Markets are bouncing back from yesterday’s risk-off sentiment despite this morning’s releases of a hotter-than-anticipated PPI and weaker-than-projected Consumer Sentiment data. Investors are indeed piling into everything, as short- and long-term inflation expectations ticked down in today’s UMich print, sending odds of a September rate reduction from the Fed upward to 90%. A critical risk, however, lies in financial conditions loosening, a development that is already contributing to our real-time tracking measures pointing to July inflation of 0.3% m/m for headline and core. A continuation of these developments, which is my base case, will deter the Fed from dishing out its first cut of the cycle in September, opting for December instead.

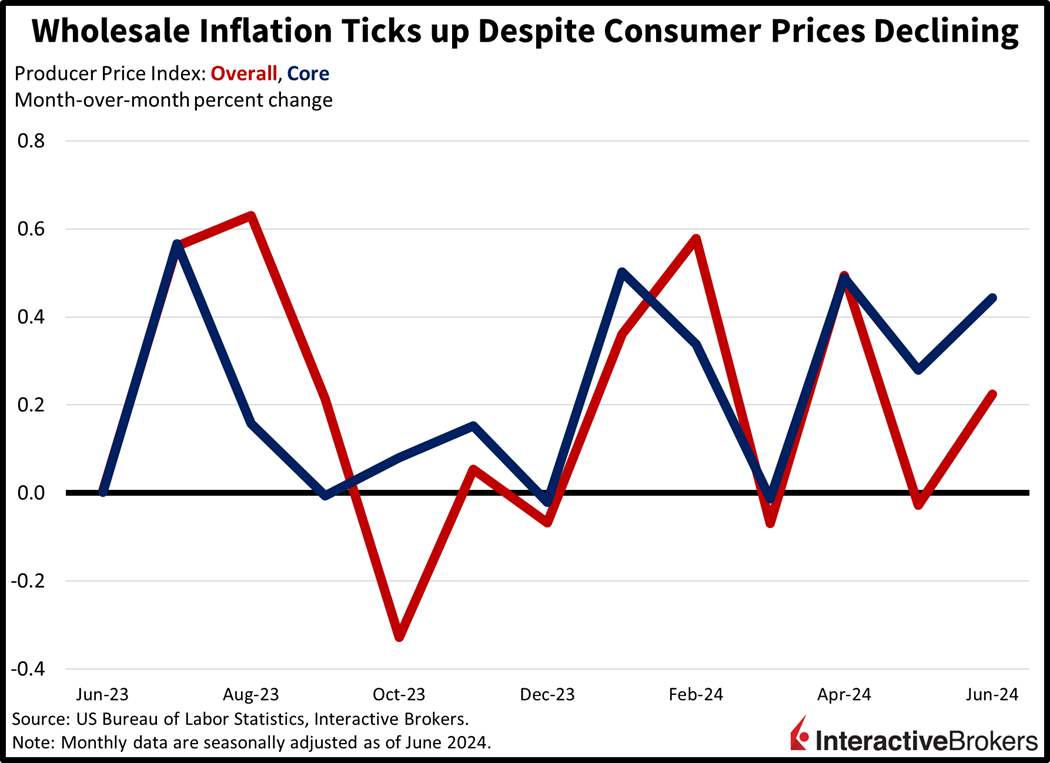

Wholesale Prices Exceed Expectations

June wholesale prices rose despite deflation in energy, food and in the transportation and warehousing category. The Producer Price Index (PPI) rose 0.2% month over month (m/m) and 2.6% year over year (y/y), stronger than the 0.1% and 2.3% projected as well as the -0.2% and 2.2% in May. Similarly, core figures, which exclude food and energy, posted upside beats of 0.4% m/m and 3% y/y, loftier than the median estimates of 0.2% and 2.5% and the previous month’s 0.3% and 2.3%. While energy, the transportation and warehousing component and food saw charges drop 2.6%, 0.4% and 0.3%, trade services and other services experienced cost increases of 1.9% and 0.1%.

