Last week we were bearish toward bonds, but we now shift our view in favor of the bull camp. We have altered our opinion because of a developing trend of slackening US and Chinese economic data. We think the slowing trend has been accentuated by a lack of workers willing to take jobs, resulting in restaurants closing or reducing hours, among other things.

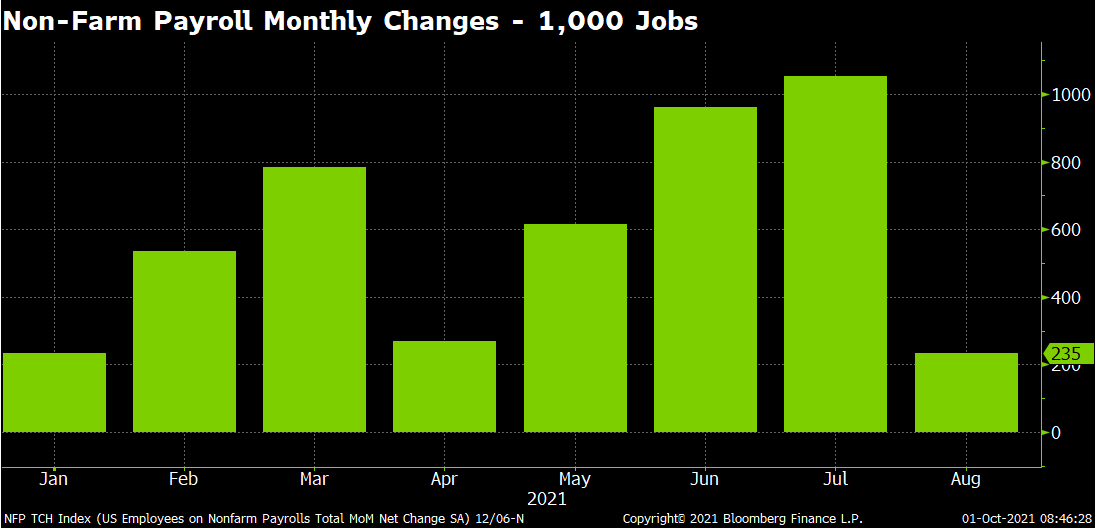

The September non-farm payrolls report could be a major inflection point for all the markets, with a disappointing result potentially seen as a reason for the Fed to push back its tapering plans. And while the Treasury markets did show a lack of resiliency in the wake of a third straight week of increases in initial jobless claims and massive equity market losses, soft economic numbers are stacking up, and inflation measures have moderated, and the Fed decision to taper before the end of the year is being called into question.

The technical picture also seems to benefit the bull camp, as the declines in the past two weeks have been massive and concentrated. The most recent Commitments of Traders report showed a spec and fund net short of 108,752 contracts for Treasury Bonds, the largest net short since July.

—

Originally Published on October 1, 2021

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Margin Trading

Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!