Climate change is a maddenly complex subject. Yet it’s useful to think about in terms of three numbers: 1.2, 1.5 and 2.0.

Despite more than two decades worth of global climate conferences like the COP26 gathering now underway in Glasgow, the world has failed to tap down the growth in greenhouse gases that are heating up the planet and destabilizing weather patterns.

At the COP21 conference in Paris back in 2015, 195 nations signed a landmark agreement to hold the increase in the global average temperature to well below 2°C above pre-industrial levels and pursue efforts to limit that increase to 1.5°C.

Where are we now?

Record Heat

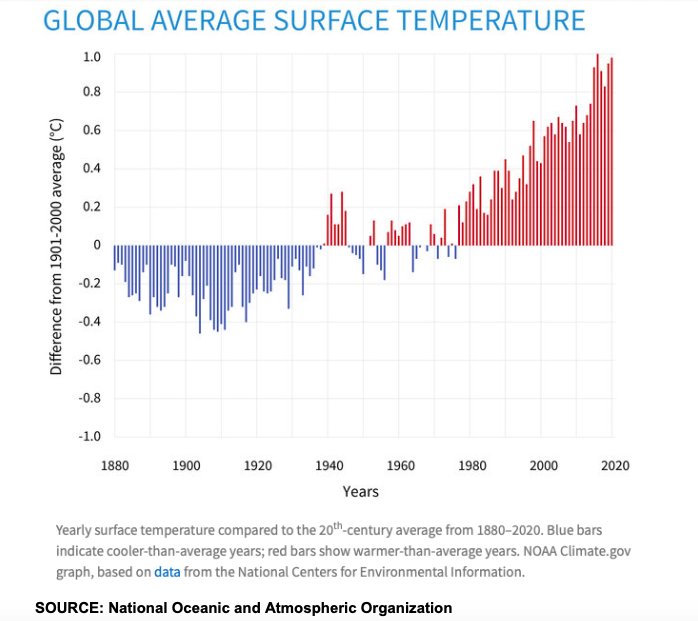

In 2020, one of the warmest years on record, global temperatures hit 1.2ºC (2.2 degrees Fahrenheit) above pre-industrial levels, according to the World Meteorological Organization.

Last year, there were a record number of hurricanes, wildfires and floods amplified by climate change that cost the global economy some $210 billion in damage, data compiled in a report by reinsurance company Munich Re showed.

The climate change price tag in the US hit $95 billion, double the level in 2019, thanks to a record number of Atlantic hurricanes and wildfires in California.

In the first half of 2021, we’ve seen severe heat waves in North America’s Pacific Northwest and historic flooding in Germany.

Climate Stakes

A world that warms to 1.5°C is now considered a pretty aspirational target. Yet even if global economies decarbonized quickly enough to hit that goal, the climate impact would still be negative.

If we slip to 2.0°C or more, the risk of a climate breakdown increases markedly, according to research by climate scientists.

Consider the following: With a 1.5°C increase, extreme hot days in the mid-latitudes of the planet will be 3°C hotter (5.4°F) than pre-industrial levels. A 2°C increase, translates into about 4°C hotter (7.2°F) than pre-industrial levels.

Sea levels are expected to rise by about 0.26 to 0.77 meters (0.85-2.52 feet) relative to the average from 1986-2005 by 2100. If you’re looking at a 2°C increase, sea levels are projected to rise by 2100 by 0.36 to 0.87 meters (1.18-2.85 feet) during the same period.

Takeaway

With an 1.5°C increase, the Arctic Ocean will become ice-free in the summer about once every 100 years. It’s once every 10 years at a 2°C increase.

Managing the tradeoffs between the economic hit of an overheated planet and shifting away from a multi-trillion dollar fossil fuel industry is a challenging one for political leaders, business executives and investors.

Yet if you want to know what’s at stake, 1.2, 1.5 and 2.0 are the numbers to keep an eye on.

—

Originally posted on November 5, 2021 – COP26: The Global Climate Equation in Three Numbers

DISCLOSURE

This piece is provided as educational information only and is not intended to provide investment or other advice. This material is not to be construed as a recommendation or solicitation to buy or sell any security, financial product, instrument, or to participate in any particular trading strategy.

Disclosure: Interactive Advisors

This material is not intended as investment advice. Interactive Advisors or portfolio managers on its marketplace may hold long or short positions in the companies mentioned through stocks, options or other securities.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. Interactive Advisors does not offer services through any other broker-dealer. The use of an affiliate for brokerage services represents a conflict of interest. Interactive Advisors clients acknowledge this conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it can meet its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Interactive Advisors, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or Interactive Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!