Investors focused on financial instruments that aim to improve the environment, society, and governance-related (ESG) issues have recently been contending with a slew of headwinds that have placed the investment philosophy under some significant pressure.

A long list of exchange-traded funds (ETFs) that tout ESG-related themes have lost a relatively large share of value, amid certain marketing practices among major financial firms that some regulators have deemed deceptive.

Indeed, a host of large financial institutions have been hit with reputational damage in 2022, arising from regulatory scrutiny and material fines, including each of Goldman Sachs’ and Deutsche Bank’s asset management arms, as well as BNY Mellon’s investment advisory business.

In the case of Goldman Sachs Asset Management (GSAM), for example, the company paid US$4 million to settle charges with the U.S. Securities and Exchange Commission (SEC) for policies and procedures failures involving two mutual funds and one separately managed account strategy marketed as ESG investments.

Sanjay Wadhwa, Deputy Director of the SEC’s Division of Enforcement and head of its Climate and ESG Task Force, said that in response “to investor demand, advisers like Goldman Sachs Asset Management are increasingly branding and marketing their funds and strategies as ‘ESG.’

“When they do, they must establish reasonable policies and procedures governing how the ESG factors will be evaluated as part of the investment process, and then follow those policies and procedures, to avoid providing investors with information about these products that differs from their practices.”

BNY Mellon Investment Adviser also paid a US$1.5 million fine to the SEC for misstatements and omissions about ESG considerations in making investment decisions for certain mutual funds that it managed.

In light of the circumstances, Cecile Fleckten, IBKR’s senior director and head of ESG and sustainability, pointed out that there is “a lot of emphasis now on disclosures and reporting and having a bit more consistency in reporting.”

The European Union, for instance, has been spearheading a myriad of directives over the past few years, including the Sustainable Finance Disclosure Regulation (SFDR), along with the recently passed Corporate Sustainability Reporting Directive (CSRD). Also, there is a taxonomy law: the Task Force on Climate-related Financial Disclosures (TCFD), and the SEC’s rule on climate disclosure rules, which has been proposed.

Fleckten continued that the recent regulatory actions taken against the likes of Goldman Sachs, BNY Mellon, and Deutsche Bank comes as “no surprise,” due – in large part – to the lack of a universal definition for ESG, leaving it to mean different things to different people. Until then, she adds, “there will be this bit of this tension on – is it greenwashing? Is it a PR exercise or is there real value in having these ESG labels?” Overall, Fleckten noted, “there will continue to be some risk of greenwashing, but the good news today is that there’s a lot of attention, a lot of focus, a lot of new regulations, a lot of areas where reporting and disclosure is becoming more pronounced than ever before.”

ESG investments had also been buoyed by the optimism presented by the passage of certain legislation such as the Bipartisan Infrastructure Law (Infrastructure Investment and Jobs Act), which, among other supportive ESG-related measures, aims to upgrade the nation’s power infrastructure to deliver clean, reliable energy in an effort to achieve a zero-emissions future.

The new law also purports to invest US$7.5 billion to build a national network of electric vehicle chargers in the U.S. to fight climate change.

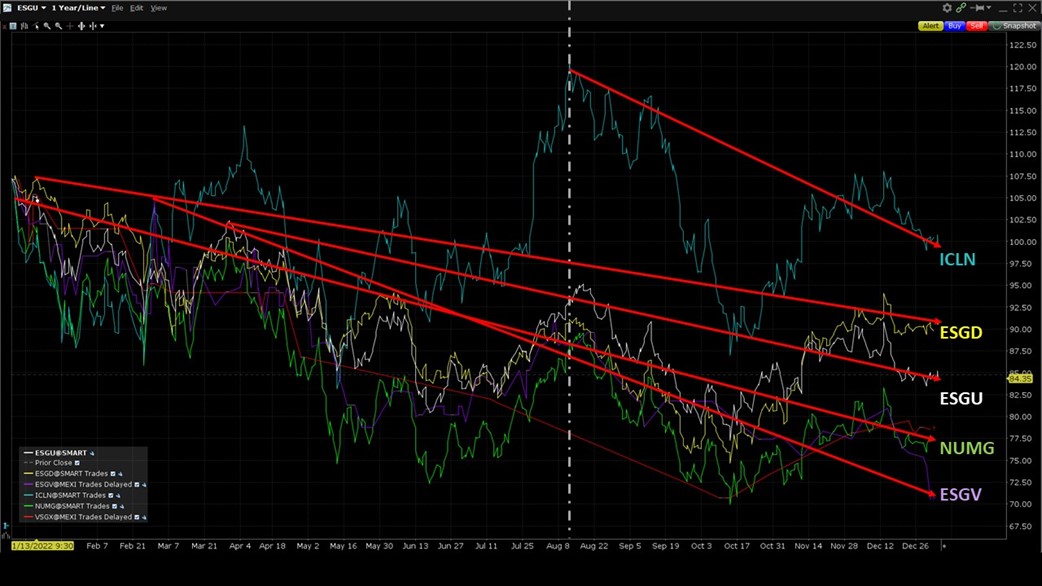

Meanwhile, some ESG-themed ETFs have lost a fairly sizable amount of value amid the greenwashing turmoil and despite the regulatory disclosures and fiscal support.

—

Learn More

Courses

IBKR Traders’ Academy – ESG Investing

Coursera – IBKR’s ESG Investing: Financial Decisions in Flux

Podcasts

IBKR Podcasts – EP 51. ESG Investing – Seeking Higher Standards as Controversy Stirs

IBKR Podcasts – EP 40. Cooking it Up in a Lab – Investing in the Future of Bioengineered Food

Webinars

IBKR Webinars – ESG Investing: The Global State of GSSS Bonds

IBKR Webinars – ESG-related Topics

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!