EXECUTIVE SUMMARY

- The dissipation of the second wave of infections will allow a modest, broad-based economic recovery: already manufacturing activity and domestic demand seem to be normalising.

- The government has also introduced tax reforms including a hike in the VAT rate and yet another tax amnesty. Fiscal consolidation is likely to proceed at a faster pace than expected as a result, enabling the authorities to guide the fiscal deficit below 3% of GDP by 2023.

DETAILS

- Indonesia’s manufacturing PMI rebounded to 52.2 in September, from 43.7 in August. Aided by easing restrictions, new orders returned to growth following 2 months of steep contraction. But export orders were weak in September as supply-side constraints and shipping difficulties held back Indonesian exports. Employment was sluggish, as resignations and redundancies remain salient and despite backlogged work for the 7th successive month. Input inflation eased slightly but remains rapid because of dearer inputs, culminating in an acceleration of output inflation to its highest in close to 3 years. Business optimism dipped slightly and was lower than the historical average but manufacturers remained optimistic.

- Headline inflation held steady at +1.6% y/y and core inflation was unchanged at +1.3% in September. Food and beverage (+3.2%) eased slightly, as did personal care (+0.4%) and education (+1.7%); accommodation (+0.4%), household equipment (+2.0%), health (+2.1%), information and communication (-0.0%) were unchanged. Clothing (+1.3%), transportation (+0.7%), recreation (+0.9%) and restaurants (+2.7%) saw a slight uptick from the previous month.

- Budget 2022 has been approved by parliament. Spending is pegged at IDR2.71qd, down just a smidgen from IDR2.75qd envisioned in the President’s budget speech. Macroeconomic assumptions were broadly unchanged, with growth seen at 5.2% (previously 5%-5.5%) and inflation (3%), oil price (USD63) and the Rupiah (IDR14,350/USD) all unchanged. Revenue (IDR1.85qd) and tax collections (IDR1.51qd) were retained in the final budget, and the fiscal deficit is pegged at IDR868tr, or 4.85% of GDP, in line with the draft document.

- Tax reforms are pending approval by parliament in the coming week as the authorities eye an ambitious mop-up in revenues as part of an aggressive fiscal consolidation effort.

- Key measures include a 1% hike in the VAT to 11% from April 2022, followed by another 1pp hike by 2025 at the latest. But VAT exemptions on basic necessities will stay, on the grounds of cost-of-living concerns despite concerns of leakages and inefficiencies. There is a revision of VAT provisions for loss-making firms, but details are lacking. There is also no mention of a reduction in the exemption threshold for MSMEs.

- On income tax, the government will introduce a top tax bracket of 35% for those earning more than IDR5bn a year (the next bracket imposes a 30% tax rate on incomes above IDR500mn), but the threshold for the tax lowest bracket (5%) has been lifted from IDR50mn to IDR60mn.

- Corporate tax rates, which were supposed to come down following the passage of the omnibus bill, will remain unchanged at 22%.

- A carbon tax of IDR30 per kilogram of CO2 equivalent will be imposed, albeit at less than half the proposed rate (IDR75), from April 2022. On the flip side, the government can alter the tax rate through a government regulation, without having to go through parliament. The government will establish a carbon tax roadmap that will be reviewed by parliament, detailing the priority sectors for taxation, renewable energy development plans, as well as emission reduction strategies.

- Last, the government intends to launch another tax amnesty in 1H22, with a similar design to the previous amnesty. Assets acquired in the period of 1985-2015 will come under a tax rate of 6%-11% depending on its location and use, which is below the 15% outlined in the finance ministry’s draft but significantly higher than the 1%-4% during the 2016 amnesty. Taxpayers who declined to take part in the 2016 amnesty can now sign up for the 2022 program, and assets obtained in the latter period of 2016-2020 will be subject to a higher tax rate of 12%-18%.

