QMIT by QuantZ presents Q2 2020 Factor recap. To learn more about QuantZ/ QMIT and to get their factor research + heatmaps daily or even real-time, please get in touch!

Q2 2020 Factor recap:

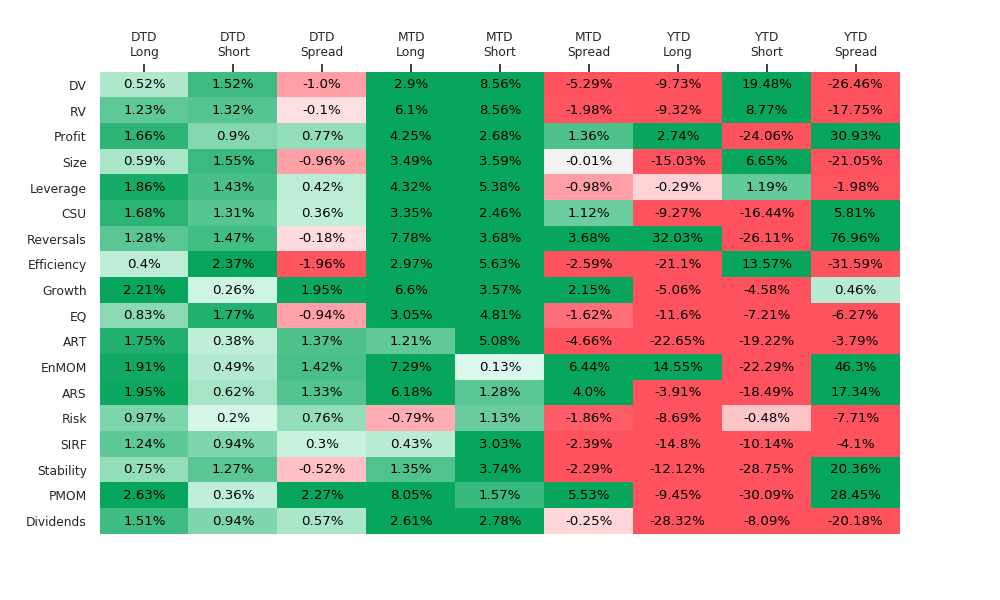

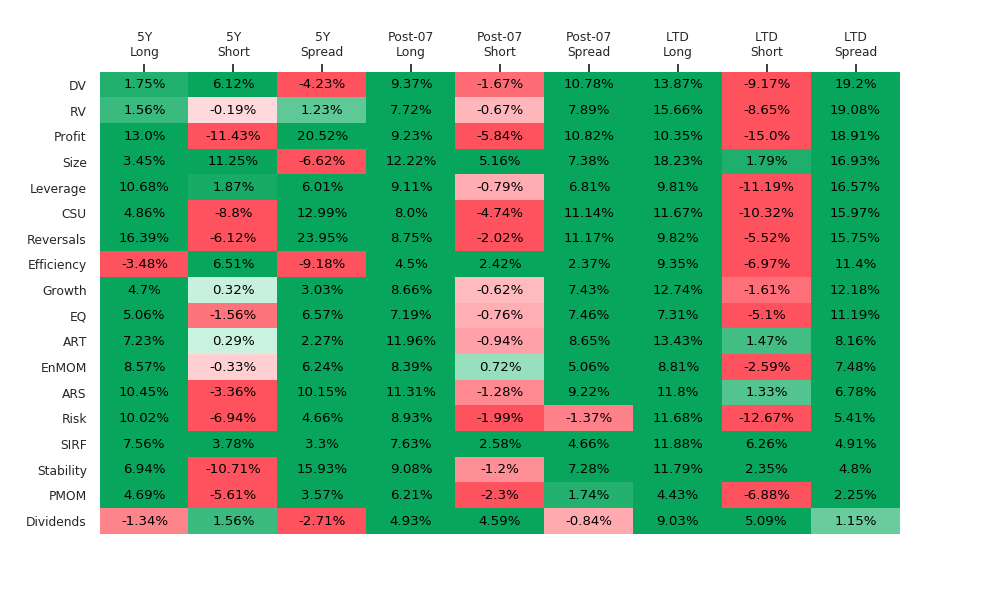

- The Q1 Covid Crash & the subsequent rebound in Q2 has been tremendous live validation of our REGIME BASED FACTOR INVESTING framework. In Q1- during the fastest crash ever (Feb 19th – Mar 23rd) – we documented that our Risk OFF ESBs shone at ~ 17.5% on average vs Risk ON ESBs at -5.8% resulting in a +23.3% spread. As one might expect, in Q2 2020, the tables turned dramatically during the relief rally led by the worst to first phenomenon with Risk ON ESBs outperforming to the detriment of Risk OFF by a substantial margin as encapsulated by Figure 1. The out-sample validity of our RORO regime mapping has certainly been borne out by the evidence from the crash & rebound as per the factor flips embodied by Figure 1 & the YTD charts seen through the regime lens in Figures 2 & 3.

- If one had the right view on the regime as is required of the Quantamental hybrid discipline then it was possible to monetize much of the predictable factor dispersion. Much of the misguided commentary as to whether & how factor quants failed to deliver yet again is largely an artifact of the failure to discern the regime dependence & cyclicality of factors. Being on the wrong side of regime based tilts or allowing your factor payoffs to effectively cancel out due to RORO is a travesty that can be avoided with insights from our factor heatmaps & by deploying the ESBs and signals they represent.

- A caveat worth re-stating is that factor performance can diverge fairly significantly during such V-shaped bungee jumping episodes depending on whether one looks at the picture in terms of sector neutral, $ neutral or beta neutral ESBs. While we do also track sector neutral ESBs we have not been reporting them for the sake of brevity (to our detriment as SN has much higher Sharpe/ Sortinos in general) as we expect that sector neutrality is better handled at the portfolio construction/ optimization depending your mandate & constraints. It’s generally better to be $-neutral during the crash coming out of a bull market to be sufficiently hedged whereas during the rebound & in the subsequent bull market it behooves