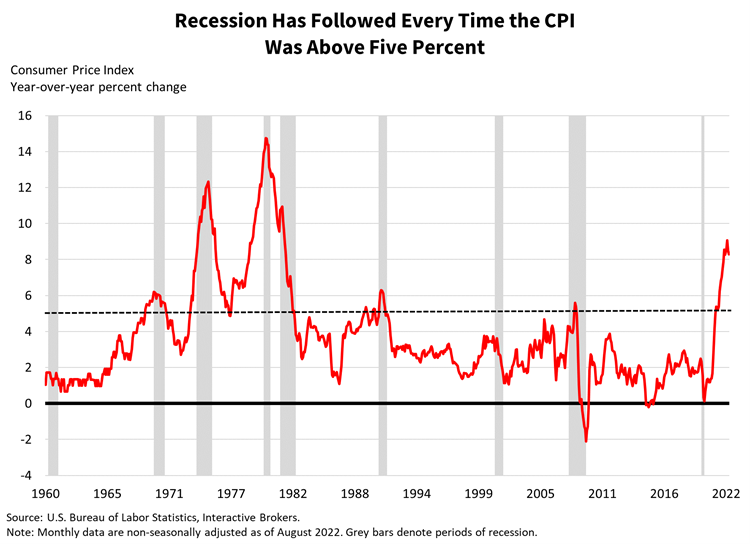

Slowing consumer spending, decades-high inflation, weak productivity and tighter financial conditions have sparked growing concerns about a potential recession. In my view, an economic downturn is likely in 2023 due to the difficulty in achieving a soft landing in general. Achieving a soft landing with inflation above 8 percent will prove even more challenging. The Federal Reserve (Fed) seeks to topple high inflation caused by excessive liquidity and broad structural shifts via higher interest rates and liquidity withdrawals. Unlike recent recessions during which inflation was moderate and the Fed was able to pivot to an accommodative posture rather quickly, this recession may require the Fed to keep their foot on the brakes longer until inflation comes down to its two percent target, similar to the 1980s. Fighting high inflation while simultaneously keeping economic growth positive is a challenging ordeal that could lead to a prolonged economic slowdown during which corporate earnings would be muted. On a positive note, an economic downturn could have a smaller impact on the workforce than past recessions as labor shortages are likely to persist.

The Fed Acts and the Dollar Strengthens

The Fed’s efforts to cool inflation by draining liquidity from the economy is raising recession flags. It’s increased the fed funds rate from 0.13% to 3.13% just this year and decreased their balance sheet by $206 billion with more to come on both fronts. These actions have contributed to the exchange rate for the US dollar reaching a two-decade high, causing a weakening outlook for US exports and GDP prospects as a result, due in part to international buyers needing to bid with more of their local currency to offset the dollar’s strength. On the plus side, a stronger dollar makes imports cheaper, helping to ease inflationary headwinds in the US in the face of declining global demand.

The stronger dollar also weakens international economies as its strength increases costs for foreign countries and businesses to pay down debt in dollars and buy dollar-denominated assets, including commodities. Capital flight is another factor, as money leaves emerging markets to seek high risk-free yields in the US. The trend can spark a possible contagion that could negatively affect the US economy. In the past, a stronger US dollar has contributed to many different financial shocks including the following:

- The Latin American and Japanese debt crises that persisted throughout the 1980s.

- The Plaza Accord in the mid and late 1980s which sought to reduce the US. trade deficit by devaluing the US dollar.

- The Mexican and Asian debt crises in the 1990s.

- The Euro Debt Crisis of 2009.

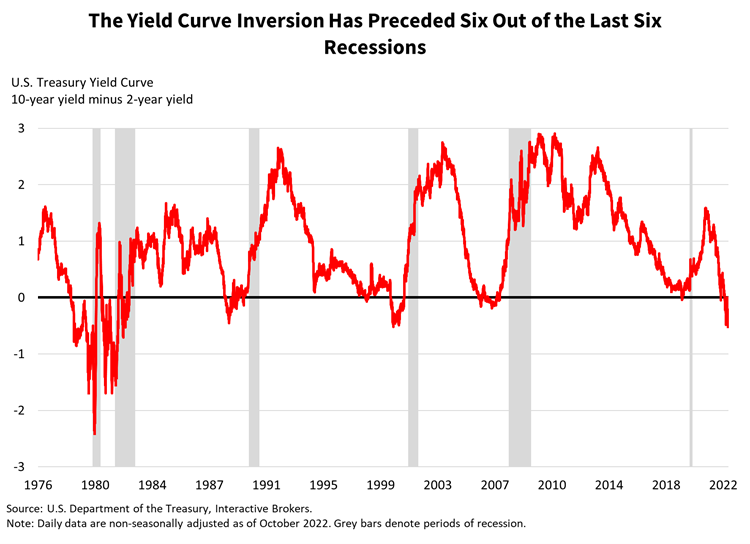

Additionally, the US yield curve is severely inverted across maturities. If history is a guide, the current yield curve suggests that the US economy can’t withstand the current level of financial tightening, with inversions across the 2-year and 10-year Treasuries preceding the last six out of six recessions.

