Despite soaring “traditional” energy prices, the long-term drivers of demand for renewables, storage and EVs are only getting stronger.

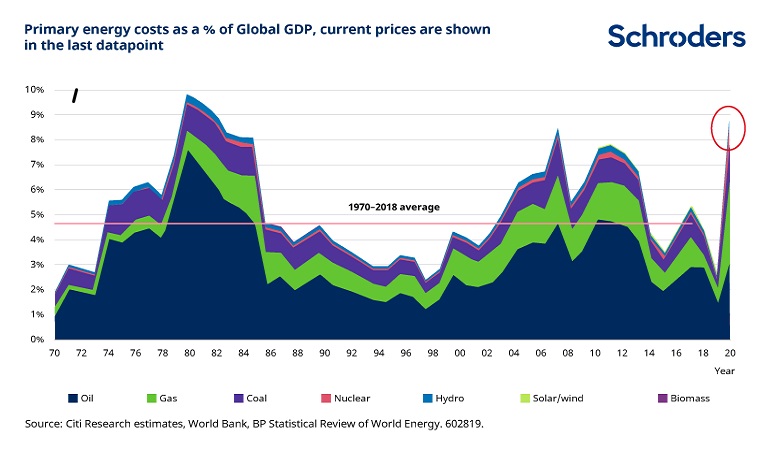

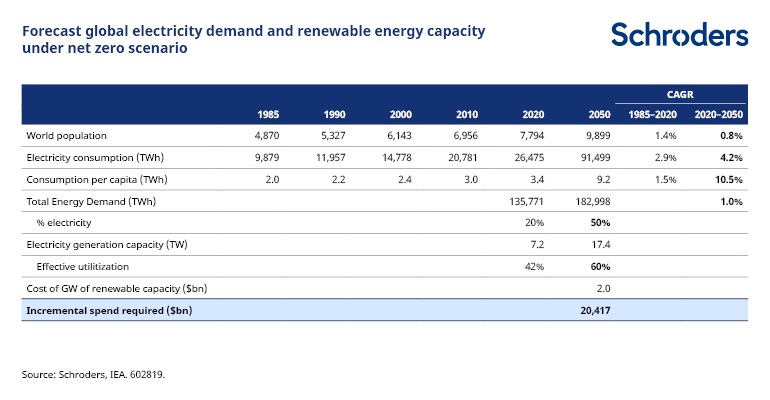

The global economy is currently facing an acute energy shortage, with oil, gas, coal, and power prices around the world rising to all-time highs. The situation is perhaps best summarised by the chart below. It highlights the combined cost of energy sources as a percentage of global gross domestic product (GDP).

After a sharp and rapid rise, primary energy costs (which includes oil, gas, coal, nuclear, hydro, solar/wind and biomass) have more than doubled to 8% of GDP, historically a very challenging level for the global economy.

When examining the implications of the current energy crisis on the battle to mitigate climate change, it is important to understand what has caused this problem.

Most major economies are now almost fully open following Covid-19 lockdowns in 2020 and early 2021. The reopening of manufacturing industries and the resumption of travel has led to a strong rebound in global demand for energy.

Although there has not been a large supply shock, a number of long-term factors have led to a reduction in the supply of fossil fuels. The first factor is the collapse in oil prices in 2014, when oil fell from $100-$120 to a new range of $40-$60 in the subsequent years. This led to a significant cut in oil and gas related capital investment, with many projects being shelved or cancelled.

While that may seem like a long time ago, it is only now that this reduction in investment is being felt. For example, there are very few new large global gas fields being brought onstream in the next two to three years, meaning that constraints on gas supply are here to stay for that long at least.

More recently, much greater focus within the investor and banking communities on the financing of fossil fuels is also reducing investment and beginning to be a factor in reduced availability of fossil fuels.

And finally, there have also been some temporary factors such as low wind speeds in parts of Europe this summer which have driven up prices. However, these are not the main drivers of the current energy shortage which is global in nature.

There are many significant implications of the current situation:

Short term focus on keeping the lights on

In the short term, governments and policy makers are going to be prioritising keeping the lights on and prices under control. China has recently asked its domestic coal miners to ramp up extraction to help mitigate the current energy shortages and has imposed energy rationing in several provinces. European authorities have introduced consumer subsidies, price caps, and profit clawbacks from some power generators to help fund consumer support programs. So, there is an immediate consequence that some climate priorities take a back seat to citizens’ more immediate concerns.

However, there have also been several encouraging policy signals. China is not abandoning any of its longer-term targets to decarbonise. In the UK, the government has sought to highlight the fossil fuel squeeze as to accelerate the transition to renewable energy.

- Read more: What is COP26?

