By Vishal Dalvi, CMT

Fusion-Trend Indicator

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

Fusion-Trend Indicator

There is no Holy Grail indicator for Trend identification, but I have tried to create an Indicator which can accurately identify Up-trending, sideways, and down trending Markets using a combination of multiple indicators as defined below. The typical time horizon of trend using these parameters is 6 months and the change of trend takes 2-3 months.

The following sub section explains the functions and indicators used in Fusion Trend calculation:

RSI

RSI (Relative Strength Index) measures the speed and magnitude of a security’s recent price changes to evaluate momentum and also overvalued or undervalued conditions in the price of that security. I have used 28 period RSI.

ADX (Average Directional Index) measures the strength of trend over time regardless of direction. The other two output parameters PDI (Positive Direction Index) and NDI (Negative Direction Index) determine the strength of the trend in positive and negative direction. I have used 28 period ADX.

Efficiency Ratio measures the quality of price move between points A and B, by comparing the total distance covered from point A to point B with respect to net move between these two points. I have calculated this indicator for 28 periods.

This function calculates four different simple moving averages. The idea is to assign different weightages to relative position of price and different moving averages. I have calculated 5 period, 10 period, 15 period and 30 period simple moving averages.

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile indicator that defines support and resistance, identifies trend direction, gauges momentum and provides trading signals. In this section we have used IM to determine trend direction by comparing the relative position of Convergence and Base line and measure momentum by calculating the number of crossovers between Convergence and Base line. Standard 9-period and 26-period are used for calculation of Convergence and Base line and look back period for number of crossovers is 28.

Short Term Trend Indicator Calculation:

We merge the above 4 indicators to make a composite score of Trend defined as Sig1 using the following logic:

- RSI: if ( RSI > 50 ) then ScoreRSI = 1

- Else ScoreRSI = -1

- ADX: if ( (PDI – NDI > 5) and (PDI > 20) and (ADI > 20) ) then ScoreADX = 1

- Elseif ( (NDI – PDI > 5) and (NDI > 20) and (ADI > 20) ) then ScoreADX = -1

- Else ScoreADX = 0

- Efficiency Ratio: If ER > 0.3 then ScoreER = 3

- Elseif ER > 0.2 then ScoreER = 2

- Elseif ER > 0.05 then ScoreER = 1

- Elseif ER > -0.05 then ScoreER = 0

- Elseif ER > -0.2 then ScoreER = -1

- Elseif ER > -0.3 then ScoreER = -2

- Else ScoreER = -3

- Moving Averages: We start with ScoreMA = 0 then

- If PriceLast > MA30 add 0.36 to score and then

- If PriceLast > MA15 add 0.27 to score and then

- If PriceLast > MA10 add 0.21 to score and then

- If PriceLast > MA5 add 0.16 to score

Finally, if the ScoreMA > 0.7 then round it up to 1

- Elseif ScoreMA < 0.3 then round it down to -1

- Else make ScoreMA = 0

- IchiMoku: if ( (number of Conv Base crossovers < 2) and (Conv > Base) ) then ScoreIM = 1

- Elseif if ( (number of Conv Base crossovers < 2) and (Conv < Base) ) then ScoreIM = -1

- Else ScoreIM = 0

Composite Score = ScoreER*( ScoreRSI + ScoreADX + ScoreMA + ScoreIM ) which could have a value between -12 to -12

tempSig1 = 14-day simple moving average of Composite Score.

Long Term Trend Indicator Calculation

This indicator compares the Highest High and Lowest Low of last 5 days with Highest Close and Lowest Close in each of the last 12 months (20 trading days for each month) to compute relative progress of price in last 1 year.

- If ( (5 day high > Highest close of month i ) and (5 day low > Lowest close of month i ) ) then + 1 score to that particular month

- Elseif ( (5 day high < Highest close of month i ) and ( 5 day low < Lowest close of month i ) ) then – 1 score to that particular month

- Else 0 score to that particular month

We add the score given to all 12 months to calculate Sig2 which can have a value between -12 and +12. As a final check, change the value of Sig2 only if price is also changing in the same directions else retain the previous day value of Sig2.

Combining Short Term and Long-Term Indicators

Based on the values of Sig1 and Sig2, we determine the change in trend according to the following logic:

- If tempSig1 > 4 and Sig2 > 4 and present trend = -1 (negative), then new positive trend starts

- Elseif tempSig1 < -4 and Sig2 < -4 and present trend = 1 (positive), then new negative trend starts

From the day, a new trend starts we start averaging the value of tempSig1 using exponential moving average with a maximum period of 30 days to get smoothened value of Sig1.

