Fed Chairman Jay Powell is frustrated. His word, not mine.[1] In a recent public appearance, he said increased vaccination rates and stopping the COVID-19 delta variant “remains the most important economic policy that we have.” Then, he cited the increasingly dire global supply chain breakdowns as a driver of inflation into 2022. In these two comments, Chair Powell issued more than economic guidance. These comments were a continuation of a theme we have seen from him for some time now: Political leaders are falling down on the job.

We have been writing for some time about Powell’s attempts to explain that many of the challenges faced by the economy since the pandemic began were best addressed through fiscal policy. What was originally an objective economic opinion has increasingly become a frustration. The 24/7 news cycle, the siloed nature of media consumption and never-ending political campaigning seems to have rendered legislators in Washington, DC incapable of governing. In the absence of more precise legislative solutions, however, the Fed has attempted to fill in the void with a much cruder set of tools the best it can, all the while knowing that it may not be sufficient. It seems Mr. Powell has simply had enough.

Meanwhile, the Chairman has been much maligned by Wall Street economists for his view that recent inflation may be transitory. Many see the improving top-line unemployment figures and the latest inflation measures as signs of a successful and sustained post-pandemic economic recovery which the Fed isn’t willing to acknowledge. They argue the Fed is risking overheating the economy and should rein in the money supply by raising rates sooner.[2]

Mr. Powell addressed these criticisms in this same appearance, commenting on the supply chain challenges as resulting in a stubbornly high inflation rate. What is important to understand in his comments is the implication that there is “good” inflation and “bad” inflation. Good inflation is driven by a growth in demand from broad-based economic strength. Bad inflation is driven by a drop in supply or a less comprehensive display of discretionary spending. It is no secret that the pandemic’s impact on the economy disproportionately impacted low-income households. Meanwhile, the issues in the global supply chain point to a supply-driven catalyst for the increase in prices the country has been experiencing.

Indeed, the Fed chairman has been consistent from the start. What he has seen as transitory inflation is likely a reflection of the discretionary spending flexibility afforded not to those who are most vulnerable in our society but to those who weren’t financially impacted by the pandemic in a material way. In addition, the Fed’s focus not just on top-line employment metrics but on minority unemployment gains is yet another example of a policy aimed at sustained inflation. Mr. Powell seems to have no intention of getting head-faked by the wrong kind of inflation. The absence of legislative resolve simply prolongs the transitory nature of circumstances which are getting in the way of the Fed’s intended outcomes.

This all leads to a more interesting line of thinking than whether inflation is transitory or sustained if one is seeking actionable insights. While most of Wall Street seems to still be singularly tracking inflation, we have spent the last year following the Fed’s eyes to its intended target: employment. We won’t rehash our prior analysis any further here,[3] but we would like to dig into some other less understood takeaways from recent employment statistics. Bloomberg recently published a well-researched opinion piece by Karl W. Smith[4] which makes some interesting observations about the nature of the recently released August jobs data. Put simply, while new hires are not materially different from the same period last year, the primary difference is in the number of people who quit their jobs. The August 2021 quit rate was materially higher than in 2020, and in general, the quit rate in the US workforce has been steadily rising all year.

Mr. Smith draws a notable contrast to what happened in the workforce after the 2001 recession, in which a confluence of events led to an excess of available unskilled labor. This set the stage for a nearly two-decade trend in which corporate America was able to do more with less, driving revenues up while lowering the share of costs associated with labor. Employers could offer fewer or less attractive benefits, invest less in training and professional development, and generally avoid those types of investments in the workforce which make the people more valuable, not just to the company but to its competitors. With the possible exception of the few years right before the pandemic, voluntary rotation out of the labor market was brought to a halt. Put simply, it was a buyer’s market when it came to hiring, with the companies holding much of the power.

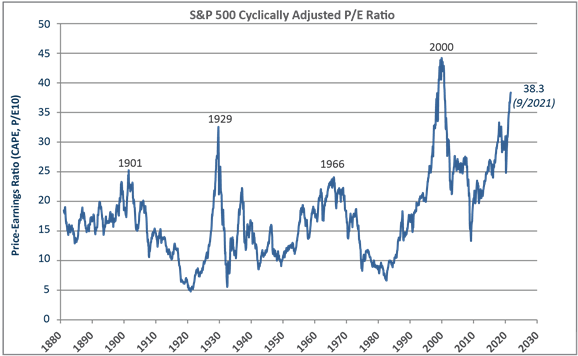

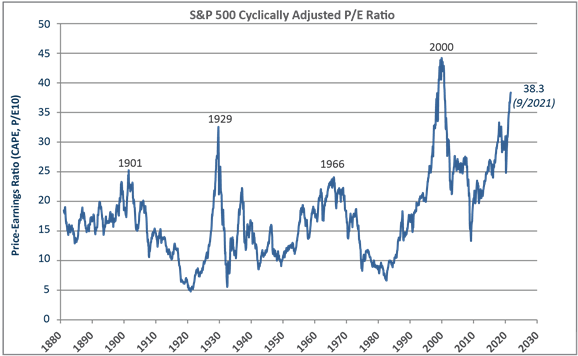

The subtext here is that the stock market became dependent on both the increased profits and the increased growth rates that came from this material change in costs. One way to see this is through the market’s price-to-earnings (P/E) ratio, which can be used to visualize the market’s future earnings growth assumptions relative to current levels. Since the price of a company’s stock generally reflects investor expectations of future earnings, the ratio of that price relative to recent actual earnings would go up with higher growth expectations, and vice-versa. As seen in Figure 1, what was a relatively range-bound value has reached levels only seen one other time in the last 140 years.

