The Risks of Stagflation Increase: January 30, 2023

The Federal Reserve’s aggressive monetary policy tightening is helping to moderate inflation, but it has a long way to go to tame price increases in the sticky services components which will likely require restoring balance in the labor market. Wage pressures are strong and consumption is chugging along while GDP growth is weakening. These factors point to growing risks of the economy lapsing into stagflation, an environment of slower economic growth alongside higher than trend inflation.

The rate of overall inflation remains high but has moderated against the backdrop of slowing consumption and tighter financial conditions. The Federal Reserve’s (the Fed) preferred gauge of inflation, the core PCE, is at 4.4% as of December, more than two times the Fed’s 2% target. The Fed is expected to continue raising the federal funds rate from its 4.38% level in order to dampen inflationary pressures. Two 25 basis point increases in 2023 are expected by the market, leaving the terminal rate at 4.88% in March. While the Fed has communicated that it’s going above 5% and that no interest rate cuts are expected in 2023, the market doesn’t believe the Fed’s Summary of Economic Projections. Modest interest rate cuts are expected by the market in the second half of 2023, leaving 2023’s year-end rate around 4.5%, a discrepancy from the Fed’s expectation of 5.13% at year-end.

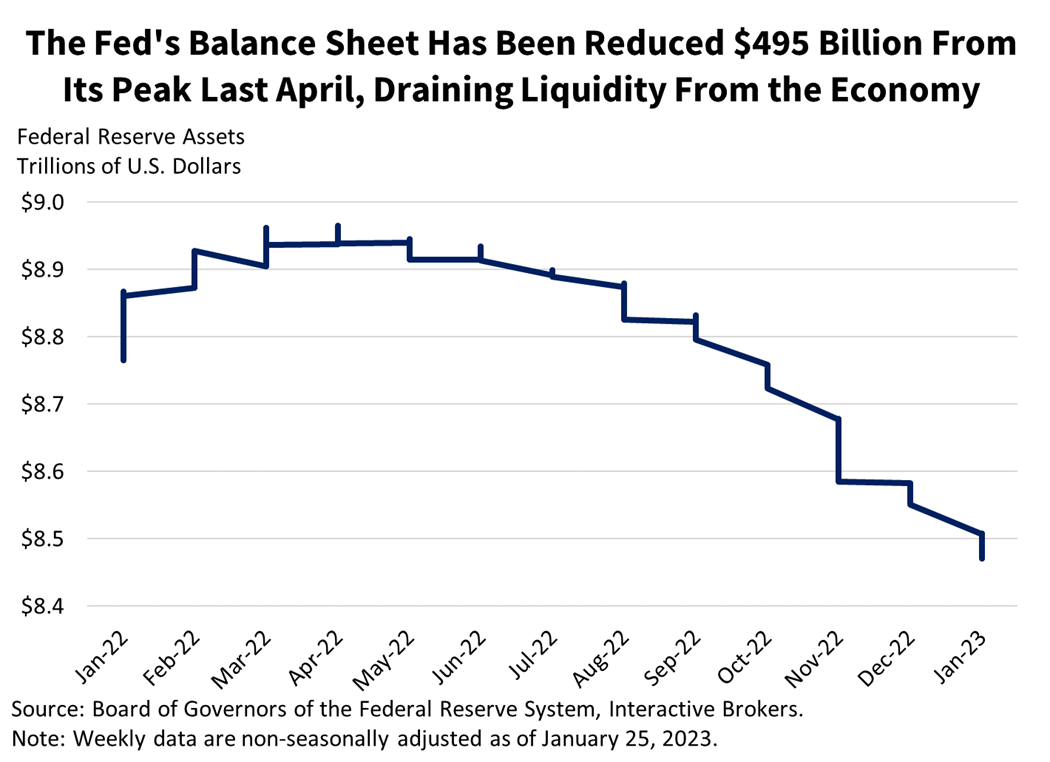

In addition to rate hikes, the Fed has increased the pace of its balance sheet reduction program to a monthly cap of $95 billion from $47.5 billion in the prior months, further constraining the money supply and financial conditions alike. Since the peak in April 2022, the Fed has reduced its balance sheet by $495 billion. As the Fed continues to tighten financial conditions, it places downward pressure on the money supply and inflation, upward pressure on short-term interest rates and downward pressure on GDP. The Fed has expressed a strong commitment of keeping rates higher for longer until it sees convincing evidence of inflation returning to the 2% target, even as economic conditions continue to deteriorate.

Leading economic indicators point to 1st quarter GDP growth of 0.3%.

