A sharp rise in natural gas prices since August has put upward pressure on a host of commodities, including coal, electricity, and oil, while squeezing margins for industrial users. Forced curtailment of industrial activities has contributed to higher prices for other commodities, such as base metals and ammonia, where output is being reduced to save natural gas.

Given existing supply bottlenecks in shipping and computer chips, the run-up in commodity prices has fed renewed concerns about inflation and a potential negative growth impulse from constrained industrial output and higher spending on heating bills. The International Monetary Fund in October trimmed its forecast for global growth, citing risks that include rising fuel costs and accelerating inflation. Unfortunately, energy-price volatility could persist in the coming months.

Gas market sparks next leg up across commodities

A confluence of one-off and structural factors has left global natural gas inventories on the low end of the historical range entering into winter and pushed prices higher.

Cold temperatures in Europe and Russia lasting through spring this year limited the typical seasonal buildup of gas inventories. Weather issues have also curbed wind and hydro power production, increasing the call on thermal generation, including natural gas.

Delayed maintenance due to COVID-19 and underinvestment in upstream production limited capacity utilization at global liquefied natural gas (LNG) facilities to levels not much above 2020, when low prices prompted output reductions.

Compounding problems, low natural gas inventories and strong internal demand within Russia, and that country’s preference for exports through the southern corridor, have contributed to a decline in northern European imports of Russian gas.

In addition, the exceptional growth over the past year in industrial production – and the resulting power needs – due to pandemic-related global demand for goods contributed to recent energy shortfalls.

Other commodities get into the party

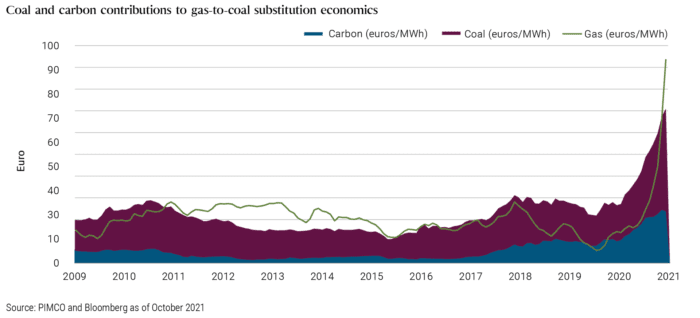

Ripple effects can be felt across the commodity complex, with higher demand and prices for competing fuels. Coal supply had dwindled after years of underinvestment amid policies in China and elsewhere aimed at curbing pollution. With more coal now being utilized for power generation, carbon prices in Europe’s emissions trading system began to rally, as coal plants emit more carbon per megawatt hour (MWh) of output.

This spiral higher, with gas, carbon and coal rising in tandem, ultimately contributed further to higher oil prices, which had been rising already. Simply put, there was nowhere to hide in the energy chain.

Beyond the pocketbooks of global consumers, a key casualty has been industrial users that are either being rationed by state policy (e.g., China and India) or constrained by high prices (Europe).

Resiliency and redundancy are lacking

Recent events have exposed what we believe are key conditions in the energy system: 1) underinvestment broadly in the supply side after years of low prices, 2) reduced system flexibility, and 3) the interconnected nature of all energy markets, including the role carbon prices play in setting substitution points between markets.

Although OPEC+ – which includes OPEC members and several other oil exporters – does retain some spare capacity in oil, and Russia likely does in natural gas, spare capacity appears to be falling across the energy supply chain, likely leaving the market more vulnerable to weather or political disruptions. With investors demanding greater emphasis on positioning companies for brown-to-green energy transitions and higher return of capital, upstream investment at the same price level is notably lower than what would have been expected only two years ago.

While renewables and environmental policies have broadly had deflationary impacts over the past decade as solar and wind capacities have grown, the hollowing out of baseload generation (coal and nuclear) has left the demand side less responsive to price changes. As the world looks to electrify automobiles and residential heating and cooling, investment in baseload power and storage will be needed to increase redundancies to help with the intermittent nature of renewables.

Though we argue it is needed to address climate change and will motivate use of additional non-hydrocarbon energy sources, carbon pricing is a potential source of additional upside pricing pressure for commodities. We estimate the rise in carbon prices over the past year has raised the level at which natural gas prices motivate substitution to coal by 15 to 20 euros per MWh, a non-trivial amount given European gas traded at 15 euros only a year ago.

What’s next?

There are signs that the situation could be easing. Gas demand has weakened, consistent with fuel substitution and decreases in industrial demand. European storage is showing signs of improvement, as are global LNG exports. China is focusing on increasing coal supplies, which are exhibiting nascent gains.

Still, the post-COVID world looks to be marked with increased volatility, and investors might look to commodity markets to hedge inflation risks. We remain positively disposed to carbon prices broadly, for which commodities may also be useful as a tool to hedge this policy-induced inflation impulse.

For PIMCO’s latest Secular Outlook, please read “Age of Transformation“.

For more insights on inflation, please visit our Inflation page.

Greg E. Sharenow is a portfolio manager focusing on commodities and real assets and is a regular contributor to the PIMCO Blog.

—

Originally Posted on November 16, 2021 – Energy Volatility Shows Power of Commodities to Influence Inflation

DISCLOSURES

All investments contain risk and may lose value. Commodities contain heightened risk, including market, political, regulatory and natural conditions, and may not be appropriate for all investors.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2021, PIMCO.

Disclosure: PIMCO

All investments contain risk and may lose value. This material is intended for informational purposes only. Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. THE NEW NEUTRAL is a trademark of Pacific Investment Management Company LLC in the United States and throughout the world. ©2023, PIMCO.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from PIMCO and is being posted with its permission. The views expressed in this material are solely those of the author and/or PIMCO and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!