Excerpt

Passive index funds are believed to offer low fees, nearly limitless liquidity, very low trading costs and (most of the time) they beat most active managers. Although not all of the above are accurate, there are still many arguments in favour of passive indexing. However, what is often left forgotten are avoidable travails linked to index funds. Attempts to regain avoidable costs lead to differences in performance of the fund and the performance of the published index, to so-called tracking error. It is tracking error that fund managers seek to minimize, falsely believing that near-zero tracking error means near-zero trading costs.

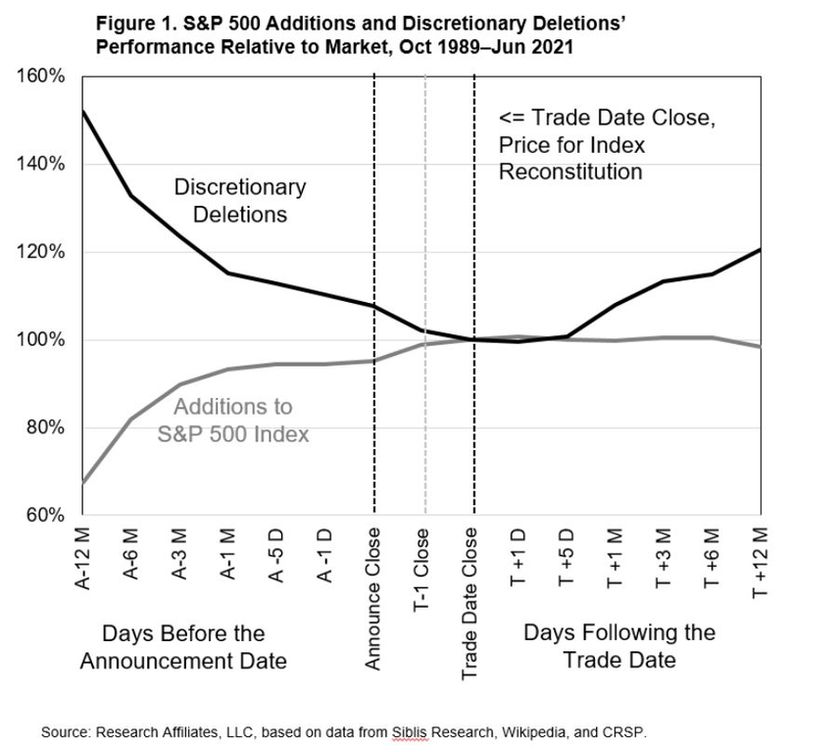

In general, after an index rebalances, traditional cap-weighted index funds buy high and sell low. Their tendency to add recent highfliers and drop unloved value stocks is what causes investors to lose. Arnott et al. (2022) target the stock selection problem around index rebalancing and propose several ideas on how to adjust index strategies in order to earn above-market returns. Authors focus on S&P 500 as the most widely followed equity index and begin their analysis in October 1989, when S&P began preannouncing changes in the composition of the index together with the “effective date” for when those changes go into effect. They present simple ways to construct an index, thanks to which it is possible to reduce both negative effects of buy-high/sell-low dynamic and the turnover costs of cap-weighted indices.

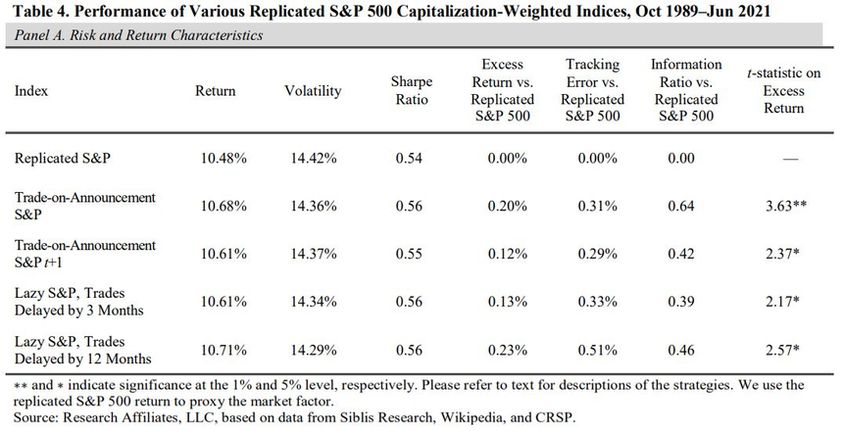

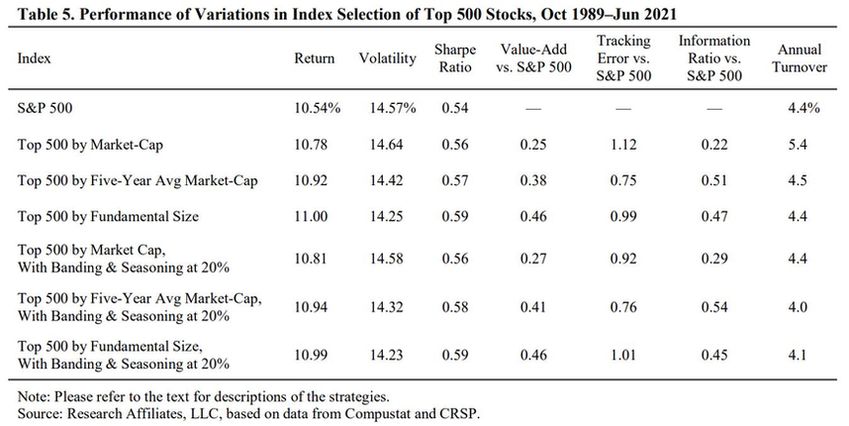

One simple tactic is to trade at the announcement date (i.e. immediately after an index change is announced). Another way to improve performance is lazy trading, meaning delaying rebalancing by a year. Finally, investors are encouraged to create alternative 500-stock universes. To decide which stocks to add to an index and which to delete they would use long-run averages or fundamental size of a business, and then cap-weight the resulting list. To further reduce turnover and its costs, banding and seasoning seem to work, as they leave out companies that come the list and then quickly fall off the list. All of these strategies positively affect portfolio returns and prove that focusing on zero tracking error does not always have to be the best choice.

Authors: Rob Arnott, Chris Brightman, Vitali Kalesnik and Lillian Wu

Title: The Avoidable Costs of Index Rebalancing

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4099610

Abstract:

Traditional capitalization-weighted indices generally add stocks with high valuation multiples after persistent outperformance and sell stocks at low valuation multiples after persistent underperformance. For the S&P 500 Index, in the year after a change in the index, additions lose relative to discretionary deletions by about 22%. Simple rules, such as trading ahead of index funds or delaying reconstitution trades by 3 to 12 months, can add up to 23 basis points (bps). This benefit doubles when we cap-weight a portfolio not selected on market value, but based on the fundamental size of a business or its multi-year average market cap.

Visit Quantpedia for additional insight on this topic: https://quantpedia.com/should-we-rebalance-index-changes-immediately/.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!