Now Fusion-Trend = Sig1 + Sig2

but if Sig1 and Sig2 are of opposite sign, we make Fusion-Trend = 0,

also, if Present Trend and Sig2 are of opposite sign, we make Fusion-Trend = 0

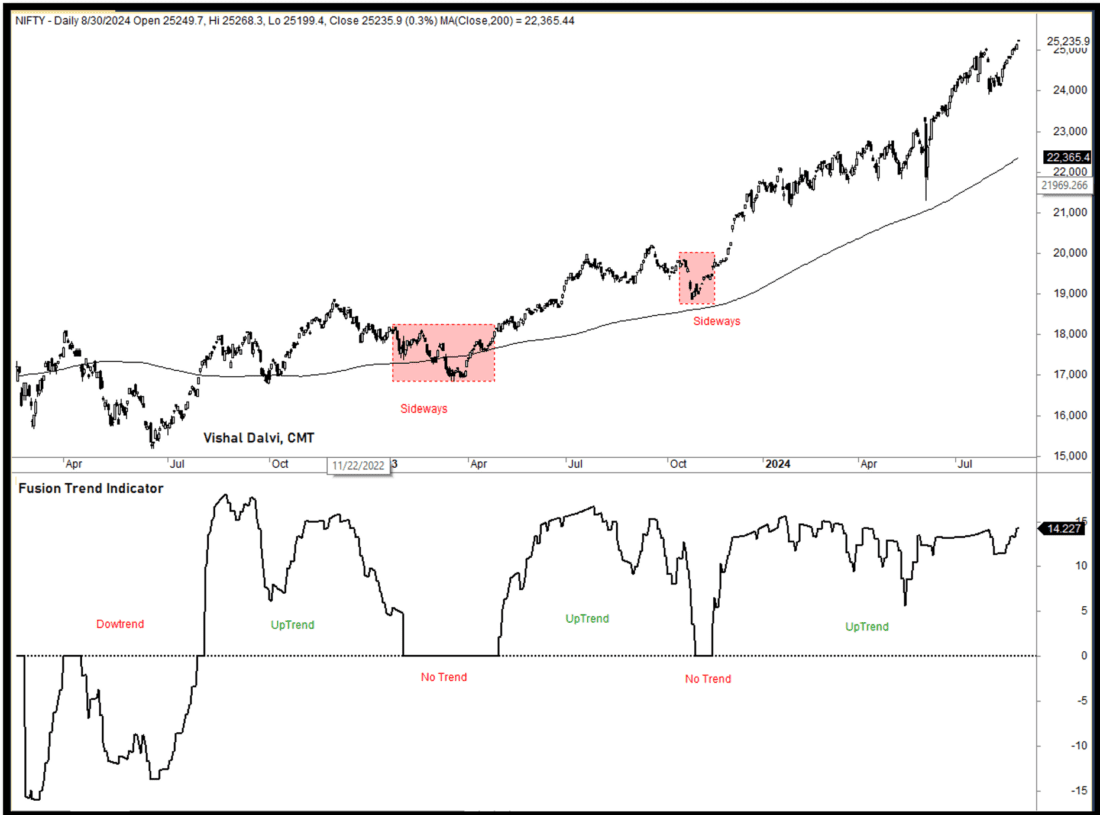

Plotting the Fusion Trend Indicator – Nifty

The chart shows how the indicator is able to respond according to underlying trend change. A value above 0 denotes an uptrend and below 0 shows a downtrend. Also there are phases where the indicator value will persist to be 0, which signifies no trend in the market.

The indicator can have several applications

- Broad Trend Filter in strategies

- Position sizing based high and low values

- Entry/Exit signals

- Identifying Reversal zones – (In an uptrend, a move back to zero can be used for anticipating a reversal trade)

- Ranking stocks for choosing in the portfolio

There are several variations possible in terms of designing the final indicator. One can try several changes with Data sampling period and Indicator period to suit ones time frame or also add/delete some indicators to make it some suitable for ones style of trading, investing. The intention of the paper is not to give you a perfect indicator but to demonstrate how a composite indicator can be constructed combining several individual indicators.

—

Originally posted 6th September 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!