one to revert back to beta neutrality because the net negative beta drift of many factors can be a serious headwind in a $-neutral construct. This is why we publish both $-neutral & Beta-neutral versions of our ESBs. Indeed, for our defensive Risk OFF ESBs we note that they are up nicely at +9.93% YTD beta-neutral but at -2.19% YTD $-neutral due to the implicit net negative beta in a strongly bullish tape since 03/23/20.

- Six ESBs in double digit positive territory YTD even on a market neutral basis is not too shabby given the turmoil in H1 2020.

- Our ESB proxy for Statistical Arbitrage – Reversals – has emerged as the YTD star performer at +77% beta-neutral & +79% $-neutral. Reversals (REV) performed consistently throughout 2019 but had ~-40% DD in Q1 by virtue of its catching falling knives during the Covid crash. It subsequently came screaming back ~+120% as per Figures 1 & 2.

- Other ESBs leading the [beta-neutral] charge this year are EnMom +46%, Profitability +31%, Stability +20% & ARS at +17%.

- Our Enhanced Momentum (EnMom) is designed to significantly outperform naïve 12mo price momentum during crises & particularly the short squeeze rebounds and it certainly has done that in 2020 at +46%, by a wide margin, outperforming our own Momentum ESB as well (at +28.5%).

- Risk [aka Low Vol] led the pack through the crisis with a staggering +44% in Q1 on top of +20% last year but then as the rebound took shape it crashed on a $-neutral basis to -22.5% YTD & to -7.7% on a beta-neutral basis. The beta mismatch for Low Vol is the best way to illustrate why one may want to be beta-hedged. In fact, the contemporaneous returns to the $-neutral Risk ESB & the implicit beta mismatch in this factor allow for a decent guess of the contemporaneous regime.

- It’s been yet another disastrous year for the Value complex with our DV at -26.5%, RV at -17.8 & Dividend ESB at -20.2% YTD beta neutral. Except for the brief counter trend rallies during the re-opening “hopium” trade, this year has again been about chasing scarce growth which is why the Growth/ Momentum complex has dominated yet again. A sustained Value resurgence clearly requires the alignment of Risk ON themes which would include tighter credit spreads and a steeper curve (for Financials to work), VIX normalization, higher inflation expectations & oil to inch higher for the Energy sector.

