This morning the S&P 500 Index (SPX) traded 10% below its recent highs. That is the textbook definition of a market correction. Corrections usually feel scary and awful when we’re in the midst them – and this is no exception. Yet this correction feels worse in many ways. The unusual nature of the recent rally is certainly a contributing factor to that sentiment.

We avoided a major correction in 2021, with a 5% drawdown serving as the maximum during a stellar year for most risk assets. We nearly had one in September 2020, with SPX falling over 9%. At that point we had rallied nearly 50% from the March 2020 low. The March 2020 selloff qualifies as a bear market — the index gave back about 1/3 of its value — but it was a remarkably short rout, lasting just over a month. The Federal Reserve’s massive liquidity injections saw to that.

Interestingly, the highs of last December from which we are currently correcting were about 50% above the lows of September 2020. It appears that there is a subtle calculus among investors that a gain of that magnitude is hard to extend.

Corrections are typically broad based selloffs, and this is no exception. The problem is that many of the most popular stocks and assets among investors – particularly new investors – are suffering far more than the blue-chips that comprise SPX.

Cryptocurrencies and meme stocks have been especially hard-hit. For example, bitcoin is down over 50% from its November high and other cryptos have fared even worse. AMC has given back nearly 2/3 of its value in that time span, and about 80% of the value it reached at its June peak. The drops are similar in GameStop (GME), though its peak was almost exactly one year ago.

Normally I wouldn’t give much thought to troubles affecting speculative pockets of the markets. The most highly speculative assets are usually somewhat of a sideshow when compared to the goings-on of major indices. But this has been an extraordinary year-plus. We saw a massive influx of new investors into the market, propelled by a unique combination of stimulus checks and boredom. While much of this new money was invested in well-known, time-tested stocks, a sizeable portion of investors became enamored with speculation rather than investment. It was quite understandable. Many of the new investors are young, and younger investors can often tolerate higher risk than their older counterparts. Some of that is youthful exuberance, some is the demographic fact that younger investors have more years to recover from investment mistakes than older ones.

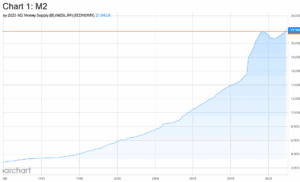

Thus who could blame investors of all stripes from jumping on the bandwagon of rising markets? The Fed was busily adding money to the financial system, while the repeated bouts of fiscal stimulus, along with child care credits and student loan moratoria, allowed many investors to increase their net savings. As real rates ranged from zero to negative, investors were quite rational to invest in equities rather than squirrel their savings into safer investments that paid nearly nothing. As their investments appreciated, their risk tolerance increased. Many discovered that margin leverage could be an inexpensive way to boost returns and that options speculation can offer inherent leverage. Margin borrowing reached record highs as the cost of borrowing declined. This was a positive feedback loop – a highly positive one for those riding their winners.

There is an unfortunate downside to leverage and risk. Taking more risk and employing leverage are wonderful when things are going your way. They are awful when thing aren’t. And now, for many, things are going poorly. As of 2 weeks ago, nearly 40% of stocks in the NASDAQ Composite Index (CCMP) were down over 50% from their highs, and that number has only increased as stocks have fallen.

As nasty as the decline might seem when we look at broad indices, the large stocks that dominate these market-capitalization indices are outperforming their smaller-cap brethren. For example, the small-cap Russell 2000 Index (RTY) is down over 25% from its November high. That’s a real bear market for those investors. RTY failed to confirm SPX’s December high, and has been paying the price ever since.

Circling back to why the underperformance of speculative darlings should be a major source of concern, I have become quite concerned that those same new investors who have become key actors in the markets’ rise could now sour on investing entirely. It would imply that we see outflows from those investors just as fiscal stimulus seems dead and the Fed is discussing how quickly to raise rates and potentially remove liquidity from the system. As concerning as those prospects are, another one concerns me more. It would be a real shame if we, as an industry, enabled a new investor class, offered them the ability to profit in unprecedented ways, only to make them feel like the game was rigged against them. All successful investors have experienced losses in their careers, but this was a generational opportunity for both profit and loss in a very short time frame.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Margin Trading

Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!