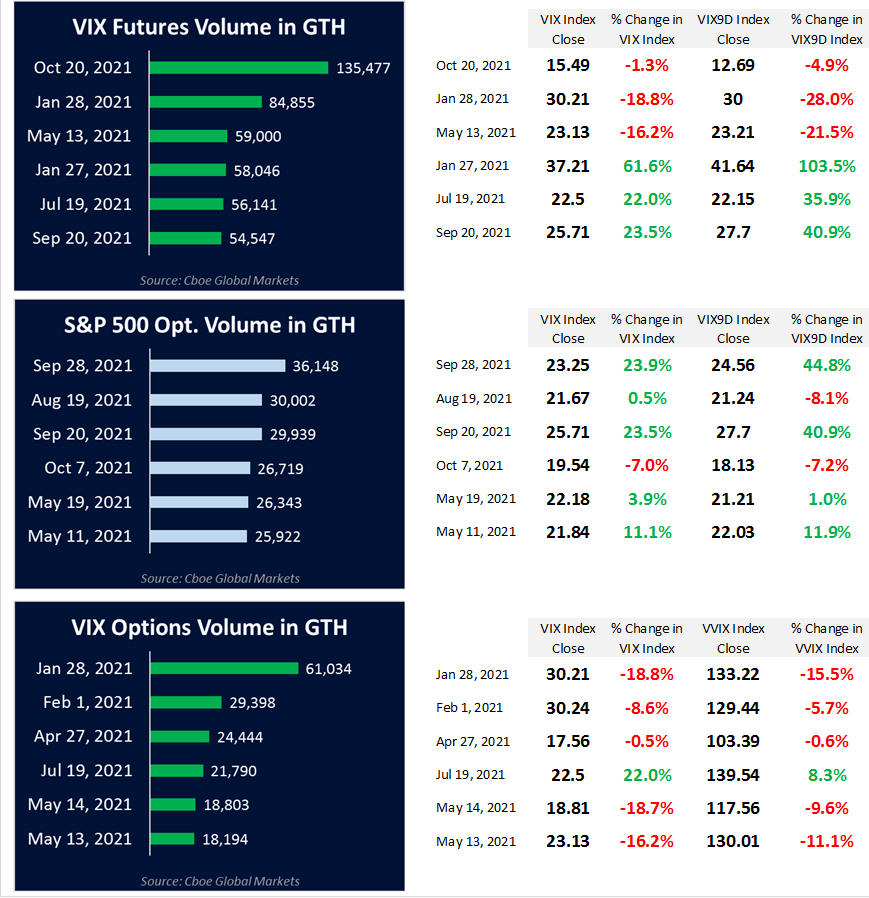

Historically, dates with the highest volumes during GTH sessions have been linked to major news events. GTH enable market participants to trade their view of the market immediately, even when news breaks well before or after regular U.S. trading hours. Volatility never sleeps, and neither do market-moving headlines.

2020 Dates with the Largest Volumes During GTH

Source: Cboe Global Markets

The VIX Index rose 504% over the course of 20 trading days with a daily closing value of 13.68 on February 14, 2020 and a daily closing value of 82.69 on March 16, 2020. Trading volume for VIX futures exceeded 117,000 contracts during GTH sessions between February 26, 2020 and March 6, 2020 as concerns about the COVID-19 pandemic increased.

Day traders igniting frenzied buying into heavily shorted stocks, concerns centered around fiscal stimulus measures and September syndrome all led to the highest significant volume during 2021. After a significant rise of 61.6% on January 27, 2021, the VIX Index rose more than 20% on July 19, 2021 (22%) and September 20, 2021 (23.5%).

2021 Dates (Through October 2021) with Largest Volumes in GTH

Source: Cboe Global Markets

The expanded GTH enables market participants to express their views of market-making events as they are happening and adjust SPX and VIX options positions around the clock.

2. Price Movements During GTH

Many market participants may assume that the majority of price movements happen during U.S. trading hours, but according to Professor Oleg Bondarenko of the University of Illinois Chicago, that is not always the case. Professor Bondarenko’s research on U.S. stock market performance during trading hours throughout the day found that four hours during the trading day (outside of U.S. regular trading hours) accounted for the entire average market return, uncertainty reflected by VIX futures prices rose overnight and fell around the European market open and the results of Professor Bondarenkos’ research were stronger during the 2020 COVID-19 crisis.