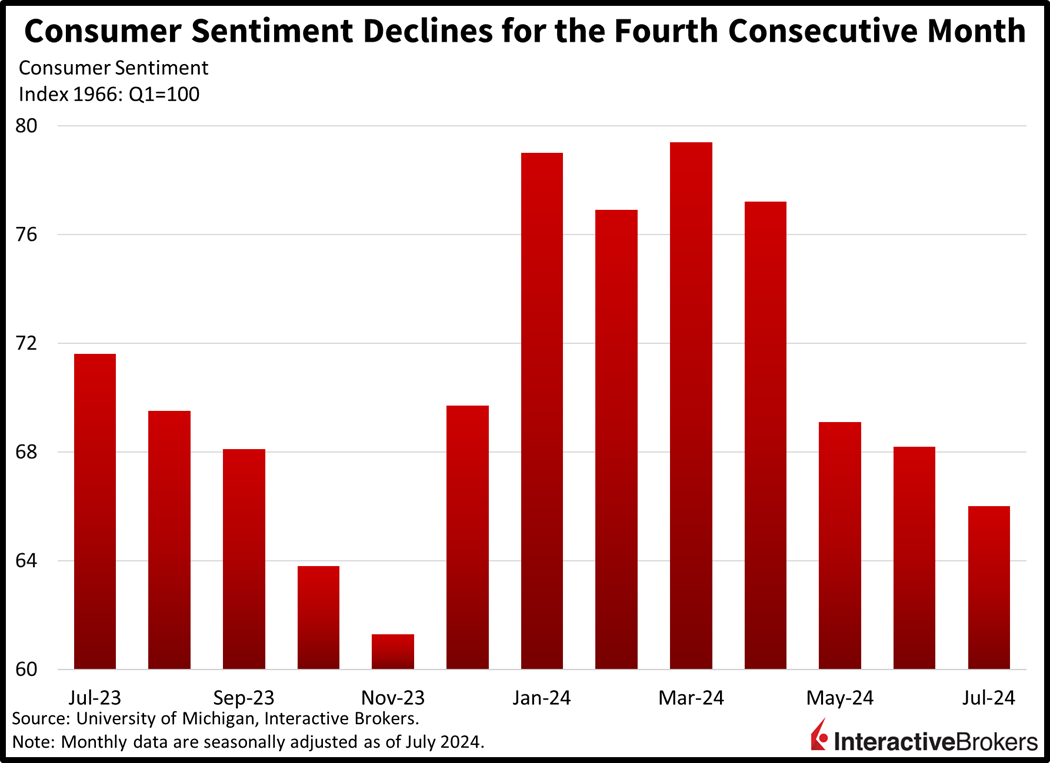

Consumers Express Worst Sentiment of the Year

Folks are currently feeling the lousiest they have this year regarding the economy and their finances, with the University of Michigan’s (UMich) Consumer Sentiment Index declining for the fourth consecutive month. Sentiment dropped to 66, beneath projections of 68.8 and June’s 68.2. Both sub-indices for current conditions and future expectations sunk to 64.1 and 67.2 from 65.9 and 69.6 during the period. Meanwhile, inflation expectations for one- and five-year periods both dropped from 3% to 2.9%. Still, consumers blamed elevated prices for their sour moods, while uncertainty concerning November’s presidential election also weighed upon sentiment.

Investment Banking Powers Earnings Beats

Corporate CFOs continue to emerge from their capital raising hibernation, helping JPMorgan Chase, Citigroup and Wells Fargo beat analyst consensus expectations for second-quarter earnings and revenue. The increased capital raising activity follows a pickup in investment banking earlier this year that helped Morgan Stanley and Goldman Sachs post strong first-quarter results. Today’s better-than-anticipated earnings releases, however, featured commentary regarding potentially persistent inflation and high interest rates. Credit losses also emerged. Consider the following earnings highlights:

- JPMorgan Chase’s revenue jumped 20% y/y, driven in large part by investment banking fees soaring 52%. Equity trading revenue also increased significantly while fixed income climbed in the low single digits. The earnings release, however, included a cautious tone. For one, JPMorgan increased its provision for credit losses, implying the bank anticipates an uptick in loan defaults. Additionally, CEO Jamie Dimon said trade issues, large government deficits, demands for infrastructure upgrades, and countries rebuilding their militaries could sustain inflation and high interest rates for longer than many investors anticipate. He also believes geopolitical risks are the highest they have been since World War II. Shares of JPMorgan declined 1% in premarket trading.

