See the previous installment in this series for Setup and Download.

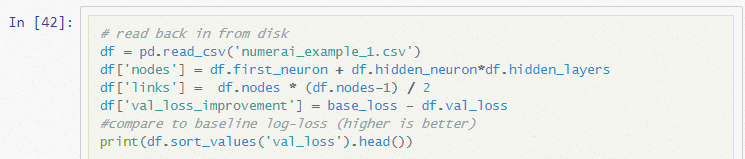

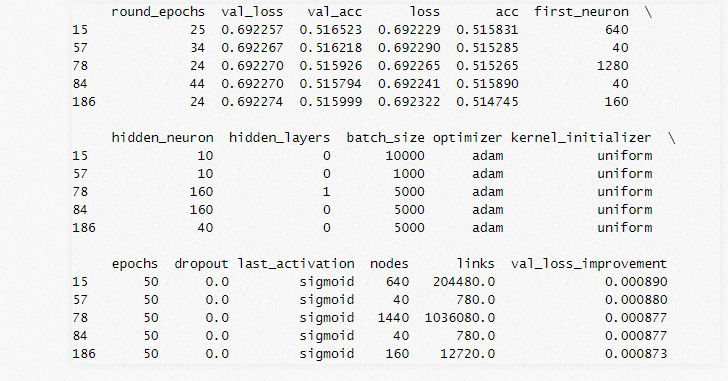

Below is a peak into what that data looks like. You can get results directly from the returned Scan() object but I prefer to read back the csv and analyze that since I’d like to be able to monitor results as the come in (different process) and be able to evaluate in future w/o re-running the Scan.

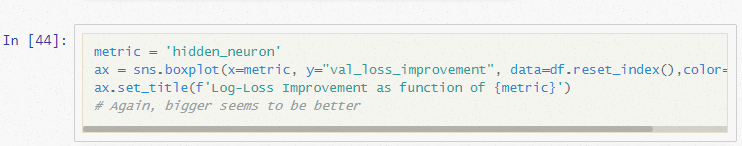

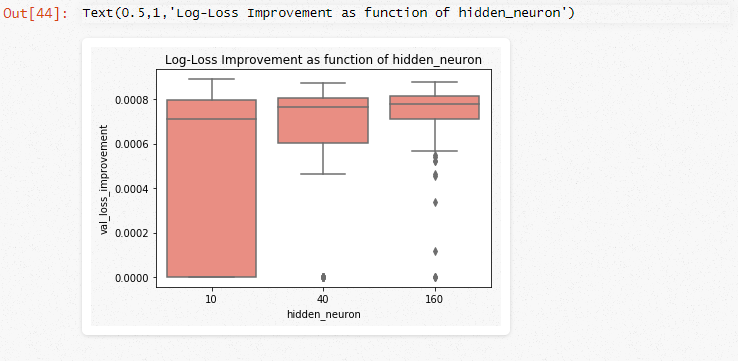

Note: Since Log-Loss values are all so tightly distributed, I’m creating a vallossimprovement metric which is the improvement relative to naive baseline (always estimating 50% probability). For this metric, higher is better.

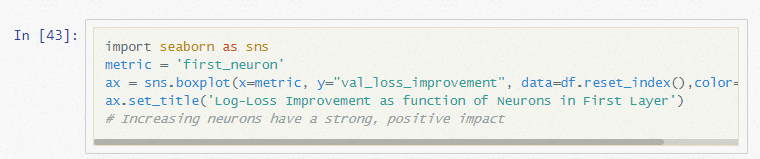

We could simply take the top result and call it good. However, I think the real value here is to gain understanding about how parameters affect results. Further it’s very unlikely that we’ve happened to find the global maximum with our starting values.

