By Todd Stankiewicz CMT, CFP, ChFC

1/ One Wild Week

2/ Is the Market Rotating?

3/ Let the Prices Lead

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

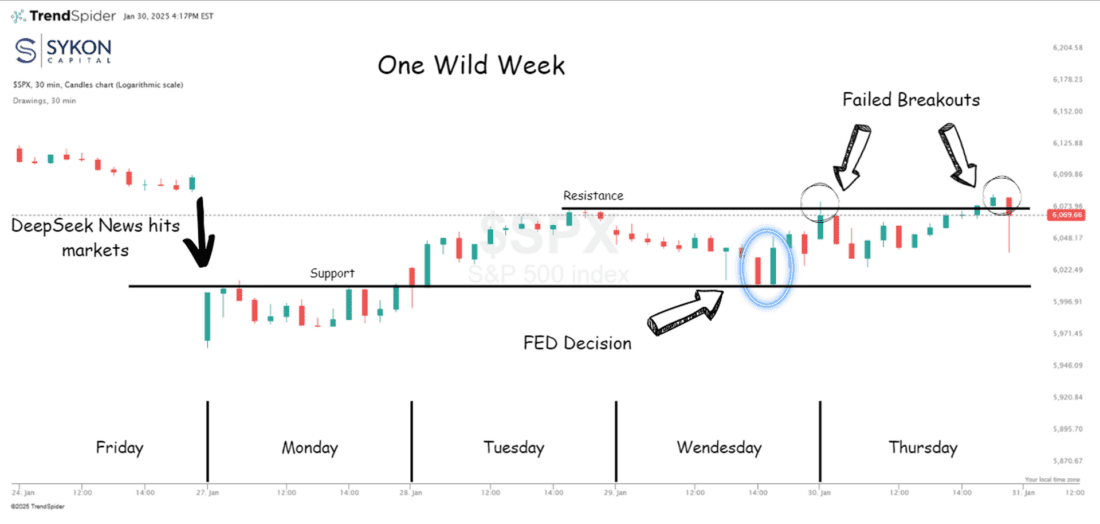

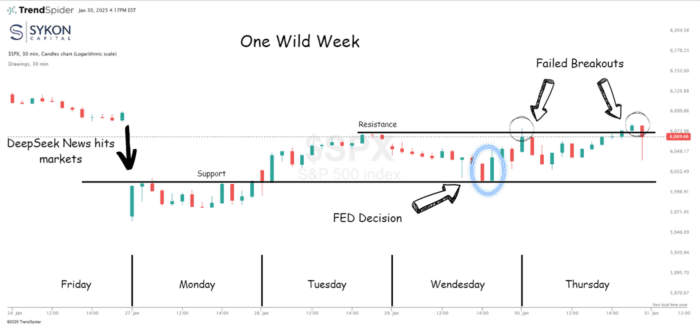

One Wild Week

This was my fourth time guest-authoring ChartAdvisor, and it was easily one of the most action-packed weeks I’ve had.

Monday opened with a gap down after news that DeepSeek might be changing the game in AI. The concern? If true, valuation models for current AI companies could crumble under new assumptions. The Nasdaq dropped over 3%, and Nvidia tanked 17%. This was a real-time example of just how fragile valuation models can be. At these levels, everything has to go right just to hold the line.

Then we had the FOMC. As expected, rates stayed put on Wednesday. But as I’ve been (not so quietly) pounding the table about, the Fed is still worried about inflation making a comeback. That should be a warning sign for investors: if markets hit turbulence, the Fed Put might not be there anymore.

Not with CPI still at 2.9% year-over-year.

Now, all eyes are on the S&P 500. The breakout attempt failed twice today. Keep a close eye on the support and resistance levels, a move outside the current range could give us a hint about what’s next.

