AT A GLANCE

- As sustainable investments grow, so too does the need for risk management solutions that are tailored to ESG criteria.

- New regulations in the EU are driving asset managers to consider investment criteria in more detail to ensure it’s both beneficial to portfolios and suitably sustainable.

In the aftermath of the crucial COP26 climate talks and with key sustainability targets becoming more of a priority, Environment, Social and Governance (ESG) criteria have moved to the forefront of fund managers’ decisions, meaning that risk, reward and sustainability are now the three key considerations for fund managers.

As sustainable investments grow, so too does the need for risk management solutions that are specifically tailored to ESG criteria. Although approaches to sustainability are many and varied, the investment industry will need to coalesce around a few core benchmarks that are capable of attracting sufficient liquidity to make risk management straightforward and economic. They will also need to fit with the required ESG credentials of regulators and investors.

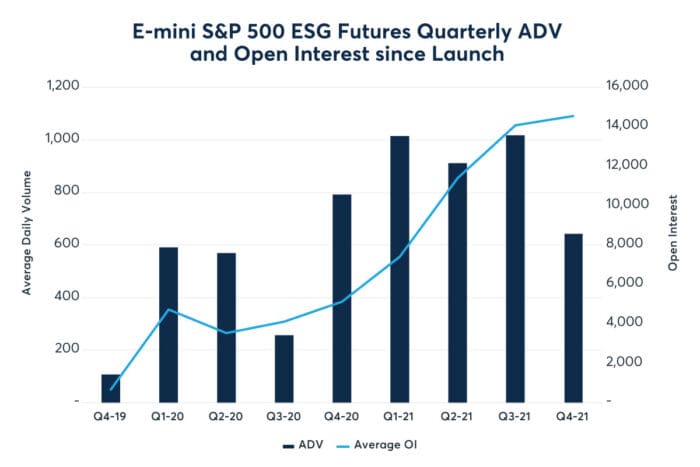

The obvious place for the market to turn to is specialised ESG versions of existing, highly successful and highly liquid benchmarks. For example, the S&P 500 index is perhaps the world’s most widely quoted index. Its ESG version – the S&P 500 ESG index – has a 5-year tracking error against the S&P 500 index of just 1.06%. As a result, the S&P 500 ESG index has emerged as a leading candidate to provide a general benchmark for the ESG investment sector that is backed by a deep, liquid futures market. The leading methodology has also been used in the recently launched S&P Europe 350 ESG Index and provides a template for a more standardized, holistic approach to ESG investing across the globe.

More Demand for ESG

ESG investment accelerated in 2020. Even during the initial COVID-driven equity sell off, sustainable based funds saw record amounts of inflows while nearly all other asset classes saw significant outflows.

This won’t be enough though. New regulations, such as the EU Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomies, are creating demand for more products and driving asset managers to consider investment criteria in more detail to ensure it’s both beneficial to portfolios and suitably sustainable.

For fund managers, derivatives will continue to play a role in financial transactions by reducing credit and market risk, which will not change under new ESG principles. Derivatives can support risk management related to climate change and this trend will only continue as the underlying markets develop.

The careful use of derivatives allows firms to manage specific risks related to ESG factors. They allow funds to meet target allocation in a more cash efficient way than investing directly in the underlying stocks – potentially enabling more capital to be channelled towards sustainable investments.

Transition to a More Sustainable Economy

Having a few core benchmark products around indices that meet the requirements of SFDR and are Article 8 compliant should attract sufficient liquidity pools and create price transparency, that in turn will allow ESG strategies to be efficiently implemented, which will help the transition to a more sustainable economy.

With concerns around greenwashing, best expressed by regulatory developments such as SFDR, having a market for liquid instruments that meet the more strenuous requirements for ESG investing is crucial.

Since private capital will need to be mobilized to meet the needs of the various global green initiatives; from the 2030 Agenda, the European Green Deal or the Ten Point Plan for Industrial Green Revolution in the UK, and new regulations, such as SFDR and the EU Taxonomies, it is expected that ESG derivatives will play a greater role in the following years. It’s essential now that the market rallies around core liquid products with high ESG standards to avoid devaluation of a pivotal sector of the markets and the future of the economy.

—

Originally Posted on November 18, 2021 – Risk, Reward and Sustainability: Future Proofing the ESG Economy

OpenMarkets is an online magazine and blog focused on global markets and economic trends. It combines feature articles, news briefs and videos with contributions from leaders in business, finance, economics and politics in an interactive forum designed to foster conversation around the issues and ideas shaping our industry.

All examples are hypothetical interpretations of situations and are used for explanation purposes only. The views expressed in OpenMarkets articles reflect solely those of their respective authors and not necessarily those of CME Group or its affiliated institutions. OpenMarkets and the information herein should not be considered investment advice or the results of actual market experience.

Neither futures trading nor swaps trading are suitable for all investors, and each involves the risk of loss. Swaps trading should only be undertaken by investors who are Eligible Contract Participants (ECPs) within the meaning of Section 1a(18) of the Commodity Exchange Act. Futures and swaps each are leveraged investments and, because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles and only a portion of those funds should be devoted to any one trade because traders cannot expect to profit on every trade.

BrokerTec Americas LLC (“BAL”) is a registered broker-dealer with the U.S. Securities and Exchange Commission, is a member of the Financial Industry Regulatory Authority, Inc. (www.FINRA.org), and is a member of the Securities Investor Protection Corporation (www.SIPC.org). BAL does not provide services to private or retail customers.

In the United Kingdom, BrokerTec Europe Limited is authorised and regulated by the Financial Conduct Authority.

CME Amsterdam B.V. is regulated in the Netherlands by the Dutch Authority for the Financial Markets (AFM) (www.AFM.nl).

CME Investment Firm B.V. is also incorporated in the Netherlands and regulated by the Dutch Authority for the Financial Markets (AFM), as well as the Central Bank of the Netherlands (DNB).

Disclosure: CME Group

© [2023] CME Group Inc. All rights reserved. This information is reproduced by permission of CME Group Inc. and its affiliates under license. CME Group Inc. and its affiliates accept no liability or responsibility for the information contained herein, including but not limited to the currency, accuracy and/or completeness of this information, and delays, interruptions, errors or omissions. This information is an unofficial copy and may not reflect the official and accurate version. For the definitive and up-to-date version of any of this information, please see cmegroup.com.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from CME Group and is being posted with its permission. The views expressed in this material are solely those of the author and/or CME Group and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!