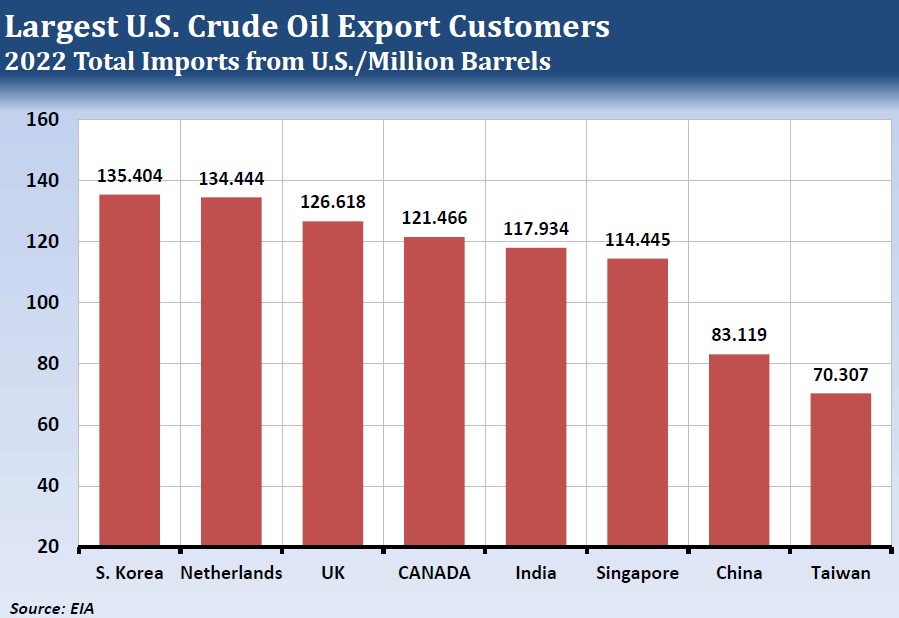

This week’s EIA Report showed US crude oil exports at 3.362 million barrels per day (bpd) for the week ending March 3, a decline of 2.267 million from the previous week and the largest weekly decline since May 2021. But keep in mind that the previous week’s export number, 5.629 million bpd, was a record. Net crude imports fell below 1 million bpd for the first time in more than 60 years.

The nine highest weekly readings for US crude exports have occurred since last July. And while there was a sharp decline last week, the exports tend to have wide swings. In contrast to crude oil imports, which mostly arrive via pipeline from Canada or Mexico, US crude oil is primarily exported via tanker ship. Canada is the fourth largest destination for US crude exports, but Mexico has not received any since late 2018.

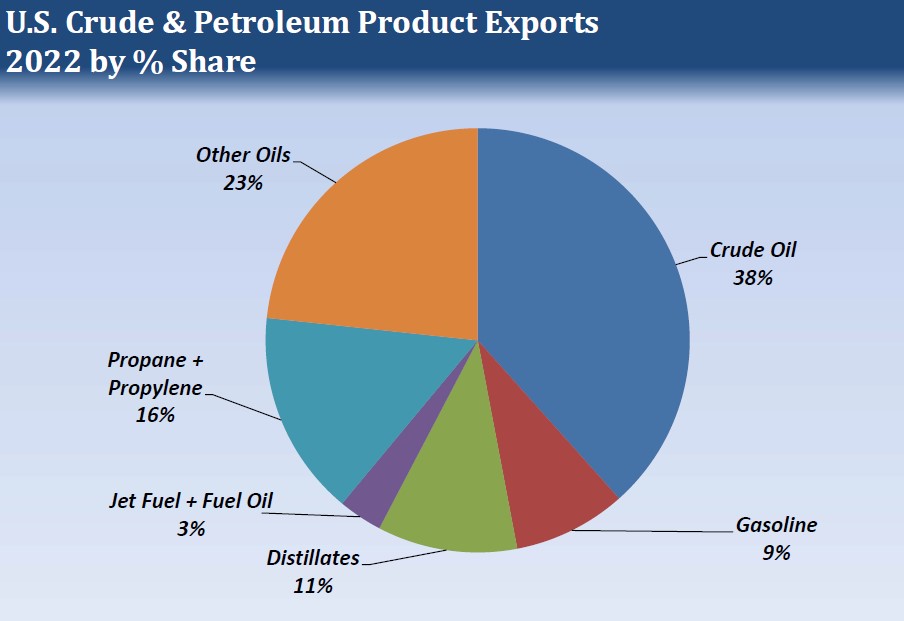

US crude exports have been trending higher since restrictions were lifted in late 2015, but petroleum product exports have been underway since late 2007. These products include gasoline, distillates, propane, and other oils, such as lubricants, asphalt, and unfinished oils. The US has been a consistent net exporter of petroleum products since 2011, and the products accounted for 62% of all US petroleum exports last year.