Consumers Struggle with Inflation

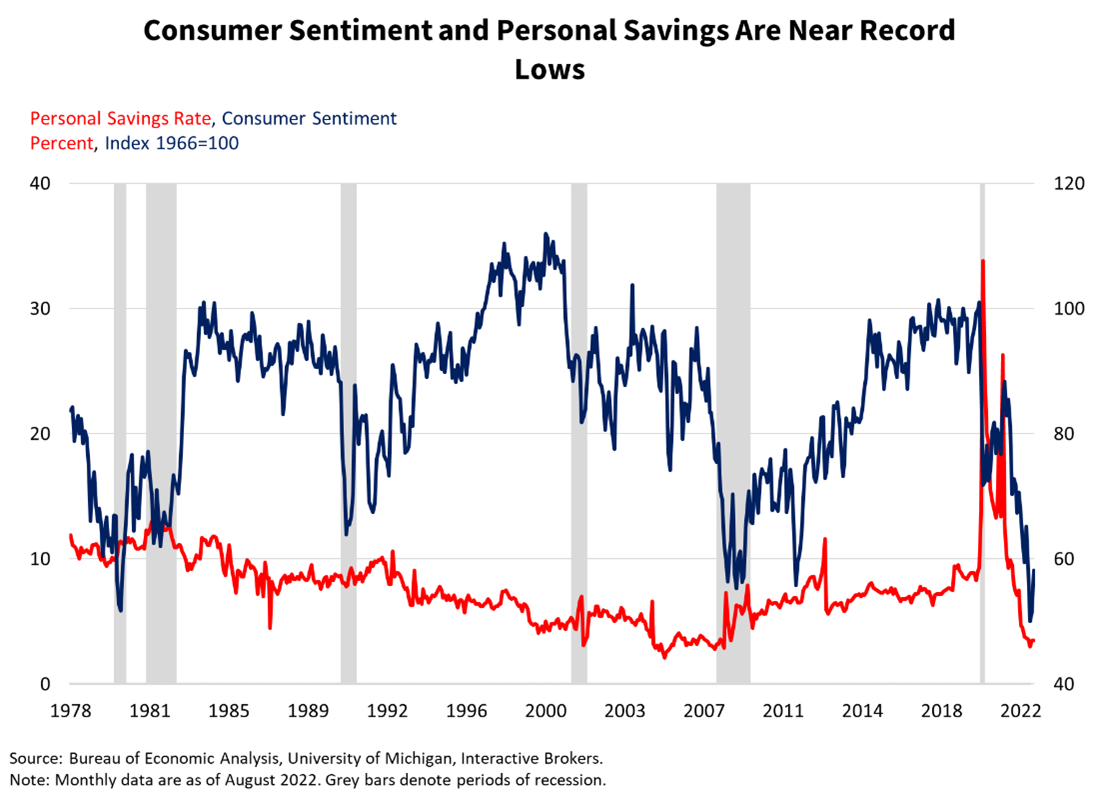

The growth of consumer spending has slowed but remains positive in the face of tightening financial conditions and inflation. Consumer sentiment, savings and spending benefited from increasing values of homes, equities and other assets in 2020 and 2021 as well as unprecedented amounts of fiscal stimulus, which have partially buffered households from economic weakness and inflation. Savings rates and sentiment, however, have retreated to recessionary levels, pointing to further spending contractions in the future.

In some recent months, furthermore, consumer spending hasn’t kept pace with inflation, implying that consumers are feeling the pinch of price increases and buying less.

Credit card debt, meanwhile, has risen to concerning, record-setting levels. As rates continue to rise, consumers will have to allocate more of their budgets toward interest expenses, a particularly troubling concern against the backdrop of a weakening economy.