Assessment: Tax reforms are imperfect, but will help broaden the tax base

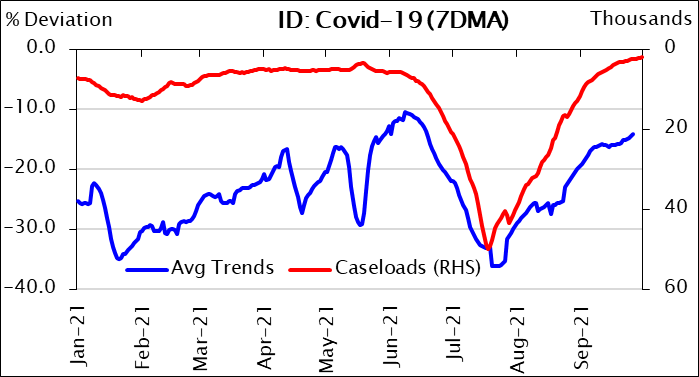

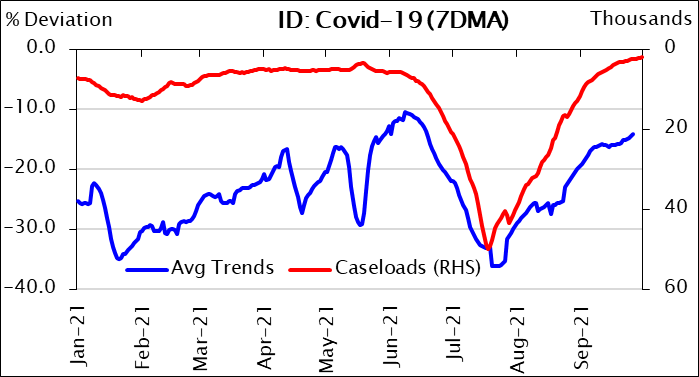

- Spirited revival in PMI suggests economic conditions are normalising: Domestic demand appears to be stabilising following the dissipation of the second wave of infections as daily caseloads have fallen below pre-crisis levels (see Chart below, red line). Reports ascribed this to low testing rates, but the fact that mobility trends are converging with levels last seen just before the outbreak of the second wave are unmistakable, as they hint at a nascent revival in business and consumer confidence. If sustained, the economy could still mount a convincing recovery in 4Q21, aided by government support measures as well as the external tailwind from stirring commodity prices.

- Having attained natural immunity with large swathes of the population coming down with Covid-19, we believe the economy can grow 4% this year, though higher vaccination rates are pertinent to prevent another wave of infections spurred by new strains of the coronavirus in the foreseeable future, perhaps as early as 1H22.

- On the downside, the ever-benign inflation print points to not insignificant slack within the economy, accentuated by price controls on fuel and utilities that have prevented the spillovers from higher commodity prices to the Indonesian economy.

Source: CEIC. RHS scale for Covid-19 cases have been reversed. Average mobility trends refer to the average of retail, workplace and transit station.

- Watered-down tax reforms still a step in the right direction: Hashing out a tax measure, when the pandemic is far from over, was never going to be an easy or smooth-sailing task. It appears finance minister Sri Mulyani got her way on the VAT tax hike, albeit after some compromises with parliament, an institution that is never known for expeditious efficiency. For instance, she has never been in favour of another tax amnesty, for the obvious reason that repeated amnesties undercut the government’s credibility on staunching tax evasion and avoidance, at a time of increasing desperation to claw back more revenues to cushion the blow from expenditure rationalization to guide the fiscal deficit south of 3% by 2023.

- Some of the tax measures are also crafted imperfectly and poorly, such as raising the upper end of the income tax bracket. This points to another weakness of the Jokowi administration, as the popular president has refused to put his political capital to use when the situation calls for it. In this instance, broadening the tax base by lowering the VAT threshold and curtailing the VAT exemptions would be critical to get more economic agents to pay their fair share of taxes. It is true that higher income taxes are more progressive in theory. In practice, the government has a poor track record of improving tax compliance, evinced by the mixed results from the 2016 tax amnesty when the windfall was rather modest.

- Putting it all together, the positives still outweigh the negatives insofar as the tax reforms are concerned. Discretionary authority to raise the carbon taxes give the government a freer hand to hike rates in future. The VAT hike from 2Q22 will also help buttress the government’s fiscal position when the recovery should have kicked in, barring another exogenous shock or a new wave of infections. Seen in that light, the tax reforms may well enable revenues to surprise on the upside vis-à-vis Budget 2021’s estimates, and cushion the hit to growth stemming from the looming spending cuts that is probably still necessary for the 3% fiscal cap to kick back in.

—

Originally Posted on October 5, 2021 – Indonesia: Tax Reforms Far From Perfect But Is Still A Step In The Right Direction

Disclosure: Smartkarma

Smartkarma posts and insights are provided for informational purposes only and shall not be construed as or relied upon in any circumstances as professional, targeted financial or investment advice or be considered to form part of any offer for sale, subscription, solicitation or invitation to buy or subscribe for any securities or financial products. Views expressed in third-party articles are those of the authors and do not necessarily represent the views or opinion of Smartkarma.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Smartkarma and is being posted with its permission. The views expressed in this material are solely those of the author and/or Smartkarma and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!