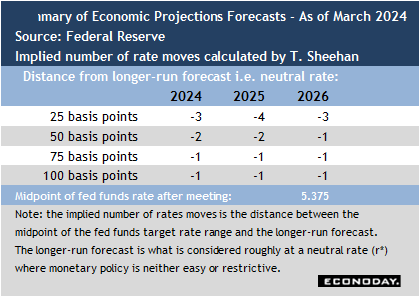

The FOMC meets on Tuesday and Wednesday of the June 10 week. The FOMC statement released at 14:00 ET on Wednesday will get a close read for any guidance in regard to the interest rate outlook. However, it is the summary of economic projections (SEP) that may be more informative. Markets will be looking for hints about any changes in the FOMC forecasts that will shape expectations for moves in the fed funds rate.

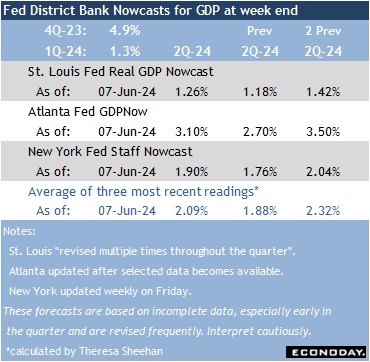

The prior SEP was issued on March 20 and implied three rate cuts of 25 basis points later in 2024. Shortly after that, the data on inflation, the labor market, and economic growth made that projection out-of-date. The inflation data for the first quarter as a whole showed a “sideways” move that didn’t change much at the start of the second quarter in data for April. Labor market data through May is consistent with tight conditions. GDP growth in the first quarter was a modest 1.3 percent – somewhat below the FOMC’s longer-run forecast of up 1.8 percent – while early forecasts for the second quarter point to growth a little faster than the longer-run. The combination of recent lack of progress in disinflation, a healthy labor market, and tempered growth will keep the FOMC on hold as far as rate cuts go.

It is widely anticipated that the SEP will reduce the forecast for rate cuts to only one or two this year – and maybe even none.

The June 11-12 FOMC meeting is almost certainly the last before Chair Jerome Powell delivers his semiannual monetary policy testimony before Congress. It isn’t on the Fed’s event calendar yet. It could be scheduled before the recess around the Independence Day observance on July 4, or it could be a week or two after that. In any case, Powell’s prepared remarks for that testimony are probably going to closely align with the June 12 FOMC statement and his remarks at the press conference which will happen at 14:30 ET on Wednesday.

Fed policymakers will remain wary about under- or over-reacting to any one piece of economic data. It will probably take a full quarter’s worth of numbers consistent with a resumption in disinflation before the hawkish tone of Fed comments ease while the economy chugs along with moderate growth and the labor market shows little sign of substantive loosening.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Inflation is not going away normal rates used to be 7 1/2 8 1/2% on mortgages pre-2008. Too many people grew up being spoiled with low to zero interest rates and have no idea what normal lives especially people under 30..