2/

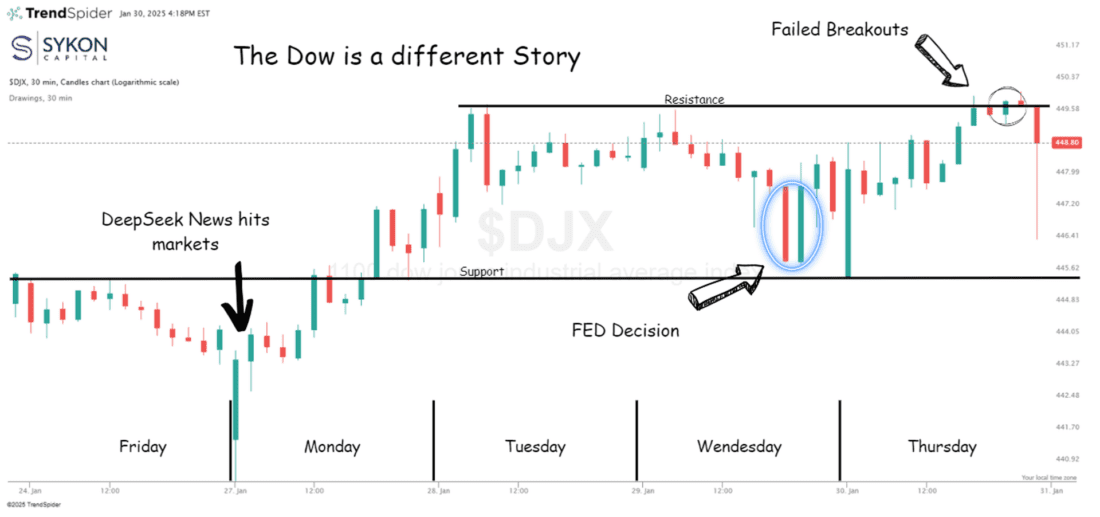

Is the Market Rotating?

While tech took a hit this week, the Dow Jones Industrial Average quietly pushed through last week’s highs and is now flirting with new all-time highs. That’s a notable shift. It looks like capital is rotating, and we may not see the same level of extreme concentration we’ve had recently.

If that’s the case, breadth could expand, which would support a broader market rally. Keep an eye on a breakout above the 450 level, we failed this attempt at the end of the day Thursday, but if that happens, we could finally see some momentum in the indices that have been lagging growth stocks over the past couple of years.

3/

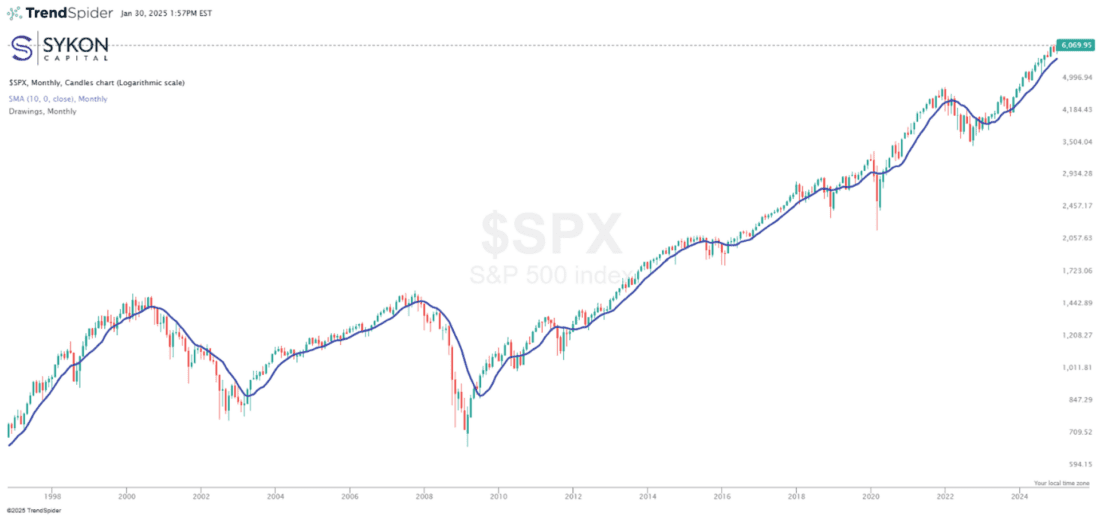

Let the Prices Lead

I’ll leave off with this last post for the week, it’s simple, but it sums everything up.

The past few months have been littered with news, hype, and emotion. My advice? Ignore it.

Pick an indicator. Pick a level. In this case, the 10-month moving average of the S&P 500.

- If the index stays above this level, it’s an uptrend. Staying long probably makes sense.

- A move below likely signals a trend change, meaning the odds are no longer in your favor.

Let prices lead. The fundamentals will follow.

Disclaimer: Advisory Services offered through Sykon Capital, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. The information contained in this presentation has been compiled from third party sources and is believed to be reliable as of the date of this report. Past performance is not indicative of future returns and diversification neither assures a profit nor guarantees against loss in a declining market. Investments involve risk and are not guaranteed.

—

Originally posted 31st January 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!