We look at whether China’s recovery will boost the rest of the world by raising growth or whether it will cause inflation to come roaring back.

The outlook is decisively better for China after the government’s pivot on zero-Covid policy (ZCP) late last year. Early indications from high frequency data and the January PMI surveys are that service sector activity has rebounded strongly. By contrast, the positive impact on manufacturing was capped by weak external demand while housing transactions have only muddled along after some initial improvement.

Recovery in China to be driven by services

This is likely to set the tone for the shape of the recovery. After all, it is China’s service sector that has really been hampered by ZCP over the past couple of years as restrictions curbed travel. “Revenge spending” on services has been observed in most economies around the world that have transitioned away from measures aimed to contain the spread of Covid, and China is likely to experience the same release of pent-up consumer demand.

However, a key difference to other economies – certainly major developed markets – is that households in China do not appear to be sitting on a huge stock of savings that can be drawn down to fund a prolonged period of rampant consumption. While China’s savings rate has risen a bit, fiscal support has focused on helping the supply side of the economy rather than direct transfers to households, as was the case in the US, for example.

“Sugar high” recovery likely to fade into 2024

Our baseline forecast for China now assumes three consecutive quarters of above-trend growth starting in Q1 2023 skewed towards services. We think that will lift GDP growth from our previous forecast of 5% to around 6.2% in 2023. However, the “sugar high” will probably fade as the release of pent-up demand is exhausted, savings are spent and cyclical forces turn less favourable. We think GDP growth will ease back to 4.5% in 2024.

Limited spill-over to other economies

The positive spill-overs to other economies may be quite limited.

– Small Asian economies to benefit:

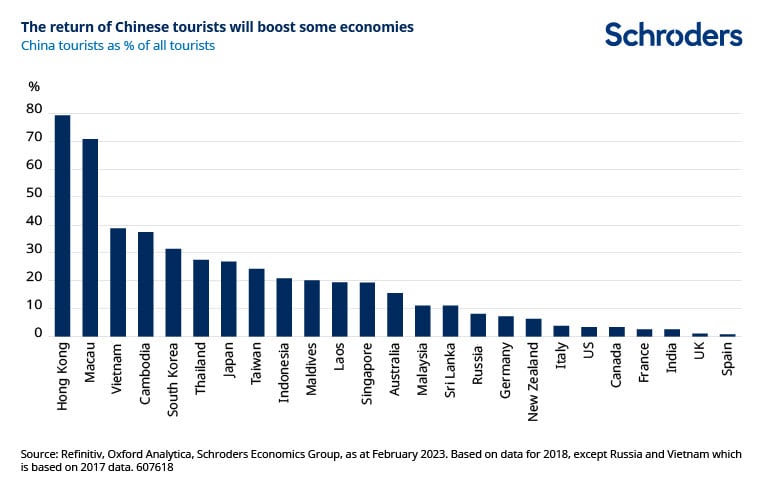

The return of Chinese tourists will boost other parts of Asia, but these are likely to be the small Asian economies that account for only a fraction of world GDP.

– European exporters may not benefit as much as in the past:

Europe would usually benefit from an upturn in China’s economic cycle as stronger growth stimulates investment by manufacturers in response to an increase in demand for goods. However, we expect the recovery to be skewed towards services, not manufacturing.

Furthermore, prior strong investment and soft external demand means that the recovery is unlikely to spur a renewed investment cycle in manufacturing that sucks in imports from Europe and the rest of the world. Finally, while ZCP may have delayed foreign direct investment, it is not clear if multinationals will increase investment in China at a time when geopolitical pressures are pushing for supply chain diversification.

– Energy exporters could benefit

Commodity exporters may receive some support if prices rise, but the playbook may be different this time. Whereas past recoveries driven by construction have buoyed the prices of industrial metals, benefiting exporters in the likes of Latin America and Africa, a recovery in services may be more supportive of energy. This could fire up global inflation again, putting real incomes back under pressure and leaving less room for central banks to lower interest rates in 2024. Some emerging markets would thrive in an environment of higher oil prices, but most face a period of sluggish growth as higher interest rates and subdued external demand bite.

China’s re-opening won’t benefit the global economy much

The upshot is that while abandoning ZCP has clearly improved the outlook for China this year, the rest of the world may not benefit much, if at all. Indeed, while we have also revised up our expectations for growth in the US and eurozone this year, the upgrades are due to domestic factors rather than a boost from China.

—

Originally Posted March 1, 2023 – Will China’s re-opening actually benefit the global economy?

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!