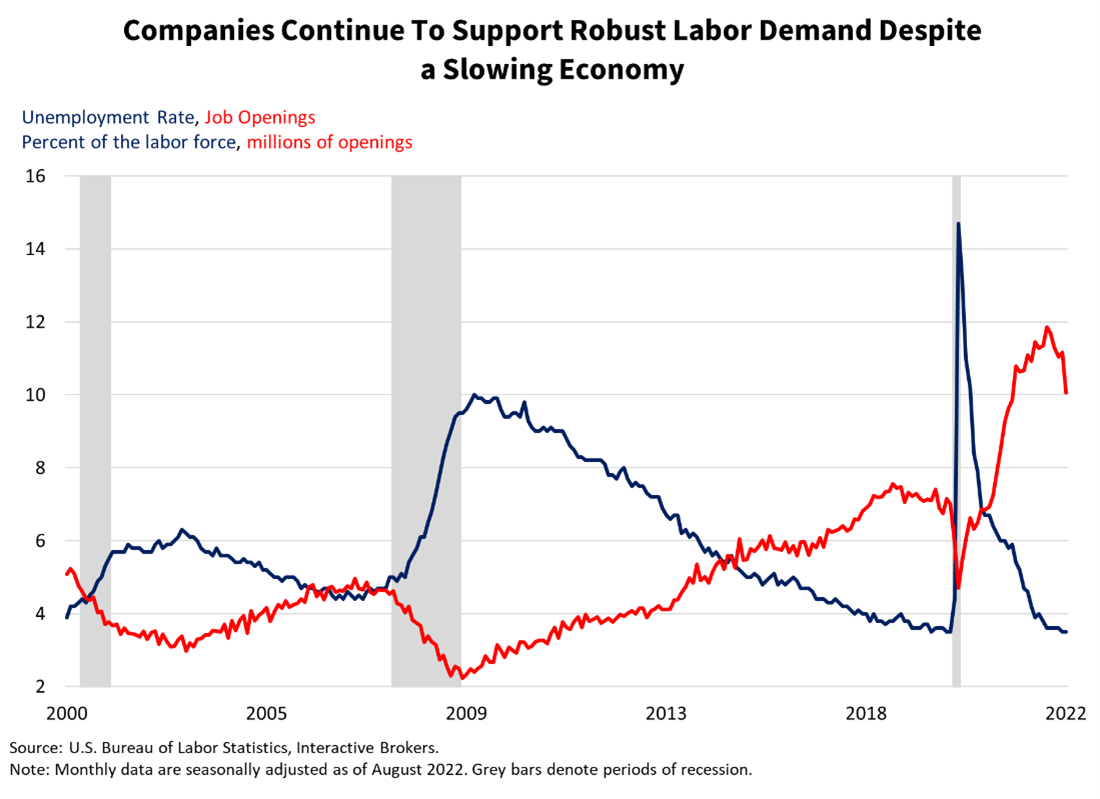

Labor Market Strength Continues

The labor market has been incredibly resilient with strong demand for workers, low unemployment, and wages increasing, albeit at rates that trail inflation. Despite isolated hiring freezes, layoffs and volatile initial unemployment claims data, job openings remain near record-high levels.

Companies want to retain their talent during this labor shortage even if it means compressing margins due to paying higher wages and experiencing declining productivity, which hit its worst level in decades in the first half of 2022.

Strong demand for labor, furthermore, is being supported by wage increases trailing increases in companies’ overall expenses, which provides businesses with an incentive to hire workers.

Like the 1974 recession, the possible upcoming recession may include job growth. Over the years, we have become accustomed to associating recessions with long-lines of workers seeking employment outside businesses, like during the Great Depression. A potential recession this time, however, is likely to have plenty of jobs.

