Thursday, 18th November, 2021

1/ Chinese market divergence isn’t deterring U.S. stocks

2/ Alibaba falls short of expectations

3/ Can NIU impress investors?

4/ The bottom line

1/ Chinese Market Divergence isn’t Deterring U.S. Stocks

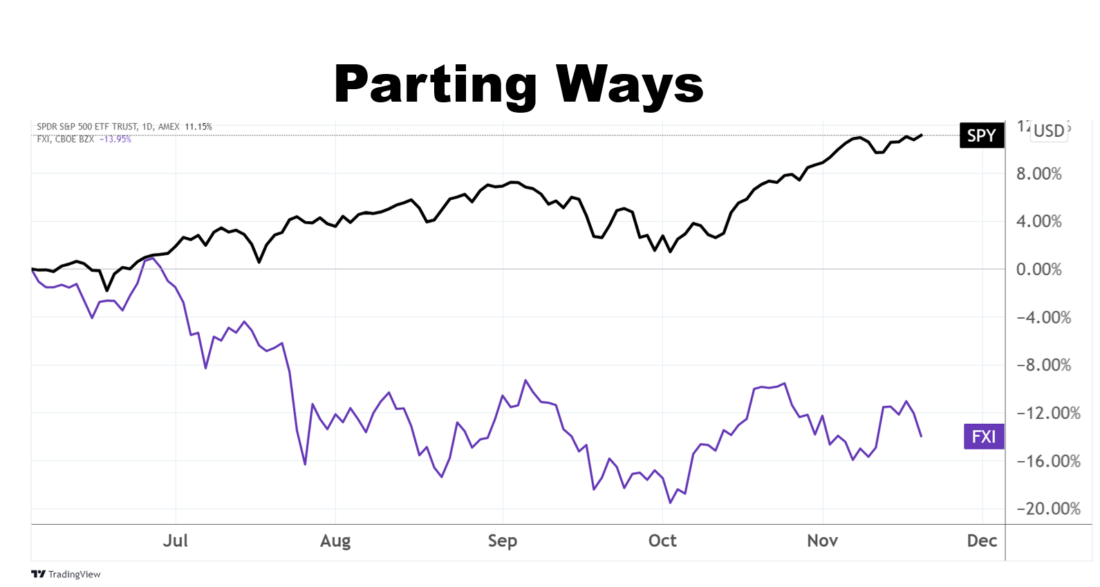

U.S. markets edged higher today, underscoring an interesting comparison that has become apparent over the past 12 months. The chart below compares the performance of State Street’s S&P 500 Index ETF (SPY) with iShares’ China Large-Cap ETF (FXI) over the last 12 months.

While SPY has continued rising, Chinese equities have been falling. Generally, if the Chinese market is doing poorly, it can often be an early indicator that trouble is brewing for the U.S. markets. So far this year it seems that the opposite has been true.

The leaders of the two countries, President Biden and China’s President Xi Jinping recently held a virtual summit which produced no breakthrough steps to better relations. Both sides reiterated points of longstanding contention, merely agreeing on the need to prevent competition from escalating into broader conflict.

SPY and FXI have been on opposite paths over the last year, with each market’s relationship with big tech companies shaping the difference. Mega-cap tech companies have been largely responsible for driving new highs in U.S. markets, while Beijing’s crackdown on big tech has hampered FXI, as investors have sought out safer havens.

A potential default of China developer Evergrande bled into domestic markets for a time, but merely served as a small pullback on a continued uptrend. FXI’s recent lows are mirrored by SPY’s levels of November 2020, and SPY appears poised to break the February highs of FXI soon.

Chinese markets could stage a turnaround but are still struggling with the same issues domestic markets face, namely inflation and supply chain disruptions. The flip side of the conversation is SPY closing the gap with FXI with a prolonged downward trend, which could be possible once the Federal Reserve changes their relatively dovish economic policy toward inflation.