Below, we examine what leading economic indicators portent to our picture of the evolving economic landscape. This is our view at the moment and our projections may be confirmed or we may have to adjust them as different, new information, including freshly released economic indicators, are made available.

Initial Unemployment Claims

Even with the Fed aggressively hiking interest rates, the labor market remains strong. Initial unemployment claims have been volatile in the last few months against the backdrop of labor shortages, real wage growth and tighter financial conditions. A broad view of the labor market misses an apparent contradiction—the tech sector has laid off more than 227,000 workers in 2022 and early in 2023 while banks and some companies have also implemented layoffs and hiring freezes. Other companies, however, are hoarding labor due to difficulties with hiring during the pandemic and the current labor shortage resulting, in large part, from historically low labor force participation. The low participation rate results in large part from Americans retiring early during the depths of COVID-19 pandemic, discouraged workers upset about income and growth prospects, a skills mismatch as companies struggle to match job openings with job applicants and to a lesser extent from working age Americans on the sidelines due to long-haul Covid. Additionally, employers have been hiring to position strongly for the next cycle with proper staffing levels instead of trimming labor in the present and playing catch up later.

We expect the economic slowdown, tighter credit conditions and higher interest rates to eventually lead to modestly higher unemployment in 2023. Fiscal stimulus has been limited in 2023 and 2022 compared to 2021 and 2020 while persistent inflation has emerged as a new generational headwind, slowing consumer spending. During times of monetary tightening and higher interest rates, business revenue tends to slow because financing the production of goods and services becomes more expensive, leading to possible layoffs as businesses attempt to sustain profit margins. An increase in initial unemployment claims would point to the following changes: lower consumption/demand, lower inflation, lower long-term interest rates and lower GDP growth. If initial unemployment claims drop significantly, demand will rise, inflation will rise, long-term interest rates will rise and GDP growth will rise. The next unemployment release will be on February 2nd. It is currently expected to be 200,000, an increase from the previous week’s reading of 186,000. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

Retail Sales

Consumers are increasingly shying away from spending as economic conditions weaken. This slowdown is occurring against the backdrop of tighter financial conditions and higher prices. After growing rapidly during most of the past two and a half years due to support from strong monetary and fiscal stimulus, retail sales have slowed and when accounting for inflation, have contracted in many recent months. This trend is especially true with goods, with recent gauges of manufacturing activity showing the sharpest contractions since the heights of the COVID-19 pandemic in April 2020. Bank executives have also reported weakness in credit and debit card usage and are bracing for recession while their loan qualification standards heighten.

Consumer spending is likely to slow further as the Fed continues to tighten credit conditions and raise rates, dampening demand, especially for big ticket items. Fiscal stimulus has been limited in 2023 and 2022 compared to 2021 and 2020 while persistent inflation has emerged as a new generational headwind, constraining consumer spending on a relative basis. During times of monetary policy tightening and higher interest rates, consumption tends to slow because goods and services become more expensive to finance. A continued slowing or contraction of retail sales would point to the following changes: lower consumption/demand, lower inflation, lower long-term interest rates and lower GDP growth. If retail sales growth ramps up again due to monetary policy easing, consumption/demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The next month’s release will be on February 15th. It is currently expected to be a 1.3% month-over-month drop, a faster pace of decline than the previous month’s 1.1% contraction. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

