Yesterday we highlighted the busy week ahead, chock full of crucial earnings and economic reports. The parade begins after today’s close when Alphabet (GOOG, GOOGL) and Advanced Micro Devices (AMD) release their Q3 earnings.

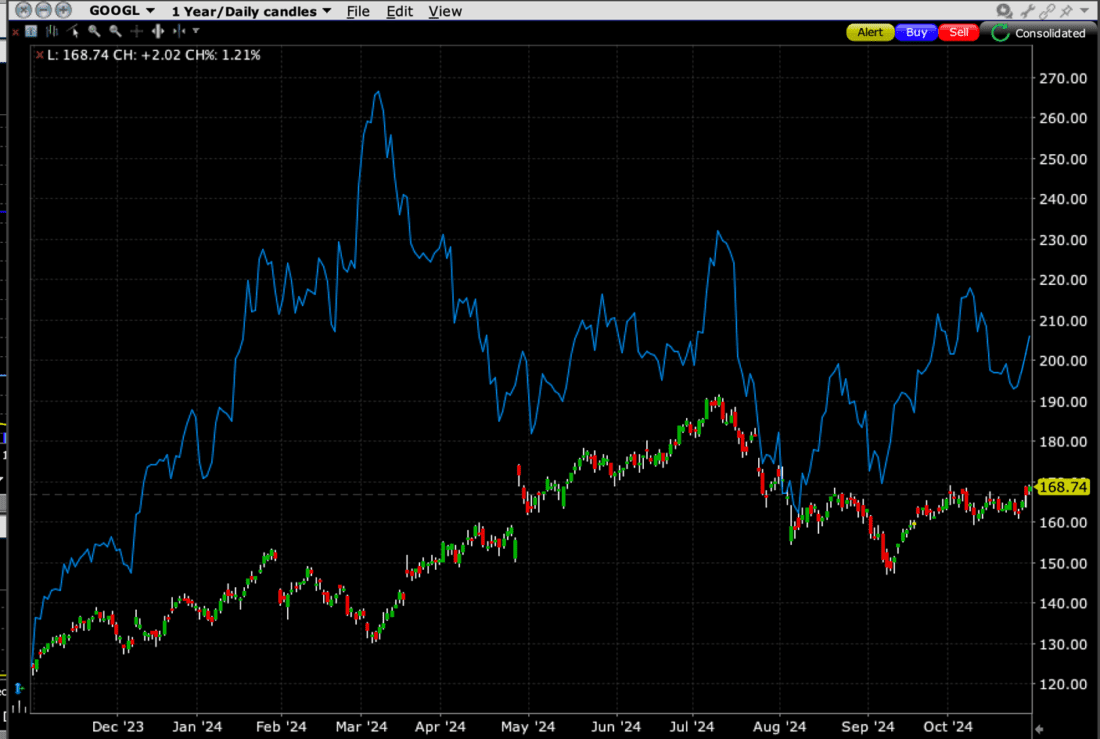

Both companies are considered key players in artificial intelligence, even though they have been overshadowed by larger peers. GOOGL got off to a slower start in integrating AI into its search than Microsoft (MSFT), while AMD clearly trails Nvidia (NVDA) on the hardware side. Their one-year performances have been quite solid, though both are also well below the highs they set earlier this year:

1-Year Chart, GOOGL (red/green daily candles), AMD (blue line)