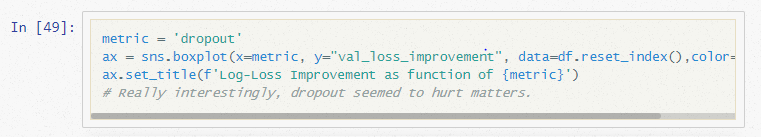

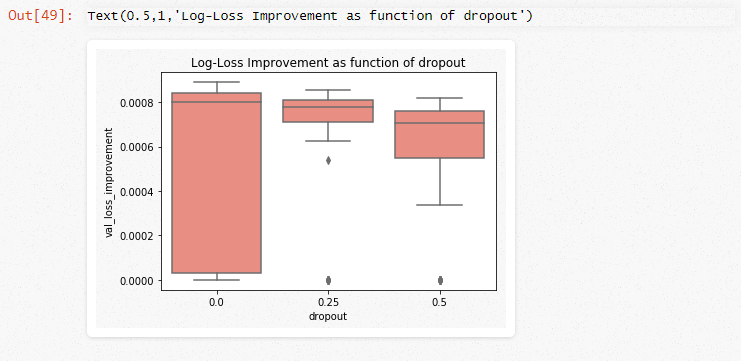

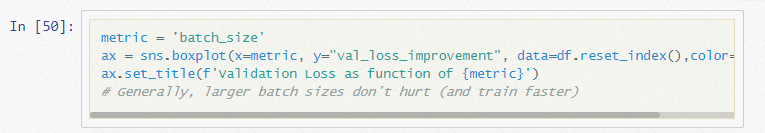

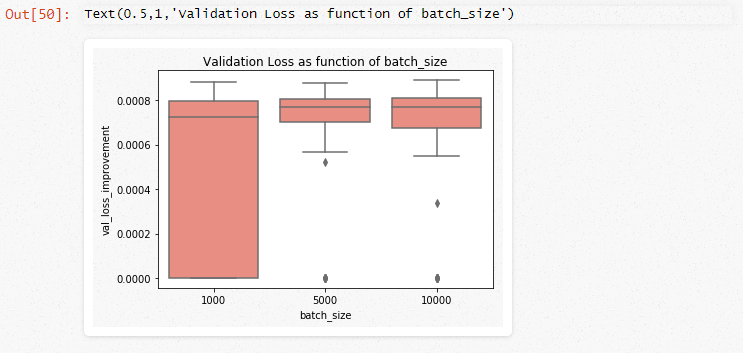

Univariate Relationships

Below, I’ll start by running several univariate measures to see what the impact of each factor appears to be, in isolation:

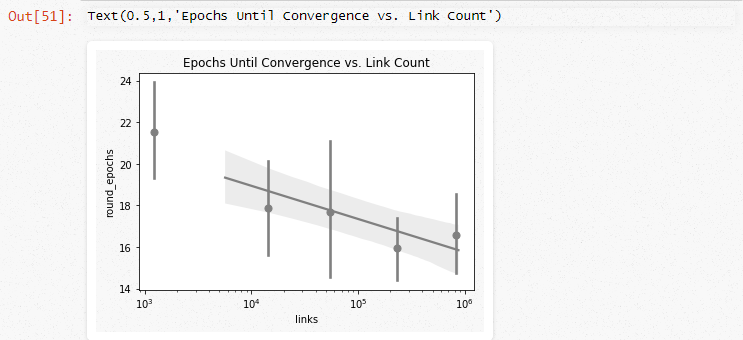

As a total aside, we can also measure relationships which all assume, but may not know for certain. Below, I’ve plotted the number of epochs before early stopping (when the model begins to overfit and get worse on validation) vs. network size. Unsurprisingly, it takes larger networks longer to converge. The relationship seems pretty close to logarithmic relative to “links” between nodes.In [51]:

Visit The Alpha Scientist blog to download the complete code:

https://alphascientist.com/hyperparameter_optimization_with_talos.html

The Alpha Scientist blog – Chad is a full-time quantitative trader who has been working on data analytics since before it was cool. He has long balanced his interest in computer science (MS in EE/CS from MIT) with a fascination in markets (CFA designation in 2009). Prior to becoming a full-time quant, he built analytics products and managed teams at software companies across Silicon Valley. If you’ve found this post useful, please follow @data2alpha on Twitter and forward to a friend or colleague who may also find this topic interesting. https://alphascientist.com/

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Alpha Scientist and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Alpha Scientist and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!