Credit spreads are a popular strategy that is used to generate income with limited risk from a modest bullish, bearish or even neutral view on a stock or ETF. Many investors are attracted to writing higher delta options because of the higher premiums, but it is important to understand the tradeoff, which is that this will risk more than the income received. Additionally, this strategy does not require the investor to own or wish to own the underlying stock or ETF. This article will explore the 2 types of credit spread strategies that can be used for bullish and bearish outlooks. To learn more about writing credit spreads and best practices, please view our latest webinar.

Example: Consider XYZ, which is currently trading at $100

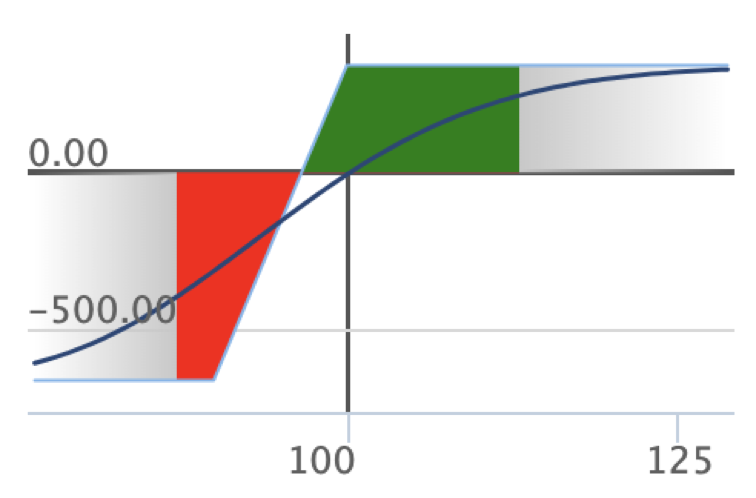

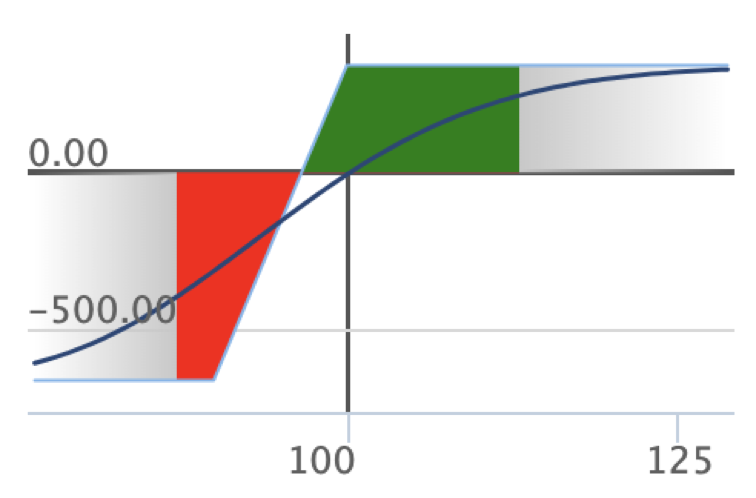

1. Bullish/neutral outlook – a bull put vertical spread can be used

- Write $100 put @ $4 credit

- Buy $90 put @ $1 debit

- The maximum reward is the $3 income received ($4 Credit -$1 Debit)

- The maximum amount at risk is $7 (the difference between the 2 strike prices – the premium received)

Chart 1: Bull Put Spread

Source: OptionsPlay

To implement a bull put vertical spread, the investor writes an “at-the-money” put and buys an “out-of-the-money” put. With a bullish outlook, writing a naked put has unlimited downside risk. However, by buying an “out-of-the-money” put, the net premium received is reduced from $4 to $3 but the risk is capped at the difference between the 2 strikes prices minus the premium received.

At expiration, if XYZ is trading:

- Above $100 – Maximum gain of $3

- At $97- Breakeven ($0 profit)

- Below $90 – Maximum loss of $7

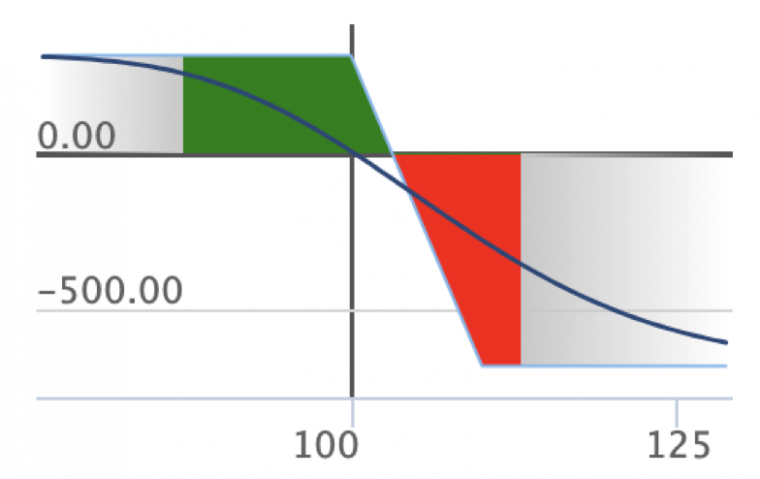

2. Bearish/neutral outlook – a bear call vertical spread can be used

- Write $100 call @ $4 credit

- Buy $110 call @ $1 credit

- The maximum reward is the $3 income received ($4 credit -$1 debit)