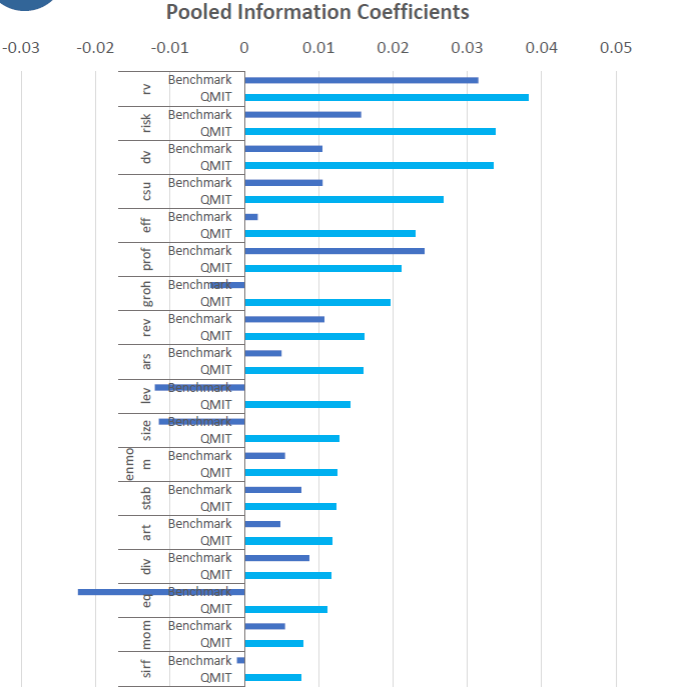

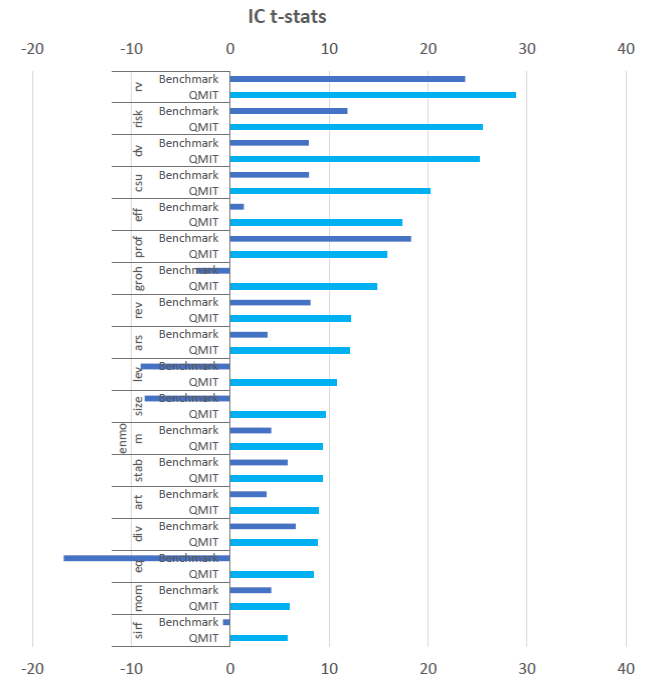

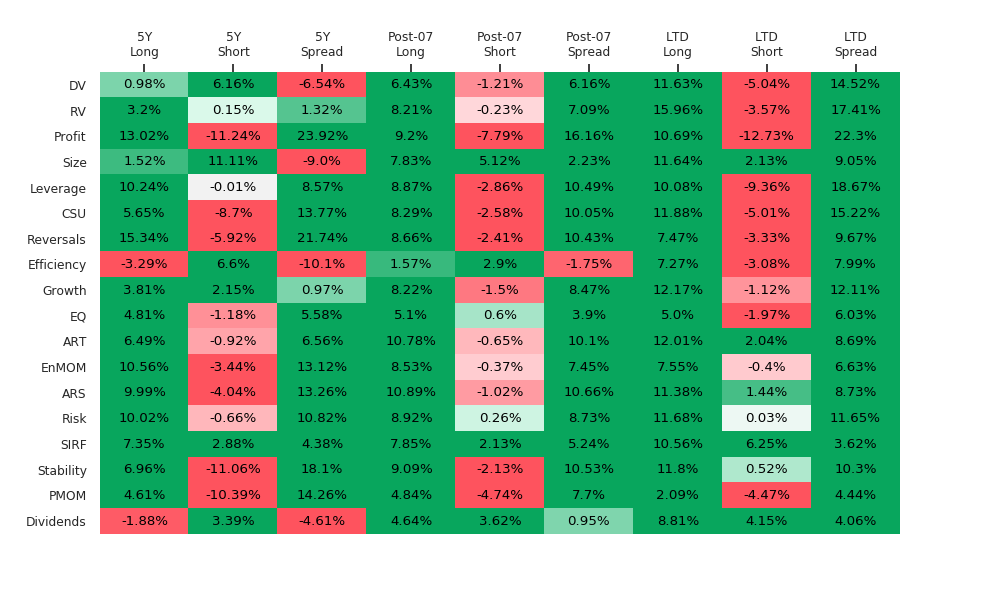

- It’s important to bear in mind the 20y longer term returns as per the heatmaps below as well as our risk adjusted stats & ICs for perspective though which given the LT dominance of RV & DV would suggest a massive reversal at some point when Covid normalization allows for a cyclical resurgence. Figures 4 & 5 show the impressive pooled ICs and truly staggering t-stats over the 20y history for our ESBs.

- Further, it’s worth glancing at Figure 6 to note the benefits of even simple equally weighted ESB combinations which can boost the Sortinos north of 5 due to the benefits of combining uncorrelated ESBs – despite recent gyrations, the value proposition of these signals remains well intact particularly on a sector neutral & beta neutral basis. The reason it works so well is because of the ensemble learners embedded in the ESBs which allow the best ones like Leverage & Profitability to exceed Sortinos of 4 & 3 (Figure 7).

- Quality’s poor showing YTD (for Lev, EQ & Efficiency ESBs) is at least consistent with the normalization of risk aversion in Q2. On the other hand, the more defensive Profitability +31%, Stability +20% & CSU +5.8% have kept marching along YTD given their enormous lead from the crash period.

- Risk-aversion negatively impacted Size (small caps) during the crash but it has yet to catch up & remains at -21% YTD beta neutral with Small Cap Value being the most overlooked corner of the US equity landscape for obvious reasons. This will see its day in the sun once the market starts looking through Covid.

