Investors are fearful that higher yields will hurt equities. But some regions and sectors may absorb the impact better than others.

The Federal Reserve recently indicated it will start reducing the pace of its monthly bond purchases and half of the members of its Open Market Committee now expect to raise interest rates in 2022.

This has made some investors nervous as tighter monetary conditions could result in substantially higher US bond yields and potentially lower equity valuations.

The 10-year US Treasury yield is the global benchmark discount rate frequently used to calculate the present value of future cash flows of financial assets. So, most equity markets will exhibit some sensitivity to changes in this rate.

However, not all markets are likely to respond in the same way. Some regions and sectors stand to benefit from rising bond yields, while others could lose out.

Investors who have the flexibility to tactically adjust their global asset allocation should take note of these differences.

Not all yield rises are equal

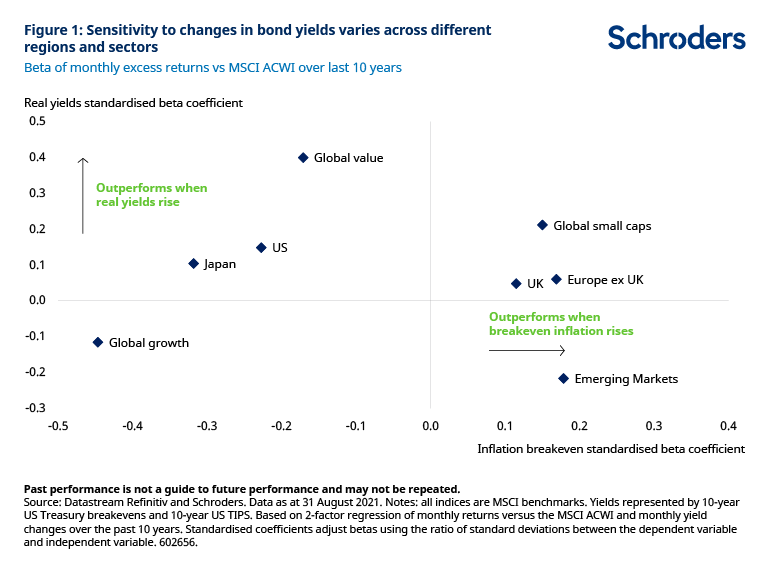

Bond yields can be approximately decomposed into a real (inflation-adjusted) interest rate and expected inflation. Each component can influence the direction of stock prices in different ways. This is illustrated in Figure 1.

For example, over the past 10 years, an increase in inflation expectations, as measured by the yield difference between nominal and real US 10-year Treasuries, has been on average associated with strong emerging market equity outperformance versus the rest of the world (i.e. MSCI All-Country World Index).

This should be intuitive, as low and rising US inflation tends to reflect improving global growth prospects, which are typically supportive for export-oriented regions such as EM.

However, if higher yields are driven by real rates, it could foreshadow tighter monetary policy and lead to higher borrowing costs. This would tend to hurt EM companies because many borrow in US dollars.

In contrast, value stocks tend to outperform the most when real yields are rising, while growth stocks tend to underperform.

This happens because value stocks are generally shorter “duration” and therefore less sensitive to changes in real yields compared to growth stocks.

This is because the expected cash flows of growth stocks extend further into the future, so are more vulnerable to changes in the discount rate used to calculate their present value.

Although it is worth highlighting that the experience of the past 10 years looks like an outlier compared to the long-term history and therefore cannot be guaranteed to continue (see our previous research).

Global small caps, European equities and UK equities tend to outperform regardless of whether rising yields are a function of expected inflation or real rates, but the magnitude varies.