- The maximum amount at risk is $7 (the difference between the 2 strike prices – the premium received)

To implement a bear call vertical spread, the investor writes an “at-the-money” call and buys an “out-of-the-money” call. With a bearish outlook, writing a naked call has unlimited downside risk. However, by buying an “out-of-the-money” call, the net premium received is reduced from $4 to $3 but the risk is capped at the difference between the 2 strike prices minus the premium received. At expiration, if XYZ is trading:

- Below $100 – Maximum gain of $3

- At $103 – Breakeven ($0 profit)

- Above $110 – Maximum loss of $7

Chart 2: Bear Call Spread

Source: OptionsPlay

Credit Spread Strategy

This strategy is ideal for neutral market conditions or when you have only a modest bullish or bearish outlook. High volatility events such as earnings announcements should be avoided, as there is a higher probability of a large move against the trade. Credit spreads are best used when the stock or ETF is trading near a support or resistance level. Overbought/oversold momentum indicators or a reversal chart pattern, such as a double top or bottom, can also be used as a signal to enter a credit spread while the stock is trading within a particular range.

OptionsPlay’s research shows that bull put vertical spreads have a slight edge over bear call vertical spreads, due to the effects of volatility. Since the credit spread is a short Vega (volatility) strategy, it benefits from a decrease in implied volatility. It is generally a good idea to deploy bull put vertical spreads during oversold conditions, when implied volatility is high. A scenario in which the stock is oversold is usually followed by a contraction in the underlying implied volatility. The opposite is true for overbought conditions, in which case bear call verticals are used. Due to the muted implied volatility at the top of a trading range, volatility generally expands when there is a reversal and the price declines. This provides a slight edge for bull put spreads over bear call spreads, due to the volatility.

Is There an Optimal Credit Spread?

The key to finding the optimal credit spread is to find the right strike prices for your risk profile. Strike prices that are “near the money” allow for a better risk/reward ratio but have a lower probability of delivering profit. Strike prices that are “far out of the money” have a higher probability of profit, but at the expense of a worse risk/reward ratio. It may be tempting to find high probability trades by using strike prices that are “far out of the money,” however, our research shows that further out of the money strike prices do not generate enough income to account for those times when there is a big loss.

Our research shows that the strategy that has most consistently yielded the best results over the long term met the following requirements:

- Write short-dated options with expirations between 4-6 weeks out

- Write a 50 Delta call/put

- Buy a 25 Delta call/put

When using the above guidelines, the income received is typically about 1/3 of the distance between the 2 strike prices. This equates to risking $200 for every $100 received, and it has a 60% to 70% probability of delivering a profit.

Managing a Credit Spread

The goal for this strategy is to let it expire worthless and keep the entire credit received. There are a few scenarios where it makes sense to exit a credit spread prior to expiration:

- If a credit spread has made gain of 50% or more, with more than half the time left to expiration, you should take the profits on the trade.

- If the credit received is greater than 1/5 of the difference between the 2 strikes, you should cut your losses at between 75%-100% of the premium received.

- If the credit received is less than 1/5 of the difference between the 2 strikes, you should cut your losses at between 100%-200% of the premium received.

Summary

Credit spreads are a forgiving strategy that allows for income generation even if the stock moves in the direction opposite to the intended outlook. The strategy provides a tradeoff by risking more than the income received when the stock moves significantly against the expected outlook. It is important to remember that this strategy should only be used under neutral market conditions and not when a large move is expected. By following the guidelines and best practices, credit spreads can be used to generate income on stocks with a small directional view. Learn to deploy this more advanced but flexible strategy in your portfolio using OptionsPlay and our latest webinar on Generating Income with Credit Vertical Spreads.

Join the Montréal Exchange and Tony Zhang at the next Options Education Day in Toronto on Sept. 14 to learn more about options and ask questions!

Take advantage of free access to OptionsPlay Canada: www.optionsplay.com/tmx

—

Originally Posted on August 29, 2019 – Generating Income with Credit Vertical Spreads

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Disclosure: Montréal Exchange - Option Matters

This material is from Bourse de Montréal Inc. and is being posted with its permission. Opinions expressed in this document do not necessarily represent the views of Bourse de Montréal Inc.

This document is made available for general information purposes only. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

Although care has been taken in the preparation of this document, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information contained in this document and reserve the right to amend or review, at any time and without prior notice, the content of this document.

Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions in this document or of the use of or reliance upon any information appearing in this document.

Disclosure: Canadian Options Trading

Canadian Listed Options involve risk and are not suitable for all investors. Trading of certain standardized Canadian Listed Options may not be permitted for U.S. Residents. For more information read the Characteristics and Risks of Listed Canadian Standardized Options, also known as the options disclosure document (ODD). To receive a copy of the ODD call 877-745-4222 or copy and paste this link into your browser: https://www.cdcc.ca/f_en/Options_Disclosure.pdf

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Montréal Exchange - Option Matters and is being posted with its permission. The views expressed in this material are solely those of the author and/or Montréal Exchange - Option Matters and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!