Recently the Royal Bank of Canada lost its title as our country’s most valuable company in terms of market capitalization. For two brief weeks, Shopify sat at the top of the heap.

Chart 1: Royal Bank vs. Shopify May 31, 2020

Source: Bloomberg

SHOP’s run has been a sight to behold.

Chart 2: Shopify (TSX:SHOP) May 31, 2020

Source: Bloomberg

During the darkest moments of the corona crisis, SHOP shares changed hands at $435. Now, not even three months later, they are ticking above $1,000. The rise has been nothing short of remarkable.

But will this trend continue, or is SHOP due for a big pullback?

It is often difficult to time the exact moment that a strong stock like SHOP will correct. However, with a move as powerful as what we have seen over the past few months, the chances of SHOP simply going quiet are low. The bull move will most likely either continue to accelerate, or there will be a sharp and swift price correction.

But how should this scenario be played?

One interesting option strategy in this environment is to sell a PUT BUTTERFLY spread. This might sound complicated, but it really isn’t.

First let’s tackle what a long position in a put butterfly spread looks like. It consists of the following:

Where X = the middle strike and a = the equal distance to the outer strikes

| Long 1 put of strike X + a |

| Short 2 puts of strike X |

| Short 1 put of strike X – a |

Click on the following link to consult the Long Put Butterfly Strategy Guide:

For our SHOP example, we will use X = 1,050 and a = 100.

This means our long SHOP butterfly will consist of:

Long 1 SHOP 1,150 put

Short 2 SHOP 1,050 puts

Long 1 SHOP 950 put

A long butterfly position will profit if future volatility is higher than implied volatility. The purchaser of the butterfly wants the underlying to expire at the level where he/she is short on the 2 puts. That is the point of maximum profit. As the price moves away from the strike, the profit eventually turns into a loss (but the maximum loss is limited to the spread between the strikes).

However, we just discussed how SHOP is likely to either continue higher on its tear or correct sharply. Therefore, a long butterfly is exactly the wrong position to implement in this situation.

But this means that a short butterfly is the ideal candidate to express our view. To understand the short put butterfly, consult the following strategy guide: https://www.m-x.ca/f_publications_en/strategy_short_put_butterfly_en.pdf

Here are the positions, using the mid-market prices as of May 29, 2020:

Table 1: Shopify Butterfly

Source: Bloomberg

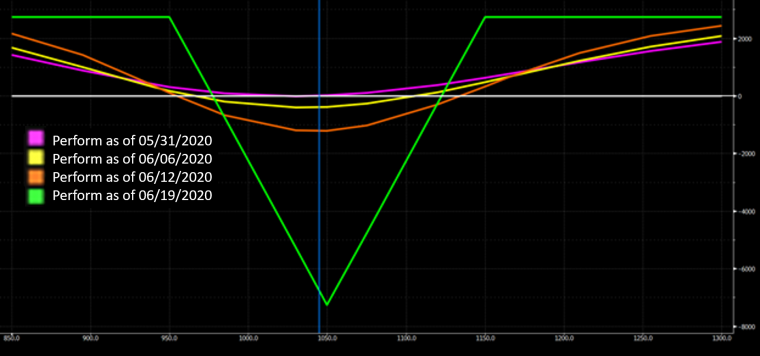

And this is what our P&L diagram looks like at various points before expiry, where the green line represents the potential P&L at expiration:

Chart 3: Shopify Payoff Profile Calculated as of a May 31, 2020 Start

Source: Bloomberg

As you can see, the maximum loss occurs if SHOP stays at the current price. This maximum loss is the spread between the wings ($100.00), or $10,000 for every 1/2/1 butterfly combination, less the $2,738.00 credit received. This maximum loss would be $7,262.00.

However, SHOP moving above $1,150 or below $950 will result in our maximum gain, which is the total credit received of $2,738.00. Our breakeven ends up being anything below $977.38 or above $1,122.62.

Given the way SHOP is moving these days, this eventuality seems probable. But if you don’t agree, then the long butterfly position provides an easy way to take the other view.

The good thing about both long and short butterfly positions is that your risk is capped. You can construct specific payoff profiles depending on your view of where the underlying will be at expiration, while knowing your maximum gain and loss in advance.

—

Originally Posted on June 10, 2020 – Butterfly on Shopify

Dollars expressed are in CAD

Disclaimer:

The strategies presented in this blog are for information and training purposes only, and should not be interpreted as recommendations to buy or sell any security. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy.

Disclosure: Montréal Exchange - Option Matters

This material is from Bourse de Montréal Inc. and is being posted with its permission. Opinions expressed in this document do not necessarily represent the views of Bourse de Montréal Inc.

This document is made available for general information purposes only. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Bourse de Montréal Inc. recommends that you consult your own advisors in accordance with your needs before making decision to take into account your particular investment objectives, financial situation and individual needs.

Although care has been taken in the preparation of this document, Bourse de Montréal Inc. and/or its affiliates do not guarantee the accuracy or completeness of the information contained in this document and reserve the right to amend or review, at any time and without prior notice, the content of this document.

Neither Bourse de Montréal Inc. nor any of its affiliates, directors, officers, employees or agents shall be liable for any damages, losses or costs incurred as a result of any errors or omissions in this document or of the use of or reliance upon any information appearing in this document.

Disclosure: Canadian Options Trading

Canadian Listed Options involve risk and are not suitable for all investors. Trading of certain standardized Canadian Listed Options may not be permitted for U.S. Residents. For more information read the Characteristics and Risks of Listed Canadian Standardized Options, also known as the options disclosure document (ODD). To receive a copy of the ODD call 877-745-4222 or copy and paste this link into your browser: https://www.cdcc.ca/f_en/Options_Disclosure.pdf

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Montréal Exchange - Option Matters and is being posted with its permission. The views expressed in this material are solely those of the author and/or Montréal Exchange - Option Matters and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link https: ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!