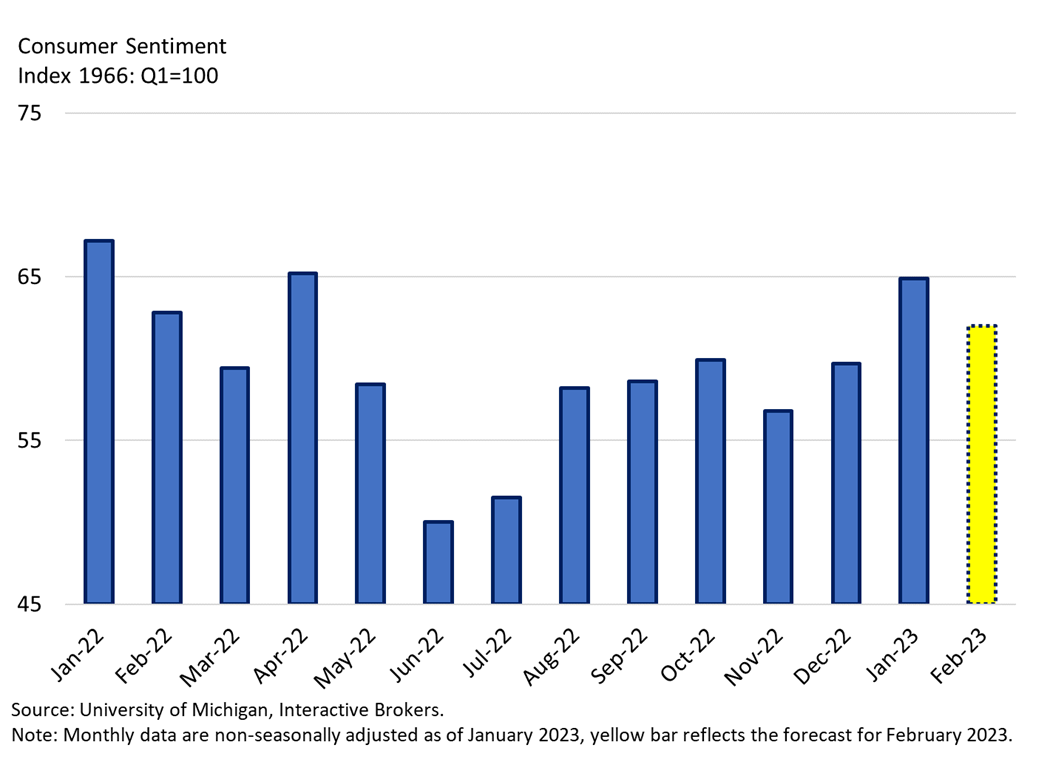

Consumer Sentiment

Consumer sentiment is bouncing along low levels as financial conditions tighten and inflation persists. Sentiment was high for most of the past two and a half years supported by strong monetary and fiscal stimulus, but it has weakened significantly. Since June 2022 however, consumer sentiment has strengthened a bit, driven by falling gasoline prices and rising real wages although it still remains at historically low levels. Fiscal stimulus has been limited in 2023 and 2022 compared to 2021 and 2020 while persistent inflation has emerged as a new headwind, weakening consumer sentiment on a relative basis. During times of monetary policy tightening and higher interest rates, sentiment tends to weaken because employment conditions and business revenue growth generally soften while goods and services become more expensive to finance, hampering consumers. This time though, employment conditions may not soften as much due to the current labor shortage and historically elevated corporate margins. Continued low levels of consumer sentiment would point to the following changes: lower consumption/demand, lower inflation, lower long-term interest rates and lower GDP growth. If consumer sentiment ramps up again due to monetary policy easing, consumption will rise, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The next month’s release will be on February 10th. It is currently expected to be 62.0, a slight decrease from the previous month’s reading of 64.9, and still hovering at a historically low level. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

Building Permits

The real estate industry is weakening dramatically under the weight of near all-time low home affordability driven by high prices and high mortgage interest rates. Building permits are falling against the backdrop of tighter financial conditions and a lack of homebuyers. After growing at a strong level for most of the past two and a half years, supported by strong monetary policy stimulus and an increased demand for housing outside of urban areas due to the pandemic, building permits have slowed and are now in contraction territory. Expectations of further slowing is expected as the Fed continues to tighten credit conditions and raise rates, slowing demand in this capital intensive, economically cyclical, interest-rate-sensitive industry. Significant home price growth has pressured affordability to near its worst level in history, leading to significant contractions in mortgage applications. During times of monetary policy tightening and higher interest rates, building tends to slow because real estate becomes much more expensive to finance. A continued contraction in building permits would point to the following changes: lower consumption/demand, lower inflation, lower long-term interest rates and lower GDP growth. If building permit growth ramps up again due to monetary policy easing, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The next month’s release will be on February 16th. It is currently expected to be a 2.0% month-over-month contraction, a faster rate of decline from the previous month’s contraction of -1.0% while remaining in a downward trend. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

