Are you expecting the price of a security to rise, and you have a target price in mind? In this article, you will learn how to choose the right strike price to optimize your return if the security reaches your target price by the time your call option expires.

Analysis of Descartes Systems Group Inc. (DSG)

In this article, we will analyze how to implement a call option position on shares in Descartes Systems Group Inc. (DSG).

Chart 1: Daily price changes in DSG to September 29, 2020 ($74.59)

Source: Tradingview.com

In analyzing the above chart, you have noticed that the price of DSG has been on an upward trend since mid-September. You have also noticed how, in the past, the Relative Strength Index (RSI) stopped just short of the oversold region (below 30), and this served as a support level, restarting growth. Currently the RSI is heading toward the overbought region (above 70). This suggests that the stock may be beginning a more or less long upward trend. Given this context, you are confident that the stock will rise to its previous peak of $82.40, so you choose this level as your target price. To take advantage of this scenario, you decide to implement a bullish strategy by buying call options to maximize your return.

Choosing a strike price

The target price of $82.40 is 10.50% above the stock’s current price of $74.59. With this target price, you need to choose the call option that will provide the best return if the stock were to reach this level when the option expires on January 15, 2021. This requires applying the following procedure for each call option strike price:

- Calculate the target price of the call options based on your target price of $82.40

$82.40 less the strike price

- Calculate the potential profit

Target price of the call option less the price of the call option

- Calculate the potential return

Potential profit divided by the price of the call option

- Select the option with the best potential return

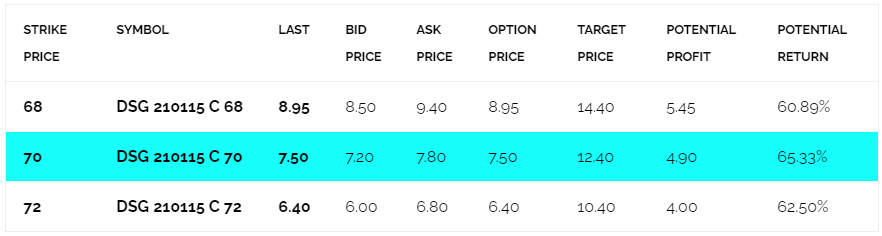

You will need to choose from among the following call options[1]:

- DSG 210115 C 68 at $8.95

- DSG 210115 C 70 at $7.50

- DSG 210115 C 72 at $6.40

Position:

Table 1: Comparative Table of Call Options

The option with the best potential return

As the above table shows, based on these three call options it is DSG 210115 C 70 at $7.50 (average of the bid and ask prices) that has the optimal combination of risk and return, with a potential return of 65% if DSG reaches the target price of $82.40 on January 15, 2021. Assuming that you have $3,000 in risk capital, you could execute the following transaction:

- Purchase 4 call option contracts DSG 210115 C 70 at $7.50

- Debit of $3,000

Profit and loss profile

Target price of the call options

DSG 210115 C 70 at $7.50 = $12.40 ($82.40 – $70.00)

Potential profit

$4.90 per share ($12.40 – $7.50), for a total of $1,960

Potential return

65.33% (4.90/7.50)

Potential loss

$7.50 per share (premium paid), or $3,000

Further action

Although the target price on DSG shares is $82.40, the potential profit of this strategy is linked to the $12.40 target price on the call options. So as soon as the call options reach this price you will be able to close out the position, even though DSG has not reached the target price of $82.40. Note that if the stock starts to fall instead of rising as expected, you may need to set a maximum loss, the level at which you will be forced to close the position, if necessary. Therefore, it will be important to carefully determine the total capital you want to invest in such a strategy.

Good luck with your trading, and have a good week!

[1] Note that for the purposes of this article, we have presented only three of the ten strike prices we evaluated.

—

Originally Posted on October 23, 2020 – Choosing a Call Option Strike Price to Optimize Return

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Disclosure: Montréal Exchange - Option Matters

This material is from Bourse de Montréal Inc. and is being posted with its permission. Opinions expressed in this document do not necessarily represent the views of Bourse de Montréal Inc.

This document is made available for general information purposes only. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

Although care has been taken in the preparation of this document, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information contained in this document and reserve the right to amend or review, at any time and without prior notice, the content of this document.

Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions in this document or of the use of or reliance upon any information appearing in this document.

Disclosure: Canadian Options Trading

Canadian Listed Options involve risk and are not suitable for all investors. Trading of certain standardized Canadian Listed Options may not be permitted for U.S. Residents. For more information read the Characteristics and Risks of Listed Canadian Standardized Options, also known as the options disclosure document (ODD). To receive a copy of the ODD call 877-745-4222 or copy and paste this link into your browser: https://www.cdcc.ca/f_en/Options_Disclosure.pdf

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Montréal Exchange - Option Matters and is being posted with its permission. The views expressed in this material are solely those of the author and/or Montréal Exchange - Option Matters and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link https: ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!