The past week and a half has been especially turbulent for US Treasury futures. The failure of Silicon Valley Bank was due to a massive loss on the sale of $21 billion in bonds, most of which were Treasury securities. As risk anxiety spread from the US banking sector around the globe, expectations for upcoming Fed rate hikes were dialed back, and this sparked a massive rally in the Treasuries.

US Treasuries holdings saw a huge increase during the first half of 2020 when COVID shut down the US economy. As of Wednesday, there were roughly $31.459 trillion held. Of that amount, $6.805 trillion were considered intergovernmental holdings, which is debt that the US government owes to its own agencies, such as the Social Security Trust Fund or FDIC Deposit Insurance. This leaves $24.654 trillion considered debt held by the public.

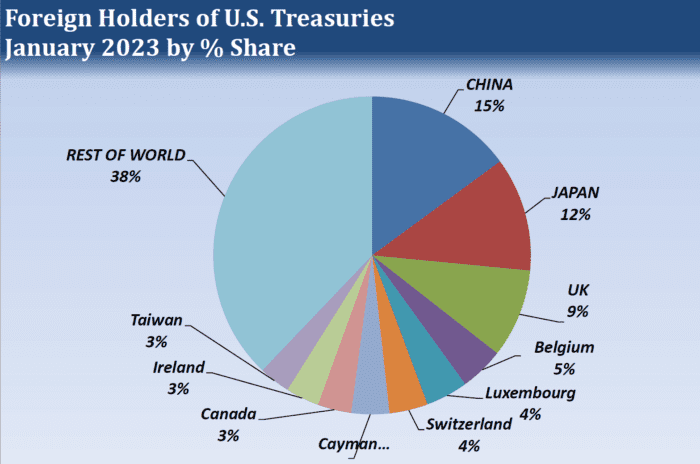

The Treasury Department’s monthly Treasury International Capital report, more commonly known as the TIC report, shows the major foreign owners of Treasury securities. The report released this week showed foreign Treasury holdings at the end of January at $7.402 trillion. This was an $83.8 billion increase from December but a $253.4 billion decline from January 2022.

When the TIC reports are released, the market usually focuses Chinese and Japanese holdings, as both nations hold large amounts in US Treasuries. Chinese holdings fell last month, and they have declined in 13 of the last 14 readings. Japanese holdings showed a moderate increase in January and reached a four-month high. Together. China and Japan accounted for 27% of foreign Treasury holdings in January, down from 41% in January 2013.

Treasuries should continue to see safe-haven inflows during times of risk anxiety, but the upward trajectory of Fed interest rates over the past year has encouraged foreign investors to reduce their holdings. This factor could intensify the market’s focus on the FOMC’s economic forecasts and post-meeting comments this coming Wednesday. If the Fed maintains its hawkish tone, we could see a further decline in foreign holdings, which could extend the turbulent price action into the second quarter.

—

Originally Published March 17, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!