Global Economics – November 12, 2021

Introduction

Inflation is accelerating and though central banks, especially the US Federal Reserve, keep blaming bottlenecks for the pressure, two years of profound monetary stimulus shouldn’t be ruled out as a contributing cause. Zero policy rates and direct bond purchases have kept borrowing rates low and have inflated both the stock market and home values and in turn have boosted demand to three-times average growth, at 7.4 percent so far this year for real US personal consumption expenditures (inflation-adjusted consumer spending). And it’s not just the amount of spending that’s inflationary, but the suddenness of its onset. This compacted burst of spending, confined within a nine-month post-lockdown period, is intensifying the shock to supply. Shield your eyes because the veil of the transitory doctrine has fallen to reveal, not just an overrun supply chain, but the predictable effects of emergency policy.

The Global Economy

Inflation

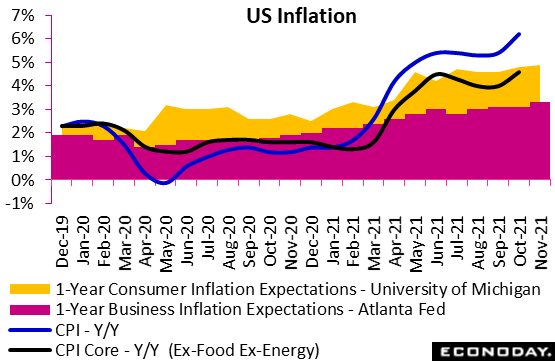

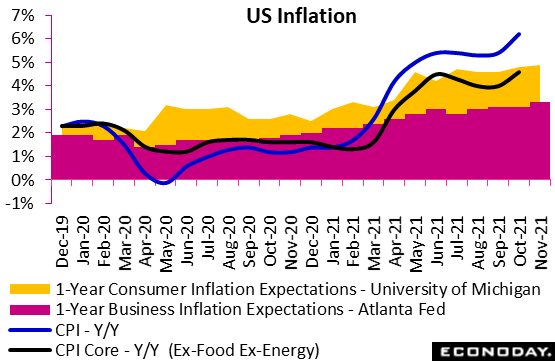

Consumer prices in the US exceeded the most extreme expectations in October, up 0.9 percent on the month to lift the 12-month rate by 8 tenths to 6.2 percent, the highest rate since November 1990. Core prices, excluding food and energy, are no less overheated in the government’s data with this index up 0.6 percent on the month and 4.6 percent year-over-year, also topping all forecasts and the highest since August 1991. Year-ahead inflation expectations as measured by the University of Michigan are extending their climb, up another tenth to 4.9 percent which compares with the low-to-mid two percent range early last year.

Inflation concerns are taking a bite out of the UoM’s consumer sentiment index which, falling far below forecasts to 66.8, is now at its worst level in a decade. One-in-four consumers this month are citing inflation as a negative for their living standards, especially those in the lower income brackets and senior citizens. Half of all American families see their inflation-adjusted incomes falling next year. Not since the 1970s have as many respondents reported rising prices for homes, vehicles, and durables. Year-ahead inflation expectations at the business level, tracked here by the Atlanta Federal Reserve, are up 2 tenths this month to 3.3 percent in what, for this report, is an extreme reading. The week’s data are likely to continue to fuel concerns that upward pressure might prove more persistent and stronger than expected, which could push the Fed into a more aggressive stance earlier rather than later.

Yet stop! There was one tidbit in the week that’s a boon to the peak inflation theorists and that’s the UoM’s 5-year reading which held unchanged at 2.9 percent, highly elevated but at least no more elevated than prior months (this reading peaked in September at 3.0 percent). Jerome Powell, head of the US Federal Reserve, likes to refer (and no doubt will soon again) to the 5-year reading as evidence that expectations are still “anchored” and not actually in danger of flying away.

—

To read the remainder of Global Economics, please subscribe via Amazon Kindle or email info@econoday.com to get set-up today!

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!