2/ Alibaba Falls Short of Expectations

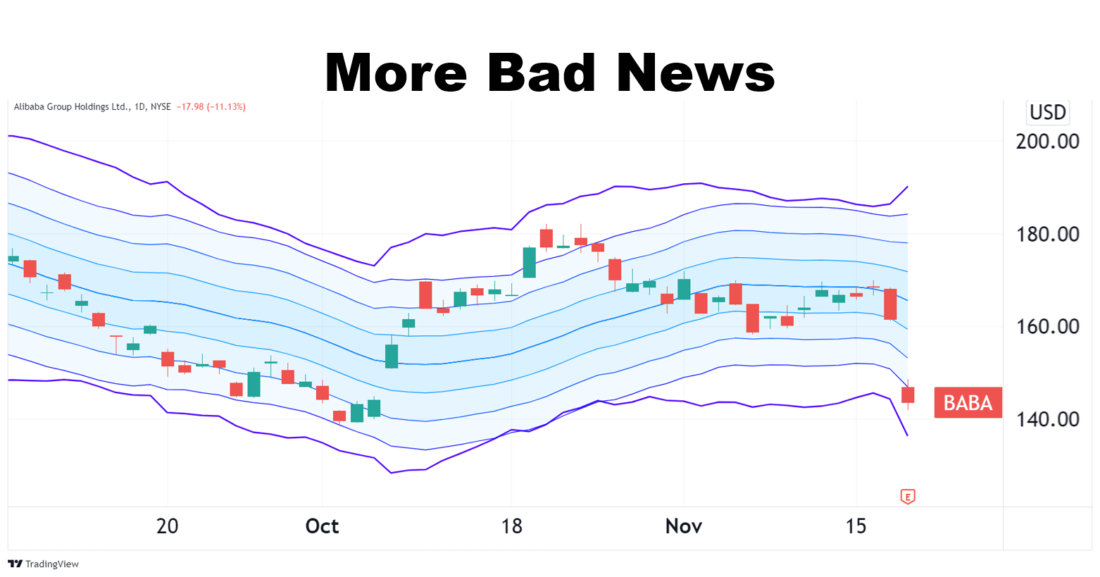

Shares of Alibaba (BABA) plunged after the company reported weaker-than-expected earnings for the fiscal second quarter. Analysts expected BABA to announce $12.11 in earnings per share (EPS) along with $205.7 billion in revenue. BABA greatly missed expectations, reporting $11.20 in EPS and $200.7 billion in revenue.

BABA’s earnings decline was the first out of any quarter in the last four years. Slowing economic growth in China compounded regulatory headwinds the company faces amid Beijing’s crackdown on big tech. The earnings-based drop has BABA shares trading in an extreme low range, well below its 20-day moving average, as per the chart below.

Prior to earnings, it appeared option traders were positioned for the stock to move higher after earnings. That’s because the open interest for BABA featured nearly 2.6 million call options compared to 1.9 million puts. However, it should be noted that implied volatility for call options prior to earnings was falling, which could mean that option traders were taking advantage of elevated premiums to sell calls, while buying puts.

After earnings, options are priced to move lower, as puts are more expensive than calls after accounting for intrinsic value.

3/ Can NIU Impress Investors?

Investors have been selling off shares of Niu Technologies (NIU) ahead of the company’s third quarter earnings announcement, which is expected Monday before the market opens. Wall Street is forecasting $1.79 in EPS and $1.39 billion in revenue. EV stocks took off last year but have had mixed results since then. Investors will be watchful to see how NIU has been able to expand their market of electric scooters.

The chart below compares the recent performance of NIU with iShares’ China Large-Cap ETF (FXI). While today’s 5% share price decrease could be seen as a side effect of BABA’s poor earnings, NIU shares have been on a relative downward trend since the beginning of the month. It’s been tough sledding for both NIU and FXI in 2021, as the stocks are down 16% and 13%, respectively, year-to-date.

It will be interesting to see how NIU is able to navigate being in a hot sector while also being a stock from China. Investors haven’t felt the need to buy up Chinese stocks right now.

4/ The Bottom Line

U.S. stocks pushed higher today even as Chinese stocks were weighed down by Alibaba’s report. The company missed analysts’ expectations, and the resulting price drop had a ripple effect on all Chinese stocks. This may also impact investor response to NIU Technologies’ upcoming earnings report.

—

Originally posted on 18th November, 2021

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!