- We’ve seen massive monetary and fiscal stimulus across the globe which has led to the recovery thus far. With the VIX back down below 30, stock specific risk down significantly & factor vol normalizing there may be relief from some of the vicious but short lived episodic rotations/ short covering we’ve seen. That said, it’s more than likely that the world may face a 2nd wave & continue inching towards herd immunity (before there is a widely available vaccine) particularly in countries like the US & Brazil where the Covid situation seems to be out of control.

- Leading up to November 2016 [& in subsequent missives], we had fully anticipated & predicted the level of policy chaos, corruption, chicanery, the spike in hate crimes, the fraying of the social fabric & even the civic unrest that has now sadly transpired (although none of us could have foreseen the specific Covid catalyst coupled with George Floyd that would precipitate all of this). The elections remain a key question for the markets this year so with the clearly emerging Blue tsunami one might wonder if the markets are now whistling past the graveyard at these levels? This may be the variant viewpoint but perhaps they are rationally pricing in the welcome return to stable governance and the easing of trade tensions with China & European allies which should be supportive of markets despite the likelihood of higher taxes under a Democratic wave. The precise policy implications at the sector & factor level have yet to be fleshed out.

- Stay tuned for more research from QMIT on how to control for multi-collinearity amongst factors while combining them or on how to deploy our combo signals to achieve that. We also have more research coming out this year on factor crowding models as well as on how to extract a crash factor from the regime based characteristics of our ESBs now that you’ve seen them deliver rather well real-time.

Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

Figure 6

Figure 7

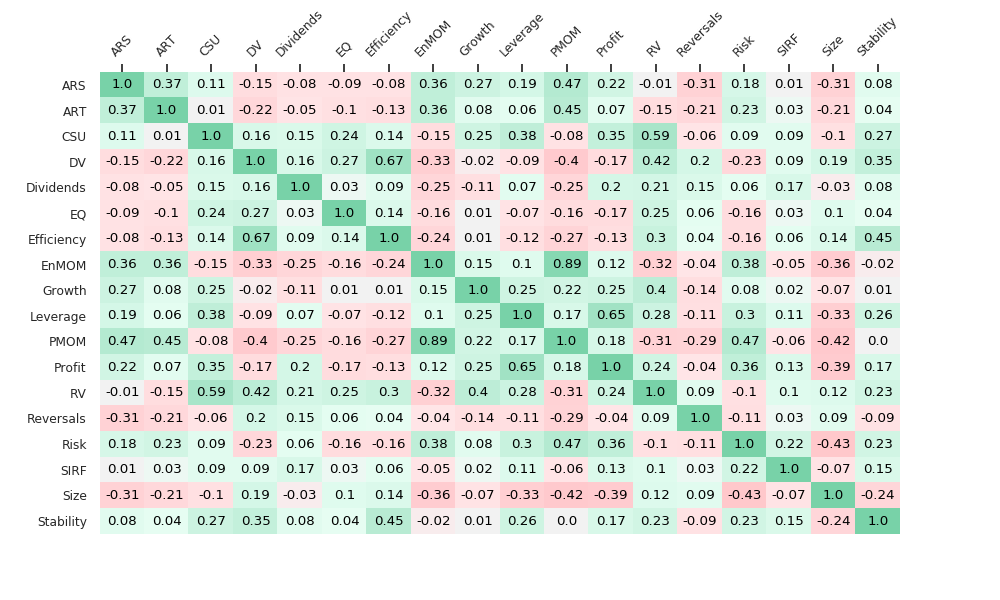

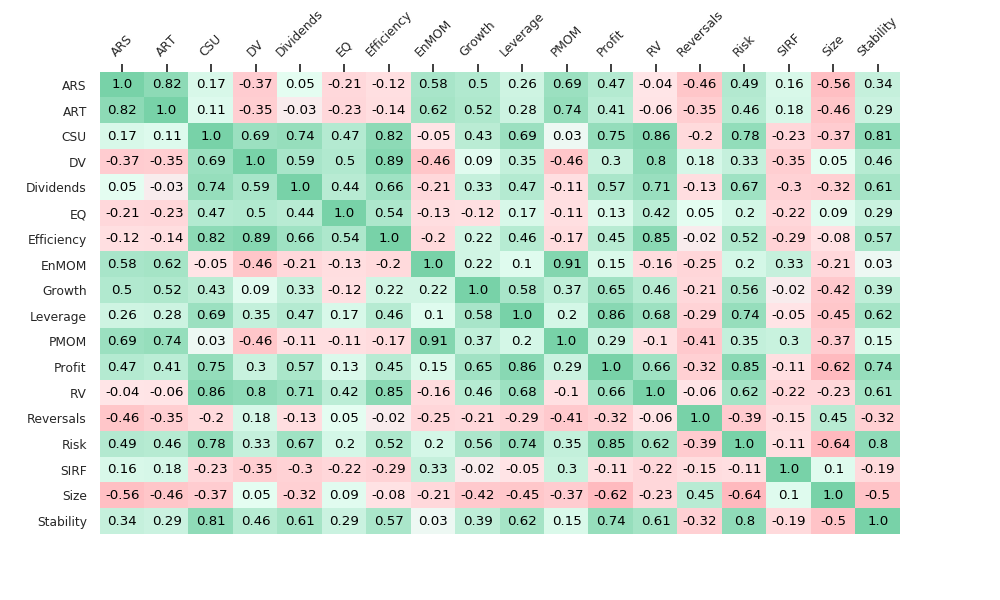

The Sector ranks table (based on bottom up aggregation of QMIT Enhanced Smart Betas within sectors) allows for sector rotation based on factors. The cross-sectional factor rank correlations tell us how correlated the factors are at this juncture vs recent 3y return correlations vs LTD (20y) return correlations. It’s worth noting that cross sectional factor rank correlations are based on today’s alphas across the entire universe while the historical return correlations are only based on the information in the tails (i.e., the 5%-tile spread returns). Further, as the astute may surmise, one can extract a risk model from our factor covariance matrix which should better align one’s alphas with the risk optimization.

