By J.C. Parets & All Star Charts

Tuesday, 28th February, 2023

1/ European Yields Reach New Highs

2/ Running With the Bulls

3/ More Losses for Grain Contracts

4/ Precious Metals Need Time

Investopedia is partnering with All Star Charts on this newsletter, which both sells its research to investors, and may trade or hold positions in securities mentioned herein. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice.

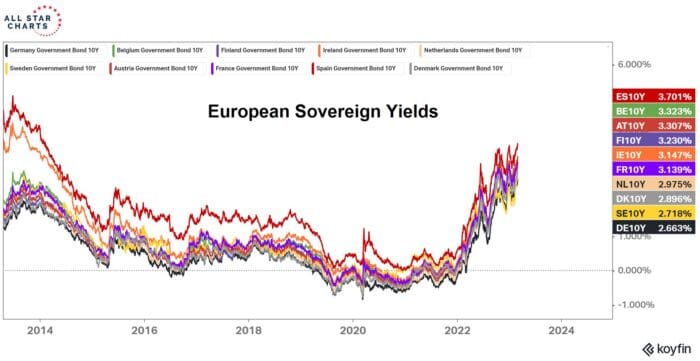

1/ European Yields Reach New Highs

When we look outside the United States, we can clearly see it’s a rising interest rate environment around the globe.

While yields are climbing in the U.S., the upward trajectory for European yields is far more pronounced. The chart below displays 10 developed country European sovereign benchmark yields:

All 10 are either challenging or printing fresh multi-year highs. We looked to these rates for confirmation during last year’s historic rise in Treasury yields.

The analysis proved invaluable as the rising interest rate environment was global in scope, and Europe often gave a good indication for where U.S. yields were heading.

We see no signs of that changing any time soon. We could expect U.S. yields to follow suit to new highs over the coming days and weeks.

2/ Running With the Bulls

When it comes to international equities, the iShares MSCI Spain ETF (EWP) has emerged as a leader as it has rallied 42% from its October lows.

Buyers are in full control as prices coil in a bull flag above a critical Fibonacci retracement level. This continuation pattern could resolve higher in the direction of the underlying trend.

If and when this pattern resolves to the upside, we’re eyeing the 2021 highs near 31 as the next potential resistance zone.

3/ More Losses for Grain Contracts

Despite soft commodities showing impressive strength, grain markets continue to catch lower.

Today, Chicago wheat futures contracts expiring in May posted fresh 52-week lows. Soybean futures dropped over 2%, while oat futures challenged their lowest level year-to-date.

The broad selling pressure also hit corn futures, as the May contract undercut its December pivot low.

The message suggests that risks could be to the downside.

The environment can change fast in any market, but particularly in commodities. We might want to be ready for a clear reversal higher. But for now, these contracts demand caution as bears take control.

4/ Precious Metals Need Time

The recent breakdown in silver speaks to a lack of risk-seeking behavior in the precious metals complex.

Silver is fondly called “gold’s crazy cousin” because it’s the higher-beta play. For this reason, precious metal bulls want to see silver advance on both absolute and relative terms.

We monitor the price of silver relative to gold to gauge risk appetite for precious metals. The overlay chart of gold futures and the silver/gold ratio illustrates why:

Silver’s bullish reversal relative to gold coincided with the yellow metal violating a significant downtrend line on absolute terms.

Buyers were entering the market, bidding up the riskier assets at a faster pace. That type of behavior bodes well for the entire space.

With silver breaking down both on absolute terms and relative to gold, we adjust our focus from overhead supply to potential support levels, as the risk could be to the downside.

—

Originally posted 28th February, 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!