And in the European Union, despite pressure from some parties the European Commission has said it is not going to intervene in the carbon market (which, in any case, is not causing the energy crisis) to reduce carbon prices. Commission Vice-President Frans Timmermans said in a recent speech that social unrest around energy prices will pale in comparison to the unrest we will see if we don’t address climate change.

Growth shock

A rise in primary energy costs of the magnitude shown above will have a major impact on global economic growth in the future. The longer energy prices stay where they are, the greater the impact as demand is rationed and production curtailed.

Corporate margin pressures and supply chain disruption

While manufacturers have been struggling with component shortages and rising logistics costs all year, the disruption is getting worse. China is now facing power cuts in many provinces, which is cutting production of key components and materials that the world’s supply chains depend on.

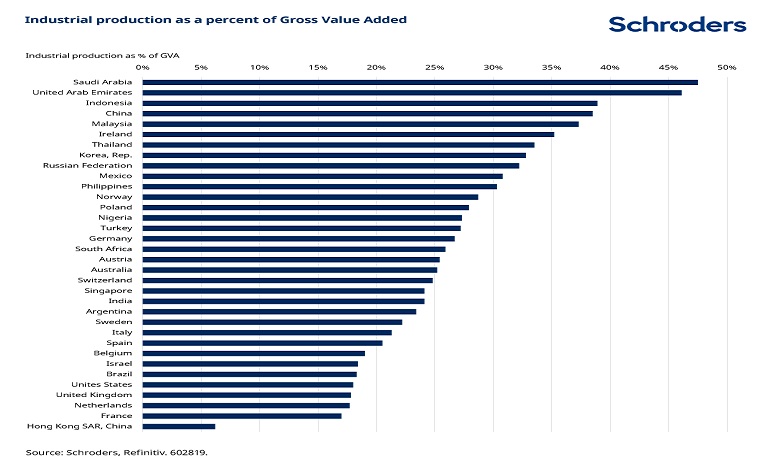

It is currently unclear how widespread the production disruptions will be, but more and more companies are facing cancellations in deliveries as suppliers declare force majeure. This is likely to affect manufacturing-focused economies most significantly, with important economies such as China, South Korea and Germany quite exposed.

Navigating this exceptionally challenging environment is already beginning to highlight which companies have invested in building resilient supply chains and have good relationships with suppliers, and we can expect material accidents ahead for companies that have focussed solely on cost in their supplier relationships.

- Read more: What makes a company a climate leader?

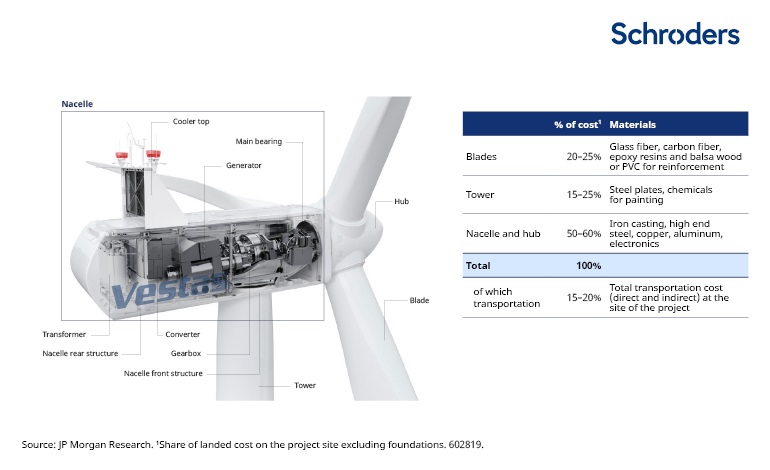

Clean energy projects are also exposed to the disruption, and in some respects are in the eye of the storm. A new wind or solar project requires a lot of electronics, copper, steel, and large-scale logistics, all of which are experiencing shortages and big price increases. JPMorgan Research has broken down the production costs of a wind turbine, as illustrated in the chart below. With significant inflation in all these production elements, manufacturing costs have probably increased by more than 20% in the last 12 months.

Some of these higher costs must be absorbed by manufacturers such as Vestas and we believe that there will be more downgrades to profitability for wind and other renewable manufacturers in the coming year. Some of the higher costs will have to be passed on to customers too, and we expect an increasing number of projects to be delayed, with costs over running. This will reduce the planned return on investment for the developer and asset owner.

Crisis could be a crucial catalyst for increased investment in climate infrastructure and renewables

Soaring fossil fuel commodity prices and related power generation costs are providing a critical lesson that the price of fossil fuel energy is inherently unstable and volatile. Renewable energy, by contrast, when combined with energy storage for reliability, is a much more stable priced form of energy. This is because the operating costs are very low, with no fuel to burn, so the price of energy produced by a wind or solar farm is the product of the project capital cost, average wind or solar energy input, and the useful life of the equipment.