Rising yields tend to be most positive for cyclicals

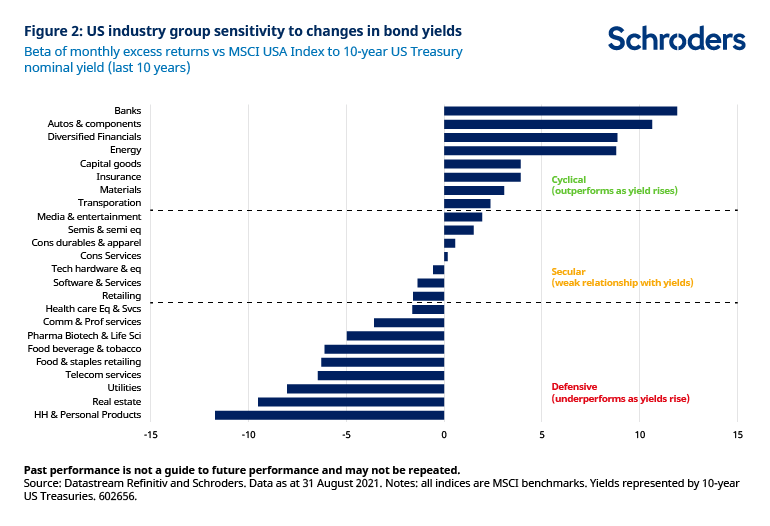

The prospect of higher bond yields also has implications for different industry groups.

Cyclical industries generally outperform the broader market when economic growth strengthens and yields rise, while defensive industries outperform when economic growth weakens and yields fall.

This pattern can be observed in Figure 2. For example, banks, energy and materials have historically outperformed when yields have increased.

On the other hand, food, telecoms and utilities have tended to underperform.

Some industries, however, exhibit a weak relationship with yields and therefore perform roughly in line with the market average when bond yields are rising.

Our further analysis has found that most industries also carry similar directional sensitivities to both inflation and real rates.

Selective equity exposure is key going forward

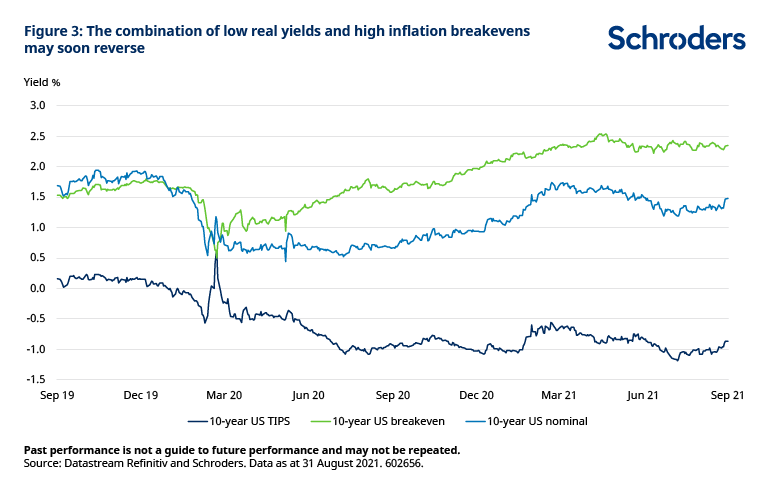

The Fed’s hawkish shift in tone signals a potential reversal in the benign combination of low real rates and higher inflation breakevens that has been so positive for equities during the Covid-19 crisis.

As markets price a reduction in liquidity, we could see upward pressure on real bond yields. Inflation breakevens may also fall as fears over a sustained inflation overshoot subside.

Our previous analysis suggests that this scenario could create both winners and losers.

Cyclical industries such as financials and energy should continue to do well amid higher real yields, while more defensive industries should underperform.

However, the broader value versus growth trade could stall as falling inflation expectations are generally more negative for value than higher real rates are for growth (and vice versa).

At the regional level, higher real rates coupled with lower inflation breakevens appear to be the worst possible outcome for EM equities.

Meanwhile, US and Japanese equities are poised to outperform given their positive beta to real yields and negative beta to inflation breakevens.

To be clear though, this assumes other economic variables remain constant, which in practice is rarely the case.

Given the high weight of financials, it’s possible that UK and European equities could also perform well.

For example, financials represent 18% of the MSCI UK Index, 15% of the MSCI Europe (ex UK) Index but only 11% of the MSCI USA Index.

It could be a tight race ahead.

—

Originally Posted on October 7, 2021 – Which Stock Markets Are Most Sensitive to Rising US Bond Yields?

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!