“Let’s go invent tomorrow instead of worrying about what happened yesterday.” – Steve Jobs

Technological innovation has the power to change the world in many ways. One common denominator underlying most trends is economics, which often determines the direction things move in. Investors, therefore, have a crucial role in this process not only so they can make informed decisions for their own finances, but so they can influence the discourse and make a positive impact on the world.

In this outlook, we highlight two megatrends which are evolving rapidly enough to warrant close attention.

On our way to a greener future – the energy transition

The energy transition boils down to this – the world is looking to recreate in a few years what was done in over a century. And this time, do it much more sustainably. But when turning back is not an option, the only way is forward. Is the energy transition accelerating?

Energy independence

The Inflation Reduction Act of 2022 in the US, which includes $369bn for energy and climate change initiatives, is perhaps the most significant climate bill in US history. Regulation is important because it paves the way for industries to thrive. Consider the impact of electric vehicle (EV) subsidies in China’s 14th 5-year plan which came into effect in 2021. Within only a couple of years, China’s EV industry has blossomed into a world-leading one. We believe the Inflation Reduction Act in the US and whatever Europe comes up with in response to it, will have a similar effect on a wide range of industries.

The consumers’ perspective

For consumers, who wish to make climate-friendly choices, the economics need to make sense as well. Take EVs as an example again. The number of electric vehicle models in the market worldwide has risen from 159 in Q4 2017 to 551 in Q4 20221. The more affordable electric vehicles become for the mass market, and the more sustainably the industry grows, the more easily the world will decarbonise road transportation.

The economics of industry

With the “Fit for 55” legislation on its way, industries will either have to switch towards cleaner sources of energy, the cost of which is going down, or pay for carbon emission allowances, the price of which continues to go up.

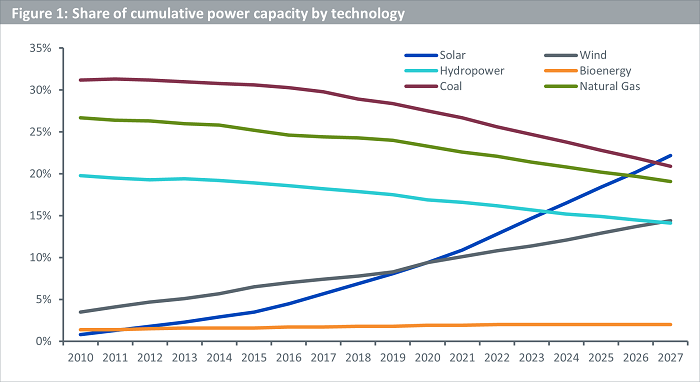

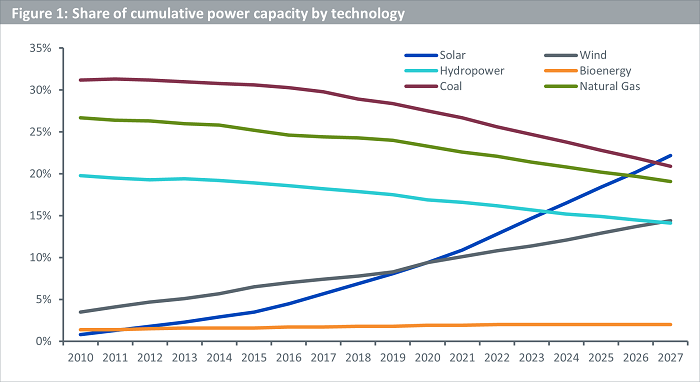

Fortunately, progress is happening in the right direction. Installed capacity for renewables continues to grow rapidly with solar power expected to outgrow natural gas by 2026 and coal by 2027 (see Figure 1 below).

Source: IEA, Share of cumulative power capacity by technology, 2010-2027, IEA, Paris https://www.iea.org/data-and-statistics/charts/share-of-cumulative-power-capacity-by-technology-2010-2027, IEA. Licence: CC BY 4.0. Last updated 05 December 2022.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

The bottom line

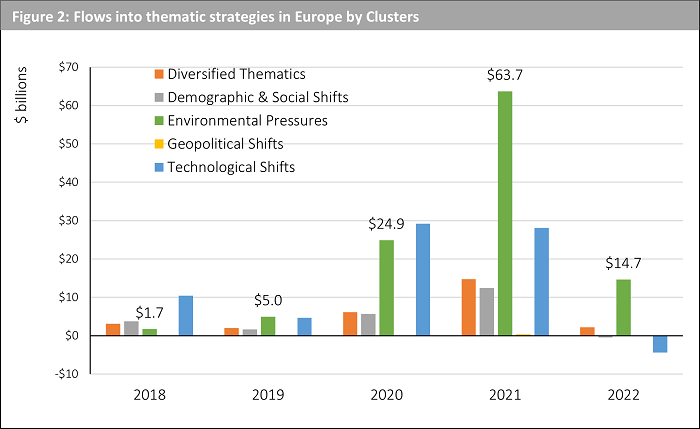

In our conversations with investors in recent months, one thing has become clear. Everyone agrees that getting to net zero will require us to employ all possible solutions. No wonder, therefore, that investors continued to deploy capital to environmental themes in 2022, despite the challenging macro backdrop (see Figure 2).