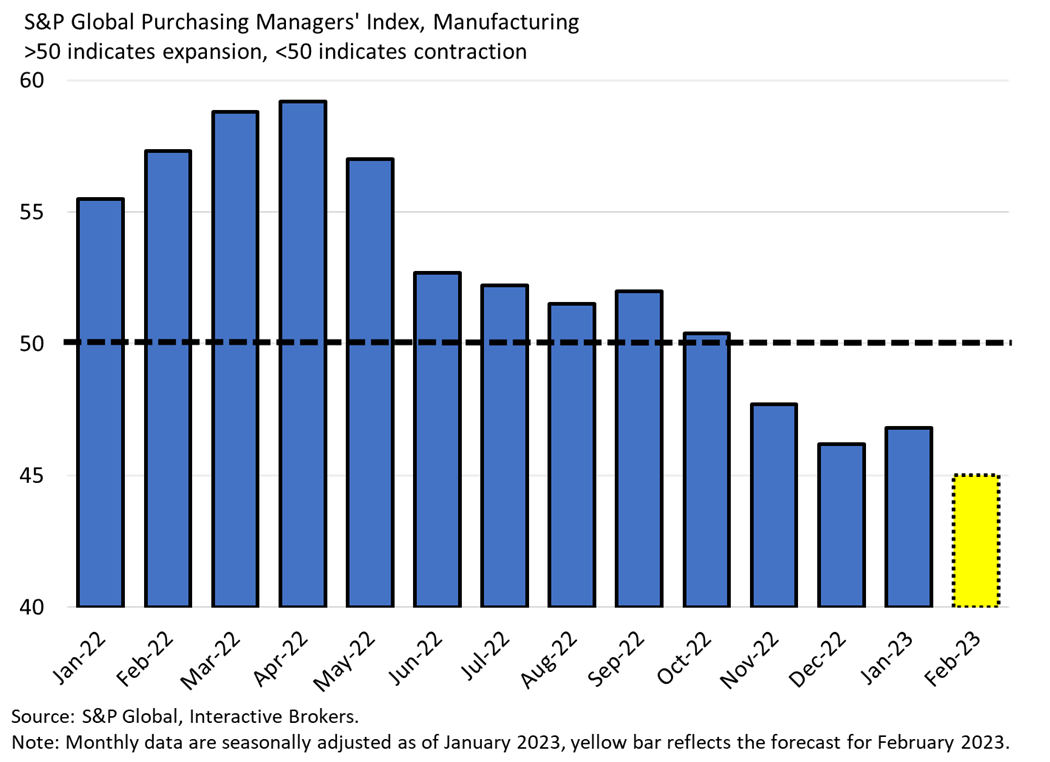

PMI-Manufacturing

Tighter financial conditions and slowing consumption are contributing to a sharp decline in manufacturing activity. After expanding at a strong level for much of the past two and a half years, supported by strong monetary and fiscal policy stimulus and increased demand for manufactured goods rather than services due to the pandemic, manufacturing activity has contracted. New orders, the largest component of the PMI, has been in contraction territory for a few months, signaling depressed demand for big ticket items, historically a leading indicator of not just the manufacturing sector, but of the entire economy. Expectations of continued slowing is expected as the Fed continues to tighten credit conditions and raise rates, slowing demand in this capital intensive, economically cyclical, interest-rate-sensitive industry. During times of monetary policy tightening and higher interest rates, manufacturing tends to slow because manufactured, durable goods like furniture, automobiles, airplanes and factory equipment become much more expensive to finance while loan qualification standards increase. A continued contraction in manufacturing activity would point to the following changes: lower consumption/demand, lower inflation, lower long-term interest rates and lower GDP growth. If manufacturing activity ramps up again due to monetary policy easing, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The next month’s release will be on February 21st. It is currently expected to be 45, a decrease from the previous month’s reading of 46.8, sustaining the downward trend from the past few months and remaining in contraction territory. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

