Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Mean Reverting Signals

So far in this series, we’ve been looking at long term general market conditions with an overall bullish sentiment coming through. Today, I want to shift gears and review a mean-reversion technical indicator that we’ve created and look at some short-term signals.

Mean Reverting trading is not for the faint hearted. Some liken it to catching a falling knife — you may do it successfully many times but you can also get cut up really badly if you don’t know what you’re doing. They are short-term trading signals, not long-term allocations to a portfolio. Although if the decision has already been made to add a name to your portfolio, a mean-reverting signal is a great entry to ensure the position is profitable from the start.

One way to alleviate the risk is to make sure that we stick to the foundations of Technical Analysis. One of the of the most enduring and important foundations is Dow Theory and two rules that are relevant to mean-reversion trading are:

- Always trade in the direction of the Primary Trend

- Use Volume to confirm if a move against the Primary Trend is a temporary correction or a change in the Primary Trend.

The CMT program is a great way to get these core foundations locked in to all you do.

Rule 1 will tell us that we only take the Mean Reverting signal if we are confident that the Primary Trend is still valid.

Rule 2 tells us that we can look at volume to determine if there is growing support for a change in trend. If volume was growing into a mean-reversion signal, it could be confirming a change in trend and we’d need to be very careful. What we want to see is a general declining of volume into the signal.

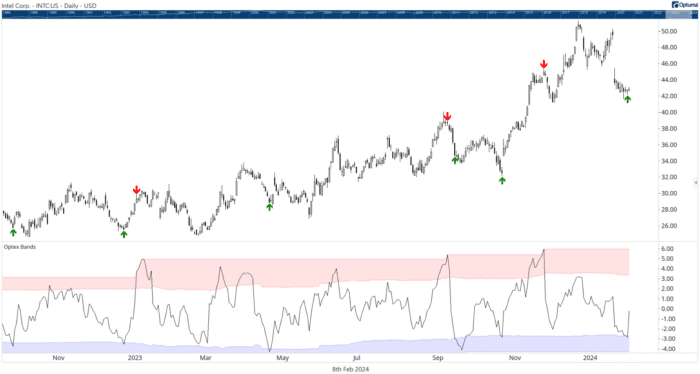

2/ Optex Bands

Optex Bands is an indicator that we built to capture high probability mean-reversion trades. (Optex was a shortening of “Optuma Extremes” since we were capturing extreme deviations).

They are built using Market Profile—a concept that has been in use since the 1980s. We have a full explanation of the calculation at https://optuma.com/optex

You can see the Optex Bands in Chart 1. The black line is the “Ratio” line and it is a volatility adjusted measure of how far price is deviating away from the point of balance on the chart.

The dynamic zones are the extreme zones. They are also calculated using Market Profile techniques.

The theory here is that an extreme move in any direction has a high probability of reverting. The more extreme the move, the higher the probability.

In Chart 1, I have also added Green Arrows when the Optex Ratio enters the Blue extreme over-sold zone and Red Arrows when the Optex Ratio enters the Red extreme over-bought zone.

They are not perfect signals—no signal ever is—but when coupled with Dow’s rules of “Trade with the Primary Trend” they do yield some good results.

3/ Russell 3000 Optex Signals

While it is great practice to go through charts looking for trading candidates, it’s so much better when we can have the computer do the work for us. In Chart 2 we have scanned for any name in the Russell 3000 that has an Optex Long Signal (as of Feb 7).

I’ve also included in the Watchlist the Monthly Change in price (which as you’d expect is down) and the Yearly Change. I really prefer to see positive yearly numbers as it give me more confidence that the security is in an uptrend giving a higher probability that this will be a good mean-reversion trade. If the Monthly is also up (eg Essent Group) then that really interests me.

Finding the candidates is only step 1. We would need to review the chart and make sure that we are confident that we are not breaking Dow’s rules and that we are willing to take on the risk associated with this trade.

Remember! No technical signal is a guarantee of success but as a concept, this type of Mean Reverting signal can be helpful to find trading candidates. Watch these names over the coming days and weeks and see what you think.

4/RRG Confirmation

We already discussed the Relative Rotation Graph earlier in this weeks posts. In Chart 3, I have added these scan results (those names with an Optex Signal) to a Daily and Yearly RRG.

As you would expect, the Daily RRG has all these names under-performing the benchmark. The Yearly RRG, however, is highlighting that some of the names are in solid out-performance territory and those are the one that I am most interested in.

Technical Analysis is more about building a case to support the trade rather than blindly taking trades. In 28 years of working with our clients, the determining factor between those who are successful and those who aren’t is their ability to focus on acceptable risk.

Mean-Reverting trades are risky, but we minimize the risk by following the foundations and using valid money management rules.

—

Originally posted February 8th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!