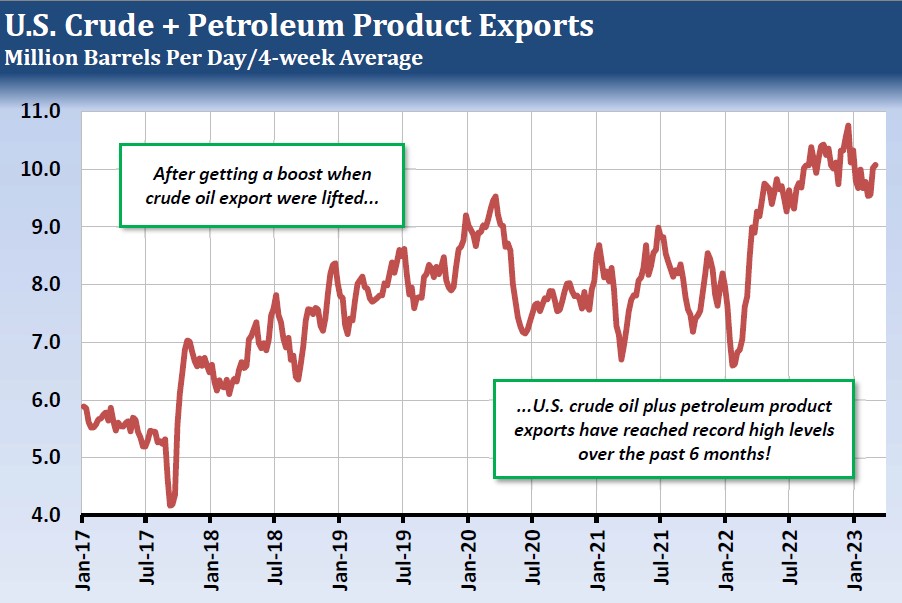

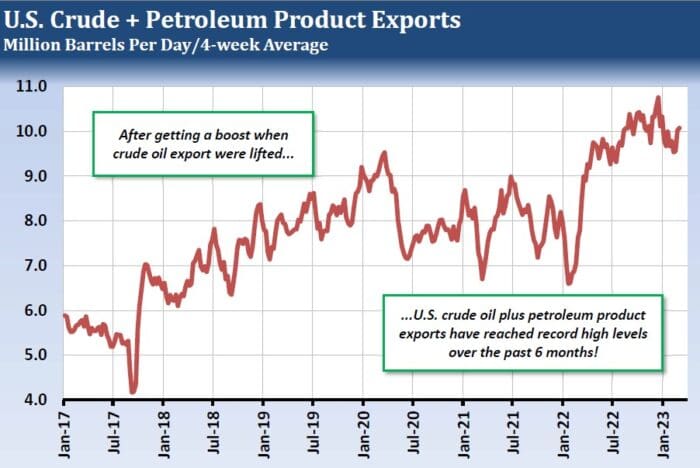

Prior to 2022, the US has only one week in which crude and product exports reached 10 million bpd. Since 2022, they have reached that level 18 times, with three readings above 11 million bpd. The Russian invasion of Ukraine has played a major role in this increase, as European customers had to look to somewhere besides Russia to meet their needs.

With US refinery throughput holding near the 15 million bpd level, we do not anticipate any sharp reduction in US crude oil imports soon. Weekly import readings have come in above 7 million bpd only six times in the last 2 ½ years, and they have stayed well below the 10 million bpd-plus levels of the mid-2000’s. With Russian exports reduced by sanctions for the foreseeable future, we expect US crude oil and petroleum product exports to stay near record levels.

—

Originally Published March 10, 2023

Disclosure: The Hightower Report

This report includes information from sources believed to be reliable, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed are subject to change without notice. This report should not be construed as a request to engage in any transaction involving the purchase or sale of a futures contract and/or commodity option thereon. The risk of loss in trading futures contracts or commodity options can be substantial, and investors should carefully consider the inherent risks of such an investment in light of their financial condition. Any reproduction or retransmission of this report without the expressed written consent of The Hightower Report is strictly prohibited. The data contained herein is subject to revision; independent verification is recommended. Any third party opinions regarding this report are not necessarily those of the authors. Due to the volatile nature of futures and options markets, the information contained herein may be outdated upon its release.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Hightower Report and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Hightower Report and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!