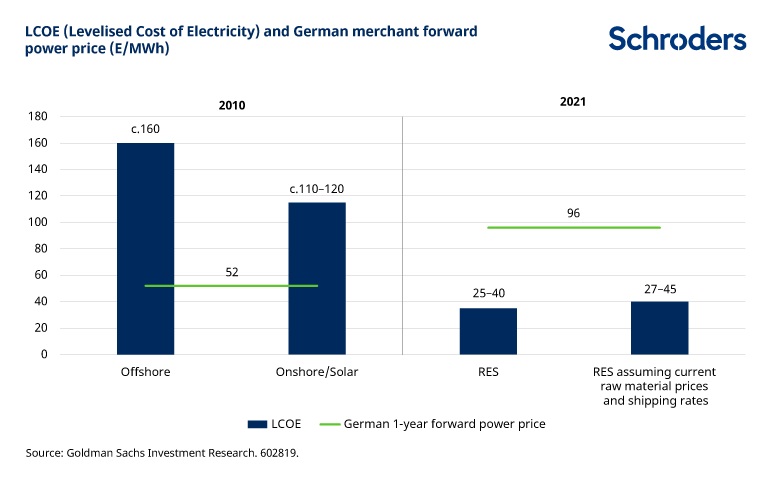

While the construction costs of renewable energy are going up, they are not rising nearly as much as the costs of power generated by fossil fuel, and as such the future economic competitiveness of renewables is improving dramatically. To illustrate this point, Goldman Sachs recently published research into the European power generation sector comparing the levelized cost of electricity between new renewable energy and the current wholesale power prices in Europe.

It is also for this same economic reason that residential solar and coupled battery storage are booming in places such as the US, as in return for their investment homeowners get a significant source of independent, relatively fixed price electricity. If you were a company facing soaring energy costs or enforced curbs on production, wouldn’t it make sense to sign a 20 year, fixed-price renewables power purchase agreement (PPA) to mitigate the business risks posed by the volatile energy market?

These same calculations will likely be done at a national level. And as renewables are a deflationary force on power generation costs, we believe there will be a boom in renewable power with connected battery storage in the coming years.

The pace of the clean energy transition is not happening fast enough

Followers of climate science already know this, as little progress has been made to reduce global greenhouse gas (GHG) emissions. However, there is a critical lesson in the current crisis which is forcing many countries to turn back to coal to keep their lights on. The reason is that weaning ourselves off fossil fuels is now understood to require a wholesale electrification of energy use, across mobility (EVs), industry, and building management (heat pumps).

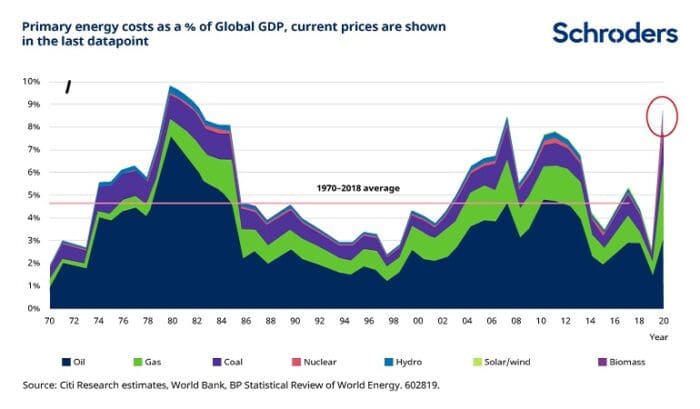

The International Energy Agency (IEA) has published forecasts for electricity demand under the net zero scenario in which electrification plays a key role. The table below highlights this, where despite slowing population growth, electricity consumption is forecast to grow by 4.2% per year and electricity’s share of final energy demand increases from 20% to 50%. This shift would require approximately $20 trillion in incremental investment just to build out the generation capacity, excluding the related infrastructure and supply chain.

Moving to electrification from combustion so widely is going to drive growth in demand for power. A region such as Europe is likely to require three times its current power generation by 2050 to meet its’ decarbonisation goals.

If we are not even building enough renewable power generation to reduce dependency on fossil fuels in a normal economic recovery environment, how can we possibly hope to achieve this goal? The pace of renewable construction needs to at least double and probably treble. Perhaps the current crisis is the catalyst required for enough decision-makers to realise that.

We believe disruption and profitability challenges will be significant over the next 6-12 months right across the climate infrastructure value chain. However, the longer-term economics and drivers of demand for renewables, storage, EVs, and the infrastructure and software that support these enabling technologies are only being strengthened by the current energy crisis.

For investors, we believe the current uncertainty and disruption may provide opportunities across all parts of the low carbon economy value chain.

—

Originally Posted on October 27, 2021 – Is the Energy Crisis Bad for Climate Change Investors?

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!