See Part I and Part II for an overview of the linear models and the concept of “regression”.

Multiple linear regression

Let’s now say we believe there are multiple factors that tell us something about KO‘s returns. They could be SPY‘s returns, its competitor PepsiCo’s (NASDAQ : PEP) returns, and the US Dollar index (ICE : DX) returns. We denote these variables with the letter XX and add subscripts for each of them. We use the notation Xi,1,Xi,2 and Xi,3 to refer to the ith observation of SPY, PEP and DX returns respectively.

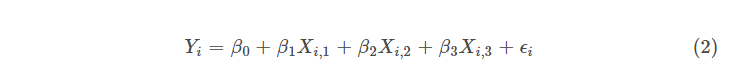

Like before, let’s put them all in an equation format to make things explicit.

β0,β1,β2 and β3 are the model parameters in equation 2.

Here, we have a multiple linear regression model to describe the relation between YY (the returns on KO) and Xi;i = 1, 2, 3 (the returns on SPY, PEP, and DX respectively).

We call it multiple, since there is more than one explanatory variable (three, in this case); and we call it linear, since the coefficients are linear.

When we go from one to two explanatory variables, we can visualize it as a 2-D plane (which is the generalization of a line) in three dimensions.

For ex. Y = 3 − 2X1 + 4X2 can be plotted as shown below.

As we add more features, we move to n-dimensional planes (called hyperplanes) in (n + 1) dimensions which are much harder to visualize (anything above three dimensions is). Nevertheless, they would still be linear in their coefficients and hence the name.

The objective of multiple linear regression is to find the “best” possible values for β0,β1,β2 and β3 such that the formula can “accurately” calculate the value of Yi.

In our example here, we have three X′s.

Multiple regression allows for any number of X′s (as long as they are less than the number of observations).

Stay tuned for the next installment in which Vivek will discuss linear regression of a non-linear relationship.

Visit QuantInsti for additional insight on this topic: https://blog.quantinsti.com/linear-regression/.

Disclaimer: All investments and trading in the stock market involve risk. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. The trading strategies or related information mentioned in this article is for informational purposes only.

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!