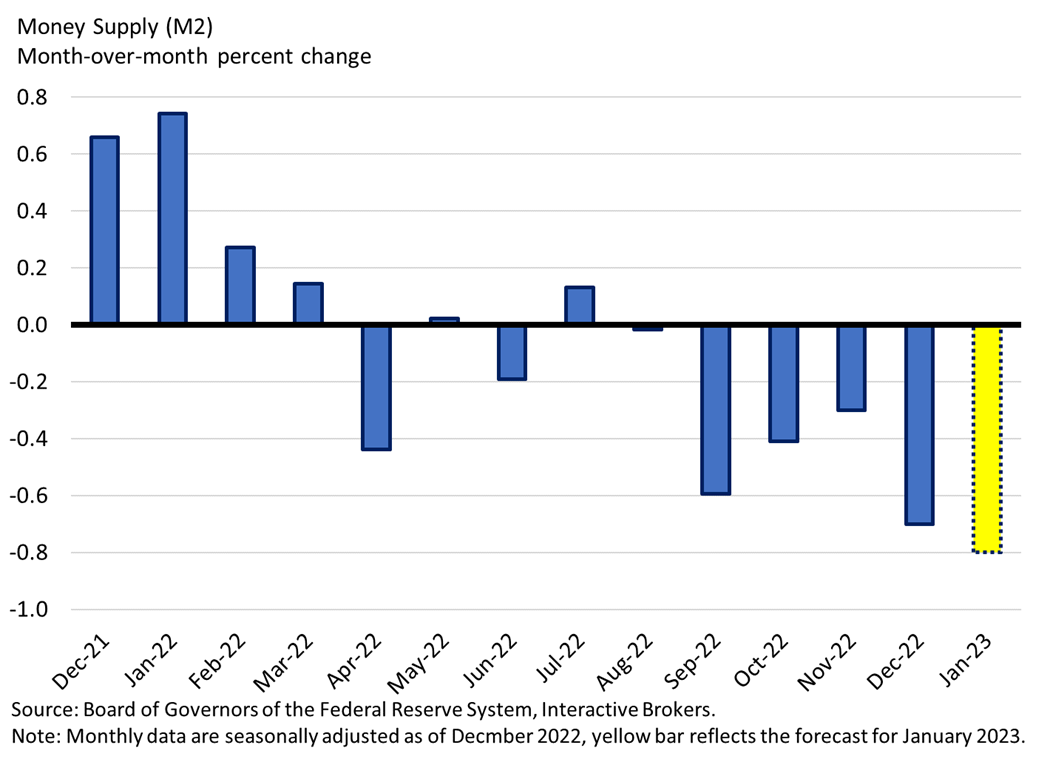

Money Supply

The rates of inflation and economic growth are weakening against the backdrop of a contracting money supply. The money supply, inflation and economic growth shift a great deal due to the Fed’s monetary policy. After increasing drastically since the emergence of COVID-19 to help businesses and households cope with pandemic disruptions, the money supply is currently contracting from its April 2022 peak. The Fed has pivoted from an accommodative monetary policy stance towards a restrictive one because it recognizes that money supply growth during years 2020 and 2021 contributed to today’s high inflation. In addition, reduced fiscal spending from Congress due to similar concerns about inflation also limit money supply growth. As credit becomes less available, the Fed continues to raise rates and reduce its bond holdings, and Congress doesn’t spend as much on a relative basis, the money supply is expected to continue contracting. The more persistent inflation ends up being, the longer the Fed will have to maintain a restrictive position and therefore, place a cap on money supply growth. At this point in time, trends of money supply contraction are sustaining because the Fed has a long road of tightening ahead in order to achieve the 2% inflation target. The Fed has embarked on an aggressive rate hiking campaign and has increased the pace of balance sheet reduction to a monthly cap of $95 billion from $47.5 billion in the months prior, further hampering money supply growth. A continued contraction in the money supply would point to the following changes: lower consumption/demand, lower inflation, lower long-term interest rates and lower GDP growth. If money supply growth ramps up again due to monetary policy easing, consumption will rise, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The next month’s release will be on February 28th. It is currently expected to be a 0.8% month-over-month decline, an acceleration from the previous month’s -0.7% reading, sustaining the downward trend from the past few months. Should the actual number be much lower or higher, we would have to adjust our outlook by slightly raising or lowering our estimate for economic indicators and ultimately our estimate for GDP.

Yield Curve

The yield curve is severely inverted against the backdrop of tighter financial conditions and weak economic prospects. As the 2-year yield rose much faster than the 10-year since January 2022, a bear-flattening move from a much steeper level from the previous two years, the yield curve is now in deep inversion territory (-69 bps), signaling economic contraction ahead. The money supply increase led to a rise in inflation which compelled the Fed to raise short-term rates significantly. The longer end of the curve, the 10-year maturity, didn’t rise as fast because longer term economic growth and/or inflation isn’t expected to rise as strongly as short-term rates did. The yield curve inversion is telling us that there’s little chance the U.S. economy can handle the monetary policy tightening that’s in the pipeline without a recession. In this case a bull-flattener, where the 2-year would fall slower than the 10-year would be desirable but that would require inflation and inflation expectations to come down further, which will likely occur towards the end of Fed tightening. Although inflation expectation figures are off their peaks, we believe inflation will prove stickier and more resilient than the market thinks. Against the backdrop of persistent core inflation and a tight labor market, the expectation in the coming months is to see a bear-steepener where the 10-year rises faster than the 2-year due to an increase in inflation expectations. The main drivers of higher inflation in the medium to long-term are the shift from globalization towards regionalization, geopolitical tensions, relative inefficiencies regarding supply chains and the commodity complex, continued deficit spending and labor shortages. If the yield curve remains severely inverted, it points to lower consumption, lower demand, lower inflation, lower long-term interest rates and lower GDP growth. If the yield curve steepens again due to monetary policy easing, demand will rise, inflation will rise, short-term interest rates will fall and GDP growth will rise. The yield curve inversion (2s, 10s) has predicted the last 6 out of 6 recessions.

Economic Indicators & The Economy

Below is a picture showing how leading, coincident and lagging economic indicators reflect household, business and government activity. Leading indicators provide early signals of future economic health while coincident and lagging indicators confirm the economic trend in later periods.

Watch Videos About Key Economic Indicators at Traders’ Academy – Click Here

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!