Gold is one of the rarest elements in the world, making up roughly 0.003 parts per million of the earth’s crust. But how much gold is the world digging up each year and what countries produce the most?

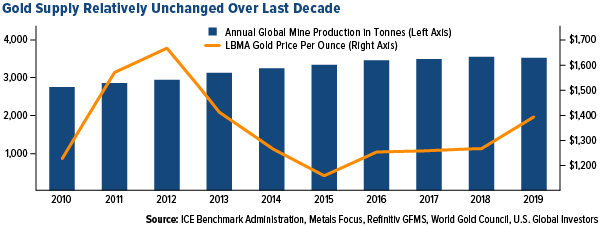

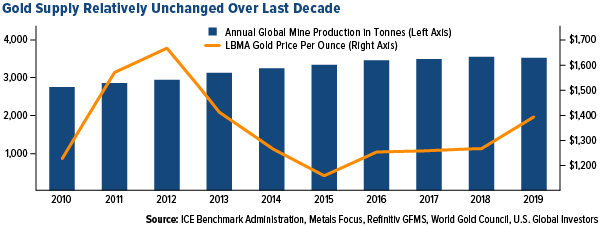

In 2019, global gold mine production was a reported 3,463.7 tonnes – down one percent from the year prior – and the first year-over-year decline in output since 2008. Gold production has remained relatively steady since 2010, raising the question I’ve explored over the years – have we reached peak gold?

The idea is that all the easy gold has already been discovered and explorers have to dig deeper to find economically viable deposits. For example, South Africa was once the top gold-producing country by far, digging up over 1,000 tonnes in 1970, but annual output has fallen steadily since. On the other hand, several nations have emerged in the last few years as growing gold producers.

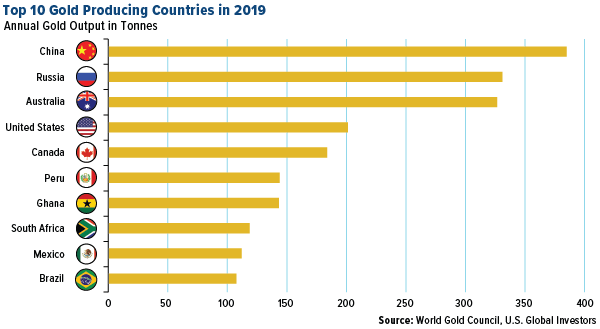

As seen in the chart below, China takes the number one spot of global gold producers by a wide margin. The top 10 rankings saw a big shift in 2019 – Russia took the lead over Australia to claim second, Indonesia fell off the list and Brazil joined the ranks as the tenth largest producer. Ghana also jumped ahead of South Africa to become the continent’s top producer.

Below are more details on the top 10 countries with the largest gold production in 2019, beginning with the top producer and top consumer of bullion, China. All data is from the World Gold Council.

1. China – 383.2 tonnes

For many years, China has been the top producing nation, accounting for 11 percent of global mine production. However, production fell from nearly 400 tonnes last year, representing the third consecutive year of declines. The downtrend is largely due to tighter environmental policies imposed by the government. For example, stricter control over the use of cyanide at gold mines forced several operations to cut back production.

2. Russia – 329.5 tonnes

A massive 83 percent of European gold comes from Russia, which has been increasing its production every year since 2010. Russia took the lead over Australia to become the world’s second largest producer – mining 50 tonnes more in 2019 than the year prior. Who is the largest buyer of Russian gold? The Russian government, of course, which purchases around two-thirds of all gold produced locally.

3. Australia – 325.1 tonnes

Australia has posted seven consecutive years of increases in production, up by 4 percent in 2019. The minerals industry produces over half of Australia’s total exports and generates about 8 percent of GDP. Higher production at several mines and the ramp of projects such as Mount Morgans and Cadia Valley contributed to increased production.

4. United States – 200.2 tonnes

American gold output fell by 11 percent in 2019, ending five consecutive years of growth. Twelve states produced the gold, worth about $8.9 billion and accounting for 6.1 percent of the global total. Around 78 percent of gold produced in the U.S. is from Nevada. If the state was considered a country, it would be number six on this list with 173.6 tonnes mined in 2019.

5. Canada – 182.9 tonnes

Canada has held the number five spot for three years now, even with a slight decrease in output in 2019. New projects in Nunavat, Yukon and Quebec are expected to support stronger output in 2020. Canada’s gold mine production is estimated to grow by a compound annual growth rate of 2.7 percent from 2019 to 2023 to reach 7.6 million ounces.

6. Peru – 143.3 tonnes

Gold output fell for a fourth consecutive year in Peru largely due to crackdowns on illegal mining operations in the La Pampa region and lower grades at existing projects. Mining is a significant portion of Peru’s economy and accounts for over 28 percent of the region’s total output.

7. Ghana – 142.4 tonnes

Ghana is Africa’s largest producer of gold, beating out South Africa for the top spot in 2019, and is also known for its reserves of various industrial minerals. Industry majors such as AngloGold Ashanti and Gold Fields have shifted their focus from South Africa to Ghana where deposits are cheaper and easier to mine. The West African nation has around 1,000 metric tons of reserves and moved up to number seven on the list from 10 last year.

8. South Africa – 118.2 tonnes

Once the top gold-producer in the world by a wide margin, South Africa’s gold mines have been slowing every year since 2008, with the exception of 2013 when production rose by a few tonnes. The nation is struggling with rising costs for electricity and labor, with many mines closing due to unprofitability. South Africa is, however, still home to the world’s deepest gold mine, the Mponeng mine, extending 2.5 miles underground.

9. Mexico – 111.4 tonnes

Although production fell for a fourth consecutive year, Mexico remains a competitive gold source. Output has risen from just 50.8 tonnes in 2008 to over 130 tonnes in 2017, one of the largest increases in a nine-year span. Mexico is an attractive place for mining due to a relatively low cost of regulation. The 2019 slowdown is attributed to disputes between local communities and contractors.

10. Brazil – 106.9 tonnes

Brazil produced 10 more tonnes of gold than the year prior to make the number 10 spot on this list. Illegal mining activity has risen sharply in the last five years in the heart of the Amazon rainforest. President Jair Bolsonaro has pushed the country to develop the Amazon economically and tap its mineral riches.

For more about gold, watch this video

—

Originally Posted on September 23, 2020 – Top 10 Gold Producing Countries

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 06/30/2020: AngloGold Ashanti Ltd, Gold Fields Ltd.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!