Manufacturing and Real Estate Flash Warnings

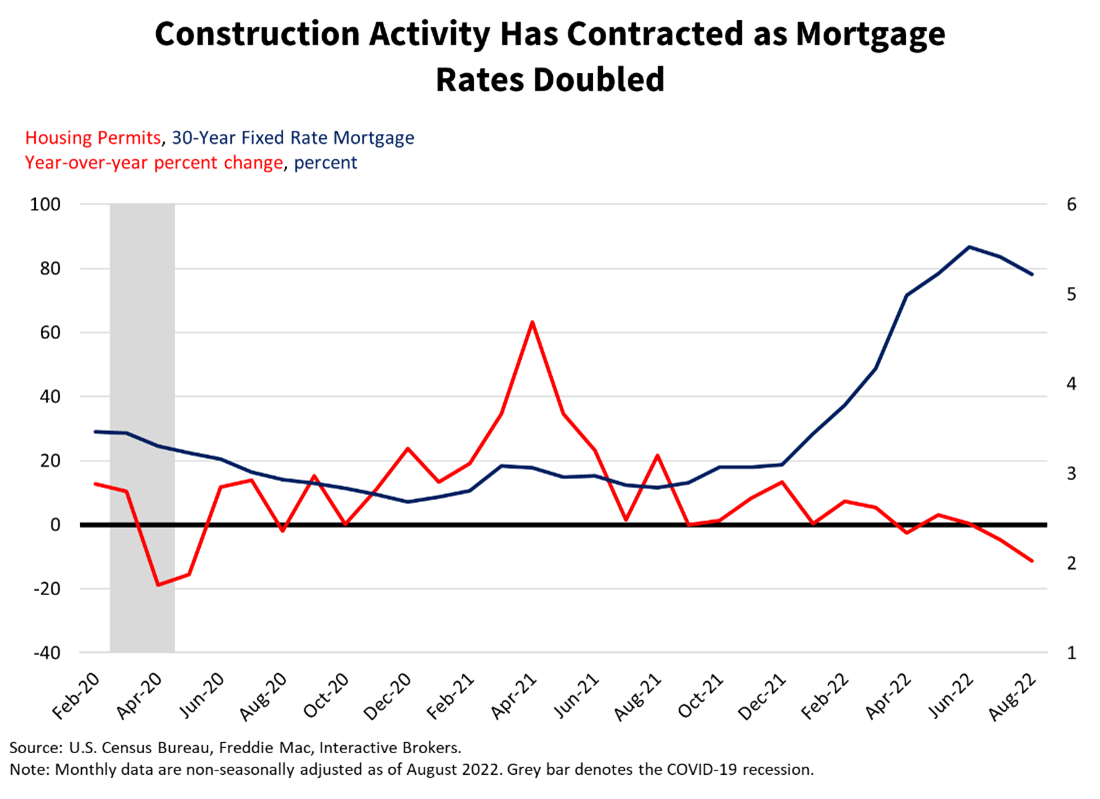

The capital intensive and interest rate sensitive manufacturing and real estate sectors provide powerful leading signals of the economy’s future trajectory. In real estate, the drastic rise in interest rates has plunged affordability to its worst level in history.

Buyers are nowhere in sight with mortgage applications and sales down significantly from normal levels. Builders’ perception that homebuyer demand has weakened has caused a sharp decline in construction, a traditionally significant contributor to economic activity. While manufacturing has weakened as well, it has fared better than real estate. New orders have hovered in and out of contraction territory, while backlogs are still present alongside rising inventories, pointing to supply chain inefficiencies and reduced demand, negative for GDP prospects.

A Persistent Inflation Outlook

Inflationary risks persist. In the short term, increasing wages and higher residential rents are likely to keep pressure on services sectors such as shelter, dining, travel and leisure. The labor shortage contributed to businesses raising their wages to attract qualified workers, pressuring final prices for services. Declining housing affordability and a tight labor market are supporting rental demand for homes as potential buyers are priced out of the for sale real estate market and pushed into the rental market. This trend has caused a significant increase in rental rates.

Stressed supply chains, worker shortages and rising oil prices are likely to keep price pressures on goods, food and energy. In the medium to long term, factors supporting higher inflation rates include the following:

- The shift from globalization toward regionalization as US companies onshore operations to gain better control over their supply chains and manufacturing.

- Geopolitical tensions, including Russia invading Ukraine, Chinese lockdowns, uncertainty over Taiwan, OPEC, Iran, North Korea.

- Inefficiencies regarding supply chains and the commodity complex.

- Continued deficit spending.

- Labor shortages.

Outlook for Corporate Earnings

With high inflation, rising interest rates and a strong dollar, corporate earnings may be muted. Corporations will have to choose between raising prices in order to pass higher input costs on to customers, which could challenge sales volumes, or sacrifice gross margins by avoiding price increases. Higher interest rates, a stronger dollar and a continued consumer slowdown, furthermore, are additional headwinds weighing on both revenues and earnings for businesses. From a historical perspective, corporate earnings shrink during recessions and equity valuations retreat during inflationary episodes. Equity valuations have already contracted significantly this year; however, earnings expectations are expected to grow in 2023 according to the analyst community, implying that investors haven’t fully priced in a possible recession.

Monetary Tightening for the Long Haul?

The Fed is likely to raise its fed funds rate to 4.63% percent and keep the rate somewhat steady until inflation declines to the central bank’s 2% target. The action would be part of the Fed striving to fulfill its dual mandates of price stability and maximum employment. Current labor market tightness provides the Fed with a buffer to keep credit conditions tighter for an extended period as the mandate of price stability dominates the monetary policy debate.

Unfortunately, recession is the likely outcome in 2023 as the economy can’t handle the drastic shift from abundant liquidity and low rates to scarce liquidity and high rates. The dynamics of the current economy; however, point to a recession characterized by affordability pressures for consumers, declining asset prices and declining corporate investment, not significant unemployment.

Watch Videos About Key Economic Indicators at Traders’ Academy – Click Here

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!