S&P 500 Index Performance by Hour of Day

Source: Screenshot from paper on Market Return by Bondarenko and Murayev (Aug. 25, 2021)

The 24×5 trading model makes it possible for global market participants to trade Cboe’s exclusively U.S.-listed VIX and SPX options during their local trading day around the clock and will allow U.S. market participants to capitalize on price movements during GTH.

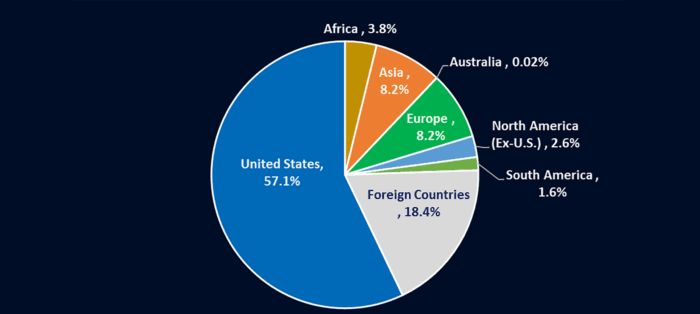

3. Multinational Exposure for the S&P 500 Index

Index exposure to different geographic areas is important to investors who manage equity risk around the clock. As global trading has increased in recent decades, the S&P 500 Index and VIX Index have become multi-national indices. As shown in the chart below, a 2019 report by S&P Dow Jones Indices estimated that companies in the S&P 500 Index make 57.1% of their sales to U.S. customers and 42.9% to non-U.S. customers.

S&P 500 Index Companies Sales by Region

Source: S&P Dow Jones Indices Report on S&P 500 Global Sales (August 2019)

The report also showed that a majority of the sales in three S&P 500 Index sectors – Information Technology (58.2%), Materials (56.8%) and Energy (51.3%) – were to non-U.S. customers.

Non-U.S. Sales as a Percentage of Total Sales by Sector

Source: S&P Dow Jones Indices Report on S&P 500 Global Sales (August 2019)

Additionally, three S&P 500 Index sectors each accounted for more than 14% of the total non-U.S. sales – Consumer Staples (17.5%), Industrials (14.7%) and Information Technology (14.5%).

Sector Sales as a Percentage of Total Non-U.S. Sales

Source: S&P Dow Jones Indices Report on S&P 500 Global Sales (August 2019)

S&P 500 Index options and VIX options may be useful and valuable tools for investors who wish to manage their multinational equity exposure.

Additional Resources

- All About 24×5

- Wilshire Whitepaper: Global Option-Writing Strategies to Reduce Risk and Enhance Income

- CFA Institute Research Foundation Whitepaper: The VIX Index and Volatility-Based Global Indexes and Trading Instruments – A Guide to Investment and Trading Features (2020)

- Options Education

- Additional Whitepapers

- Cboe Indices

There are important risks associated with transacting in any of the Cboe Company products discussed here. Before engaging in any transactions in those products, it is important for market participants to carefully review the disclosures and disclaimers contained at https://www.cboe.com/options_futures_disclaimers

—

Originally Posted on November 23, 2021 – Three Reasons to Explore Extended Global Trading Hours for SPX and VIX Options

Disclosure: Cboe Global Markets

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker, or at www.theocc.com. The information in this program is provided solely for general education and information purposes. No statement within the program should be construed as a recommendation to buy or sell a security or to provide investment advice. The opinions expressed in this program are solely the opinions of the participants, and do not necessarily reflect the opinions of Cboe or any of its subsidiaries or affiliates. You agree that under no circumstances will Cboe or its affiliates, or their respective directors, officers, trading permit holders, employees, and agents, be liable for any loss or damage caused by your reliance on information obtained from the program.

Copyright © 2023 Chicago Board Options Exchange, Incorporated. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Cboe Global Markets and is being posted with its permission. The views expressed in this material are solely those of the author and/or Cboe Global Markets and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!