Source: WisdomTree, Morningstar, Bloomberg. Period from 31 December 2018 to 30 December 2022.

See our quarterly thematic report and our thematic universe paper for more details on the WisdomTree Thematic Classification and the definition of the different Clusters.

Historical performance is not an indication of future performance and any investments may go down in value.

On our way to a more connected future – the digital transition

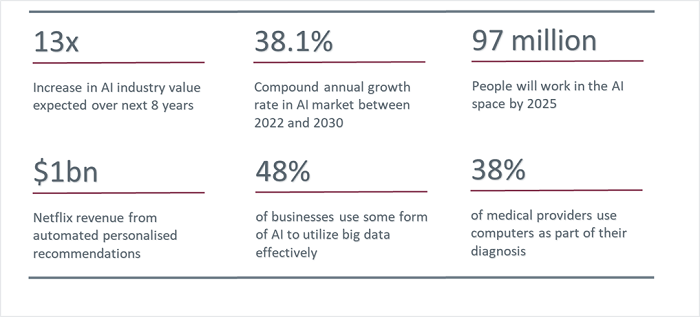

In case the question has been gnawing at you, no, this outlook blog has not been written by ChatGPT. But at WisdomTree, we are excited by the developments in artificial intelligence (AI). The buzz surrounding generative AI and its potential to revolutionise almost every industry has become palpable in 2023 because AI has entered the realm of mass adoption.

AI is getting smarter

In December 2022, DeepMind announced that its game-playing AI DeepNash has learnt to master Stratego, a much more complex game than chess and Go, by playing itself. Stratego is more complex for AI to master because of an additional element of imperfect information. In Stratego, the two players start with 40 pieces each which are initially hidden from the opponent. This means that, unlike chess, players don’t have access to the same knowledge throughout the game. This makes the number of possibilities much greater than chess and Go2.

Figure 3: The market size of AI is poised to grow

Source: Grand View Research (summarised by explodingtopics.com) January 2023.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

As AI becomes smarter, use cases will proliferate. Take healthcare as an example. In January 2023, JP Morgan’s annual healthcare conference in San Francisco was attended by notable names in pharmaceutical and biotech industries, and the chipmaker Nvidia. According to Nvidia, 80% of the company’s medical sales come from radiology systems and surgical robots while around 20% come from AI approaches to drug and genomic discovery3.

The core function of semiconductor chips is to perform lots of computations very quickly. Artificial intelligence is, therefore, not just a software concept, but a hardware one too. And once those two things complement each other, the applications can extend to any industry.

The growing need to be secure

Digitalisation outpacing digital preparedness is a risk. In 2022, there was a 38% increase in cyber-attacks worldwide compared to 20214. As the world becomes increasingly connected, generates, stores, and shares larger quantities of data than ever before, cybersecurity can no longer be treated as optional. The risk of not ensuring sufficient guardrails can often be catastrophic.

The bottom line

Digitalisation is happening, undeniably. Even policymakers are recognising it. The European Commission has termed the 2020s as Europe’s digital decade with the aim of making Europe fit for the digital age. NextGenerationEU, announced in 2021 in response to the pandemic, aims to transform economies and societies. Contained within it is a EUR250bn boost to digitalisation efforts5. Europe will not be alone in paving the way for a sustainable digital transition. Across the globe, this trend will continue to accelerate this year.

A final word

Arguably, the two megatrends discussed are expected to relent, regardless of what central banks do this year. But their path is unlikely to be linear. This is for two reasons. First, is monetary policy. Thematic investments aligned with megatrends have a strong growth tilt and, therefore, high sensitivity to what central banks do. And given timing the market to perfection is difficult, the best one can hope for is to identify reasonably attractive entry points.

The second reason is technological change. The topics driving the energy transition today, and the innovations shaping the digital transition, will not remain static. Any investment approach in these spaces must therefore be prepared to evolve with the themes. This is by no means a simple endeavour. But while outcomes can never be guaranteed, informed decisions can certainly be made.

Sources

1 Source: Bloomberg New Energy Finance, data as of 21 December 2022. Includes battery electric, plug-in hybrid, and fuel cell vehicles.

2 DeepMind as of 01 December 2022. https://www.deepmind.com/blog/mastering-stratego-the-classic-game-of-imperfect-information

3 Barron’s 15 January 2023.

4 According to Check Point Research January 2023.

5 Source: European Commission January 2023, https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/europe-fit-digital-age_en

—

Originally Posted March 23, 2023 – Thematics Outlook: When the economics makes sense, megatrends take off

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!