Figure 1: Shiller Cyclically Adjusted P/E10 Ratio for S&P 500. Note that the P/E10 ratio uses an average of the prior 10 years of annual P/E ratios to reduce impact of wild swings common in P/E ratio calculations. (Source: Online Data – Robert Shiller (yale.edu))

Notably, that last time (2000) was another period in which employee wages were not increasing substantially. For those who may not recall, the Fed was perplexed at the time by the failure of wages to keep pace with the economy and the markets. We know now that some of what caused wages to lag was the increased dependence of corporate America on non-cash compensation, such as stock options and other conditional payouts. Much of this compensation vanished when the dot-com bubble burst in 2000. However, unlike in 2000 and even 1929 (the last time the P/E ratio in the markets was near where it is today), the shock to the system came from a health crisis which triggered much of the workforce to reevaluate not just economic stability but satisfaction and fulfillment. Mr. Smith’s observations point to an insight which is not so much about the present state of the markets as it is about the future. The quit rate we are observing in the economy today speaks much more directly to a potential reversal of this trend of doing more with less. Employees have had enough, and the pendulum may be swinging the other direction. We may be entering a seller’s market when it comes to hiring.

If this is indeed the case, and we believe it may be, employers will have to do something they haven’t had to do for nearly two decades: increase wages in a long-term committed way, improve benefits and otherwise offer opportunities for advancement and education to meet the needs and demands of a newly empowered workforce. We have seen this sort of dynamic already in small pockets of skilled workers (e.g. engineers in Silicon Valley), but we believe this effect may need to be more encompassing. In this new model for the labor market, earnings growth would, on average, go down relative to the pace of growth over the last 20 years. This probably means forward-looking P/E multiples are too high. We believe such a circumstance would point to a potential sustained choppy and possibly downward period for the stock market, some companies more than others.

So how does one mitigate this effect? First, it may make sense to de-risk an equity portfolio, finding refuge in the high yield market where credit can have more insulation from the profitability decline in companies selected for resilience factors such as cashflow and liquidity. Second, this is exactly the type of situation in which ESG-focused portfolios can shine. The most direct mitigating factor for this scenario we have described is an ESG one: How does the company treat its workforce? The companies most likely to weather the potential push-and-pull between profits and happy employees are those who already have happy employees.

The neat trick that Chairman Powell has pulled off here is that he has provided the Fed with exactly the leeway it needs to be patient. If labor costs increase, we would expect to start to see that flow through in earnings toward the latter half of 2022 or early 2023. This decline in profitability should coincide with a more democratic increase in discretionary spending ability across the economy. What may be transitory inflation today, propped up for a frustratingly prolonged period, could very well give way to a more sustained inflation right around the time the Fed is expecting to raise interest rates. We are sure Mr. Powell would have preferred to see inflation tick down in between, and he may never get the credit he deserves if Wall Street just assumes he was wrong all along. After all, this will also mean a rotation of wealth from Wall Street to Main Street, the reverse of what we have seen for the last two decades. But we will know the truth and are grateful that the Fed has decided to be the adults while our elected officials act like children.

[1] Cox, Jeff. “Fed Chair Powell calls inflation ‘frustrating’ and sees it running into next year.” CNBC.com, CNBC, 29 Sept. 2021, https://www.cnbc.com/2021/09/29/fed-chair-powell-calls-inflation-frustrating-and-sees-it-running-into-next-year.html.

[2] It may be worth nothing that, from the other side of the spectrum of economic ideology, Senator Elizabeth Warren told Chairman Powell, “Your record gives me grave concerns. Over and over, you have acted to make our banking system less safe, and that makes you a dangerous man to head up the Fed….” In our experience, when a policymaker draws criticisms from both sides for simultaneously being too aggressive and not aggressive enough, it probably means she or he is striking the right balance.

[3] If you missed our previous comments on the Federal Reserve or just want to relive the experience, you can read our thoughts here and listen to Marcus on Bloomberg Radio.

[4] Smith, Karl W. “Workers Who Quit Their Jobs Could Improve U.S. Productivity.” Bloomberg.com, Bloomberg, 14 Oct. 2021, https://www.bloomberg.com/opinion/articles/2021-10-14/workers-who-quit-their-jobs-could-improve-u-s-productivity.

—

Important Disclosure Information

Zeo Capital Advisors is a fundamental investment manager to a short-duration credit mutual fund, a sustainable high yield mutual fund and separately managed accounts. Venk is the Chief Investment Officer and founded Zeo Capital Advisors in 2009.

For more information contact Zeo directly at 415-875-5604 or visit www.zeo.com.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Zeo Capital Advisors, LLC (“Zeo”)), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Zeo. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Zeo is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Zeo’s current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.zeo.com/disclosures.

Disclosure: Zeo Capital Advisors

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Zeo ), or any non-investment related content, made reference to directly or indirectly in this article, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Zeo. A copy of the Zeo’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Zeo Capital Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or Zeo Capital Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!