Source: Interactive Brokers

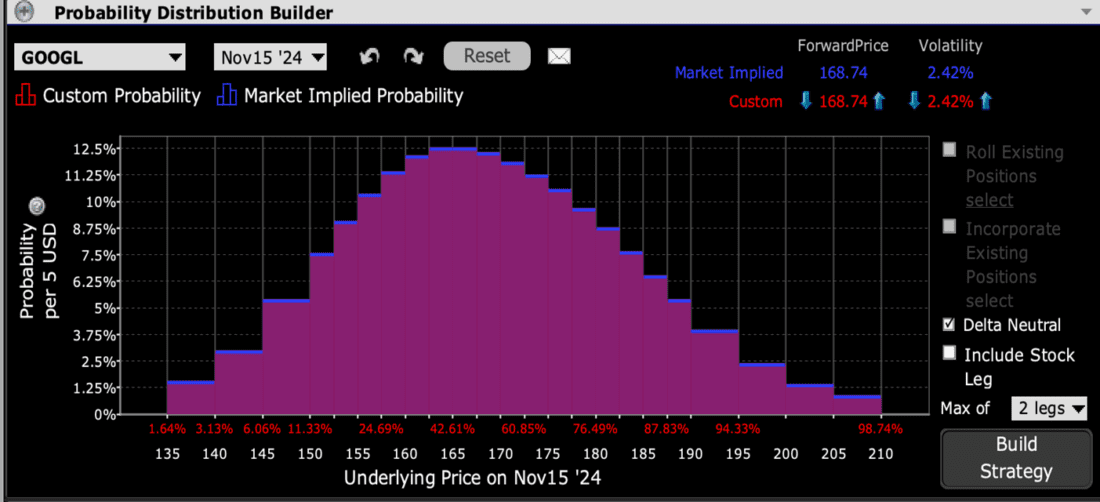

GOOGL has one of the most neutral setups that I can recall. For options expiring this Friday, the IBKR Probability Lab is almost perfectly symmetrical (though the preponderance of upside strikes shifts the curve to the right), with a peak in at-money options:

IBKR Probability Lab for GOOGL Options Expiring November 1st, 2024

Source: Interactive Brokers

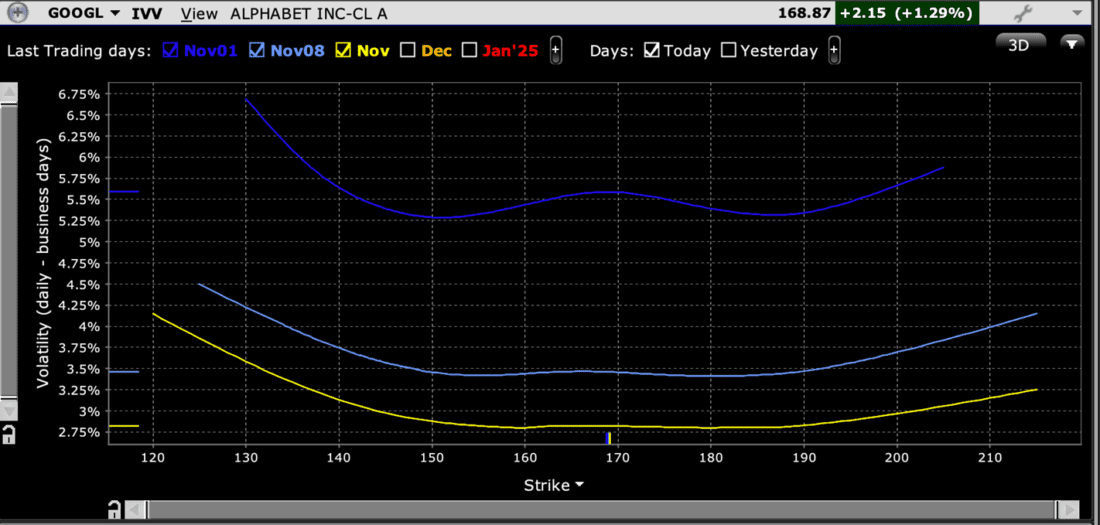

The implied volatility for weekly at-money options is roughly 6% (measured on a daily basis), which is appropriate considering the last six monthly post-earnings moves average 6.3% (-5.04%, +10.22%, -7.50%, -9.51%, +5.78%, -0.13%). Skews are quite flattish, with a now-familiar “W” shaped skew. This shape has become increasingly customary for megacap tech skews, replacing the more historically typical “Elvis Smile” that indicates risk aversion. Skews for the subsequent two weeks are also relatively flat.

Skews for GOOGL Options Expiring November 1st (dark blue), November 8th (light blue), November 15th (yellow)