Please find below heatmaps with the DTD, MTD, YTD, 5 year, Post-07 & LTD returns for our ESBs as of last night’s close. Stay tuned for more composite signals on our ESBs which will continue to be added. These spreads are based on the best methodology (defined as highest cumulative return LTD) out of five that are available to clients for each of the ESBs as regards aggregation of factors within the Smart Beta cohorts. Customized heatmaps may be available based on all five methodologies:

- Equal Weighted

- Max Sharpe Ratio optimization (on an expanding window to prevent look ahead bias)

- Risk Parity optimization (on an expanding window to prevent look ahead bias)

- Top 3 factors based on cumulative return but Equal Weighted (on an expanding window to prevent look ahead bias)

- Top 3 factors based on Sharpe ratio but Equal Weighted (based on cumulative return on an expanding window to prevent look ahead bias

Beta neutral – Daily heatmap YTD:

$ neutral – Daily heatmap YTD:

Beta-neutral – 19y Monthly +1y Daily heatmap LTD:

$ neutral – 19y Monthly +1y Daily heatmap LTD:

C-S Rank correlations for QMIT Enhanced Smart Betas:

3y Return correlations for QMIT Enhanced Smart Betas:

20y Return correlations for QMIT Enhanced Smart Betas:

QMIT by QuantZ presents Q2 2020 Factor recap. To learn more about QuantZ/ QMIT and to get their factor research + heatmaps daily or even real-time, please get in touch!

EXPLANATORY FOOTNOTES:

Sector Ranks are aggregated bottom up average ranks for each of the smart beta composites.

Factor portfolios are not sector neutral.

Generated weekly as of last night’s close this report shows the DTD, MTD, YTD and LTD returns for our smart beta composite spreads.

Factors within the cohort spreads are long-short based on top vs bottom 5%-tile (~125×125) of the largest liquid US traded stocks (usually ~2500 depending upon market capitalization & minimum $ price criterion for stocks listed on NYSE & Nasdaq).

Certain industries like Biotechs and REITS are excluded due to event risk or because a generic quant model is not appropriate for those industries.

Individual factor top & bottom portfolios are equally weighted 5%-tiles. While the combined ESB spreads also represent top vs bottom 5%-tiles they are based on the best (cumulative return LTD) of five methodologies listed above.

MTD returns/ spreads are geometrically chain-linked DTD returns/ spreads where both are based on factor portfolios formed at the prior month end close.

YTD & LTD returns are based on geometric chain-linking of monthlies without transaction costs or fees as is customary in the factor literature.

Multi-period spread returns are not the difference of cumulative top vs bottom returns. Instead, they represent the daily geometrically compounded rebalancing of the market neutral “active return” differential of the top vs bottom portfolios which is a more realistic representation.

Both Max Sharpe & Risk Parity optimization routines are based on a Hybrid methodology where we 1] find the optimal factor mix within the Smart Beta cohort based on signal blending/ “mixing” but 2] subsequently run the combined ESB spreads outsample on a fully “integrated” basis not just as the linear combination of factor returns.

LTD data commences January 2000.

Enhanced Smart Beta Definitions

ARS: This smart beta composite shows our Analyst Revisions cohort based on measures of estimate revisions, dispersion, Standardized Unexpected Earnings surprise (SUE score) & consensus change in both earnings as well as revenues which can outperform traditional metrics like a 1mo consensus change.

ART: This smart beta composite shows our Analyst Ratings & Targets cohort based on measures of analyst recommendations, target price, changes & diffusion which can outperform traditional metrics like a 1mo consensus change.

CSU: This smart beta composite shows our Capital Structure/Usage cohort based on measures including Buybacks, Total yield, Capex, capital usage ratios etc which can outperform traditional metrics like Cash/MC.

Dividends: This smart beta composite shows our Dividends related cohort based on measures including Yield, payout, growth, forward yield etc which can outperform traditional metrics like Dividend Yield.