- Citigroup’s revenue climbed 4% y/y with growth across each of the company’s business units. Results were particularly strong for capital markets, including equity trading and investment banking. Citigroup’s securities services, which safeguard clients’ assets and track portfolios, were also healthy. Citi beat earnings and revenue expectations despite the company dishing out $136 million for a regulatory fine related to data management problems. Additionally, credit card losses weighed. On a positive note, the company reduced its allowance for card losses for the current quarter. Its share price declined approximately 2% in early trading.

- Wells Fargo’s revenue grew 1% with an increase in securities trading, investment banking and investment management fees offsetting a 9% decline in net interest income (NII), which is the difference in a bank’s cost of capital and interest generated on loans. NII was hurt by higher costs of capital, driven, in part, by competition for deposit customers. Additionally, loan balances declined with corporations having tepid demand for the products. For the full fiscal-year 2024, Wells Fargo anticipates NII falling below last year’s level, and it has increased its estimate for noninterest expenses. Wells Fargo shares declined approximately 6% in early trading.

Small Caps Lead Today’s Rally

Asset prices are rewarding market bulls with stocks and bonds levitating alongside some of the cyclical commodities. All major US equity indices are gaining, with the Russell 2000, Nasdaq Composite, S&P 500 and Dow Jones Industrial benchmarks higher by 1.5%, 1.1%, 0.9% and 0.8%. Sectoral participation is terrific—every segment is higher. Piloting the bulls are consumer discretionary, technology and industrials, which are flying north by 1.6%, 1.4% and 1%. Treasurys are catching bids as well with the 2- and 10-year maturities changing hands at 4.48% and 4.20%, 4 and 2 basis points (bps) lighter on the session. Softer borrowing costs, heightening Fed easing wagers and decelerating economic prospects are weighing on the dollar, with its index down 39 bps. The greenback is losing ground relative to each of its major counterparts minus the yuan. It’s down versus the euro, pound sterling, franc, yen and Aussie and Canadian dollars. Commodities are mixed with copper and crude oil higher by 1.3% and 0.4% but lumber, silver and gold lower by 2.4%, 1.8% and 0.2%. WTI crude is trading at $83.28 per barrel on a lighter supply outlook amidst stable demand prospects.

Small Caps and Value Face Narrow Path

While yesterday’s market trading demonstrated enthusiasm for small caps and value, the economy has created an increasingly narrow path for those categories to outperform, a development that is likely to put even more significance on the ability of the Magnificent Seven to power market gains. I see two possible scenarios going forward. One scenario is the much hoped for soft landing, which is likely to feature elevated interest rates and investors requiring a significant risk premium as a result. These factors would create a strong headwind for rate-sensitive small-cap companies and value-tilted sectors that lack exciting narratives to drive multiple expansion. The second possible scenario—recession—would create revenue challenges for all corporates, but it would be particularly painful for small-cap firms which carry slim margins in aggregate. In this environment, value names are also likely to struggle because, their only answer to revenue pressures would be to reduce expenses, generally speaking. In either scenario, it will be essential for the Magnificent Seven to continue to generate revenue and earnings growth by disrupting existing industries with new products, such as artificial intelligence, robotaxis’, automation and ledgers associated with blockchain technology. But given the recent runup amidst eye-watering valuations and an equity risk premium that is negative when compared to short-term yields and in the basement relative to the long-end, the risk of a significant drawdown in the 20% range is certainly in the cards.

Visit Traders’ Academy to Learn More About the Producer Price Index and Other Economic Indicators

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Need to pass out more “free money.”