As rates moved higher and steepening yield curves provided a powerful positive windstorm for bank profitability in 2021, the more subordinated parts of the bank’s capital structure such as AT1 CoCos1 experienced spreads tightening and strong performance year-to-date. In a period of rising bond yields investors typically seek solace in higher yielding debt, such as high yield. During periods of large moves in bonds yields, the AT1 CoCos asset class has historically shown to outperform not only investment grade corporates but high yield as well2. With credit spreads between investment grade and high yield bonds sitting at a multi-year low,3 investors have increased their allocations to less conventional fixed income asset classes in search for yield. Meanwhile, investors are increasingly looking for corporate issuers with good credit fundamentals that could potentially withstand the bumpy road ahead. In this blog, we will explore the results of the most recent 2021 European-wide bank stress tests and how sustainable investing is pushing the banking sector to become accountable for their compliance of commonly accepted international norms.

EU banks pass the test

Positive developments within the macro environment have continued to provide support for European banks, who in the eyes of the European Central Bank (ECB) demonstrated resilience under the 2021 European-wide stress tests. The 89 banks participating in the stress tests would see their Common Equity Tier 1 (CET1) capital ratio fall by an average of 5.2%4 if they were exposed to a three-year stress period marked by challenging macroeconomic conditions5. As indicated by the ECB, the ECB stress test includes 38 banks from the European Banking Autority (EBA) stress test plus another 51 medium-sized ECB supervised banks representing more than 75% of aggregate banking assets within the euro area. The result has provided some comfort to investors in the AT1 CoCo market given that the CET1 ratio is associated with the trigger ratio for the asset class and is considered a key measure of a bank’s financial soundness6.

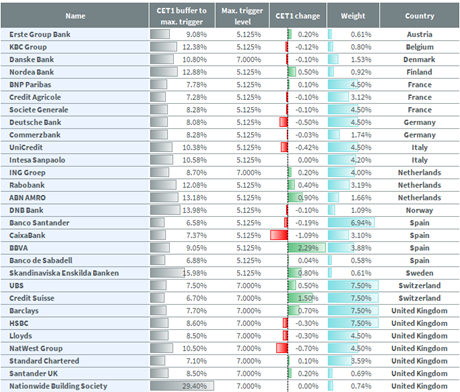

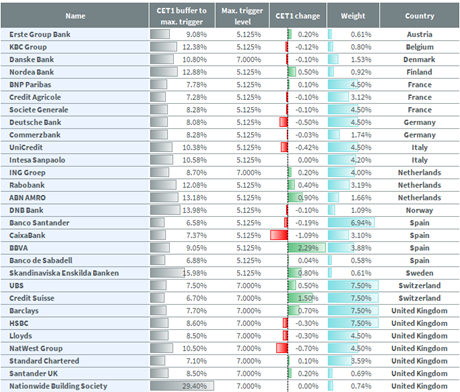

Digging into the bank issuers within the AT1 index7, the banks’ CET1 ratios continued to show a buffer to their maximum trigger ratio for their respective AT1 CoCos. Nationwide Building Society, who typically issues AT1 CoCos in Sterling, lead the pack with the highest buffer. Refer to figure 1.

Figure 1: Bank level overview of CET1 ratios buffer to maximum trigger7

Source: WisdomTree, Markit, Bloomberg, respective issuers financial results. Refer to footnote 7 for details.

You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

Sustainable investing for banks

Many investors are now keen on environmental, social and governance (ESG) screens to help bring investors’ interests in line with their investment allocations. The mind shift, led by the pandemic, in the fixed income space has resulted in investors looking to refresh their portfolios with more ESG friendly solutions. But what could this mean for the banking sector? While ESG screens are typically more difficult to assess for the banking sector, one aspect that does have an impact is assessing a bank’s compliance with United Nations Global Compliance principles (UNGC). As characterised by one of the large ESG rating agencies, Sustainalytics, an issuer is classified as breaching UNGC principles when it is found to be “responsible for egregious and severe violations of commonly accepted international norms related to human rights, labour rights, the environment and business ethics”8. The anti-corruption UNGC principle for example requires businesses to work against corruption including extortion and bribery. This is a step in the right direction towards bond investors holding banks accountable for their policies.

Sources

1 AT1 CoCos represents Additional Tier 1 Contingent Convertible Bonds

2 WisdomTree, Bloomberg, considering the moves in 10 year US Treasury yields during Trump reflation trade period from 31 October 2016 to 15 December 2016, the Synchronized Growth period from 31 August 2017 to 17 May 2018 and the most recent pandemic moves noted from 4 August 2020 to 31 March 2021. All indices are total return and USD-hedged indices. Calculations include backtested data. The iBoxx Contingent Convertible Liquid Developed Europe AT1 Index (USD Hedged) started its live calculation on 09 March 2018. AT1 CoCos are represented using the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index. Global High yield represented using the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index. Global Investment Grade Bonds represented using the Bloomberg Barclays Global Aggregate Credit Index. Global Aggregate Treasuries represented using the Bloomberg Barclays Global Aggregate Treasuries Index. Historical performance is not an indication of future performance and any investments may go down in value.

3 WisdomTree, Bloomberg, as of 2 September 2021. Credit spread is represented using the option adjusted spread for high yield cash bonds minus investment grade cash bonds for each respective region You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

4 The stress tests would fall on average from 15.1%,to 9.9%

5 European Banking Authority, dated 29 January 2021, https://www.eba.europa.eu/eba-launches-2021-eu-wide-stress-test-exercise. European Central Bank, banking supervision website quoted directly from press release on 30 July 2021.

6 European Banking Authority, dated 29 January 2021, https://www.eba.europa.eu/eba-launches-2021-eu-wide-stress-test-exercise. European Central Bank, banking supervision website quoted directly from press release on 30 July 2021.

7 AT1 index is represented using the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index. WisdomTree, Markit, Bloomberg, respective issuers financial results. Data as of 30 June 2021. CET1 change represents value change in CET1 ratios from data available as of 30 June 2021 (generally Q1 2021 available reporting) compared to latest data available as of 22 September 2021 (generally Q2 2021 available reporting). No change may indicate reporting cycle has not ended. The strategy is represented by the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index (AT1 Index). CET1 ratio is the Common Equity Tier 1 Capital ratio reported on a fully loaded basis available on Bloomberg and from the issuer’s latest financial results, if not reflected on Bloomberg. Maximum trigger level is represented by the maximum trigger observed across all CoCo issues of a given issuer. The CET1 buffer to maximum trigger represents the difference between issuer’s CET1 ratio and the maximum trigger level observed across all CoCo issues of a given issuer within the AT1 Index. The sum of “CET1 buffer to maximum trigger” and the “maximum trigger level” is equal to the issuer’s CET1 ratio. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

8 As defined by IHS Markit for bond issuer screening on an index that applies the Sustainalytics Global Standards Screening rules.

—

Originally Posted on October 13, 2021 – EU Banks Pass the Test Now Sustainable Investors Want More

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!