DV: This smart beta composite shows our Deep Value (or intrinsic value) cohort based on measures including tangible book & sales which can outperform traditional Book yield.

Efficiency: This smart beta composite shows our Efficiency cohort based on measures including Asset Turnover, Current Liabilities, Receivables etc which can outperform traditional metrics like Asset Turnover.

EnMOM: This smart beta composite shows our Enhanced Momentum cohort which can outperform traditional 12 month price momentum in both return & risk adjusted terms particularly at market inflection points.

EQ: This smart beta composite shows our Earnings Quality cohort based on a variety of Accrual measures which can outperform traditional metrics like Total Accruals.

Growth: This smart beta composite shows our Historical Growth cohort based on a variety of Earnings, Sales, Margins & CF related growth measures which can outperform traditional metrics like 3yr Sales growth.

Leverage: This smart beta composite shows our Leverage related cohort based on measures of Balance Sheet leverage which can outperform traditional metrics like Debt To Equity.

PMOM: This smart beta composite shows our PMOM related cohort which can outperform traditional 12 month price momentum using a variety of traditional momentum factors.

Profit: This smart beta composite shows our Profitability cohort based on measures like ROA, ROE, ROCE, ROTC, Margins etc which can outperform traditional metrics like ROE.

RV: This smart beta composite shows our Relative Value cohort based on measures of EPS, CFO, EBITDA etc which can outperform traditional Earnings yield.

Reversals: This smart beta composite shows our Reversals cohort which is comprised of metrics like short term reversals, RSI, DMA & other technical factors which can outperform traditional metrics like a 1 month total return.

Risk: This smart beta composite shows our Risk/ Low Vol cohort which is comprised of metrics like Beta, Low volatility etc.

SIRF: This smart beta composite shows our Short Interest cohort which is comprised of metrics related to Short Interest and its normalization by Float, trading volume etc.

Size: This smart beta composite shows our Size cohort which is comprised of metrics related to firm size including market capitalization.

Stability: This smart beta composite shows our Stability cohort which is comprised of metrics like Dispersion of EPS/ SPS estimates as well as the stability of Margins, EPS & CFs etc.

Disclosure: QMIT – QuantZ Machine Intelligence Technologies

QMIT is a data provider and not an investment advisor. This information has been prepared by QMIT for informational purposes only. This information should not be construed as investment, legal and/or tax advice. Additionally, this content is not intended as an offer to sell or a solicitation of any investment product or service. Opinions expressed are based on statistical forecasting from historical data. Past performance does not guarantee future performance. Further, the assumptions and the historical data based used could be erroneous. All results and analyses expressed are merely hypothetical and are NOT guaranteed. Trading securities involves substantial risk. Please consult a qualified investment advisor before risking any capital. The performance results for live portfolios following the screens presented herein may differ from the performance hypotheticals contained in this report for a variety of reasons, including differences related to transaction costs, market impact, fees, as well as differences in the time and price of execution. The performance results for individuals following the strategy could also differ based on differences in treatment of dividends received, including the amount received and whether and when such dividends were reinvested. We do not request personal information in any unsolicited email correspondence from our customers. Any correspondence offering trading advice or unsolicited message asking for personal details should be treated as fraudulent and reported to QMIT. Neither QMIT nor its third-party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon. QMIT EXPRESSLY DISCLAIMS ALL WARRANTIES, EXPRESSED OR IMPLIED, AS TO THE ACCURACY OF ANY THE CONTENT PROVIDED, OR AS TO THE FITNESS OF THE INFORMATION FOR ANY PURPOSE. Although QMIT makes reasonable efforts to obtain reliable content from third parties, QMIT does not guarantee the accuracy of or endorse the views or opinions given by any third-party content provider. All content herein is owned by QuantZ Machine Intelligence Technologies and/ or its affiliates and protected by United States and international copyright laws. QMIT content may not be reproduced, transmitted or distributed without the prior written consent of QMIT.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QMIT – QuantZ Machine Intelligence Technologies and is being posted with its permission. The views expressed in this material are solely those of the author and/or QMIT – QuantZ Machine Intelligence Technologies and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!