Source: Interactive Brokers

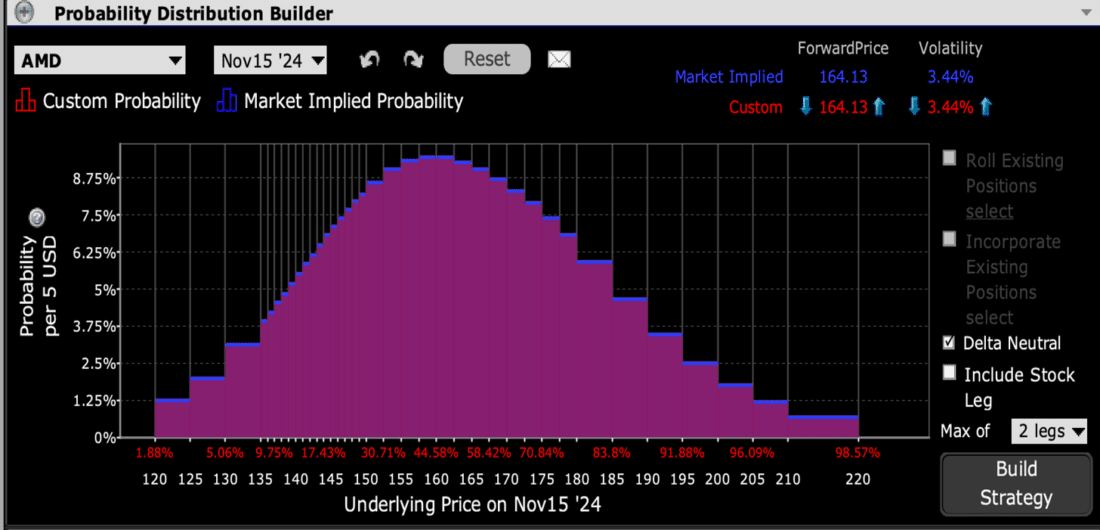

As for AMD, it is uncanny. I can essentially substitute “AMD” for “GOOGL” in the prior paragraphs. The Probability Lab is similarly symmetrical though the preponderance of upside strikes also stretches the curve to the right. And the peak is also in at-money options.

IBKR Probability Lab for AMD Options Expiring November 1st, 2024

Source: Interactive Brokers

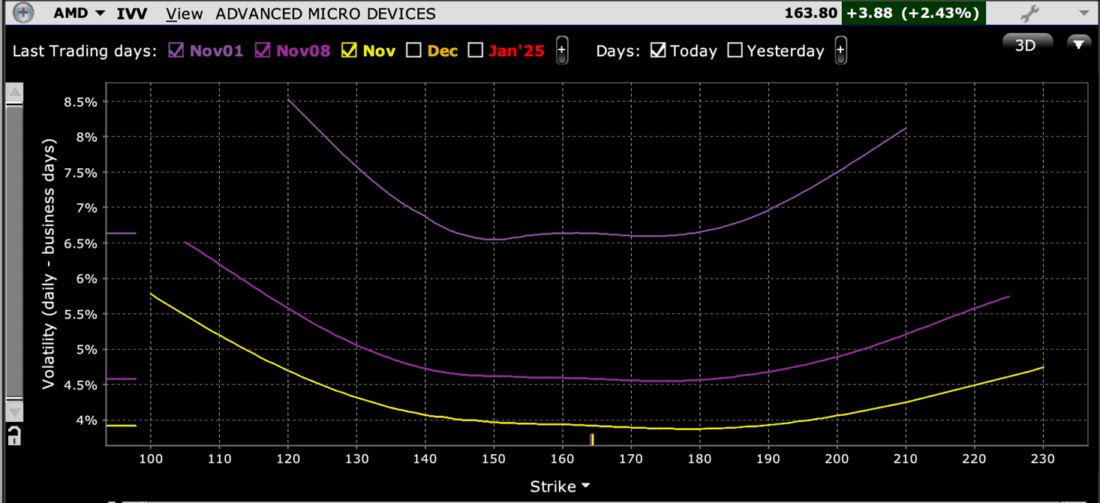

The skew chart is also uncannily similar to GOOGL’s, though the “W” in the first week’s options is a bit less pronounced and the at-money volatility for weekly options is about 7% daily instead of 6%. As with GOOGL, that value is commensurate with the 6.96% average post-earnings more for the past six reports (+4.36%, -8.91%, -2.54%, +9.69, -7.02%, -9.22%)

Skews for AMD Options Expiring November 1st (light purple), November 8th (purple), November 15th (yellow)

Source: Interactive Brokers

Quite frankly, it is difficult to find a meaningful message in the options market pricing for both these companies. The implied volatilities are almost exactly where they should be, and the skews display neither risk aversion nor a bias toward a post-earnings rally. My takeaway is that the post-earnings trading will be almost completely reliant on each company’s results and more importantly, their guidance. That’s not a bad thing, but it also means that there is unfortunately little to be gleaned from options market pricing.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

I can’t wait for trump to win so we can get the 2nd trump bump. Here comes someone to tell me stocks didn’t do well under trump last time lol

VERY TRUE ‘ difficult to find a meabingful message in the options market’ because it’s really based on WITCHCRAFT and the THROWING of the STICKS (see HOMER)-nothing more no matter how you play with the data to try and conform to your ‘wished for’ result.

For AMD, it’s best not to try to catch a falling knife.

Agreed on Trump recreating a positive market once again! Will take bit more time as so much on negative past two years. Never seen so much negativity in copy in any market publication. No confidence , but returning with Trump!

Not the same “ anonymous “ as further above. We were so much better with Trump. And will be again! Did not like seeing a picture and copy from pro Harris ilk on IAB Website! Dumb!